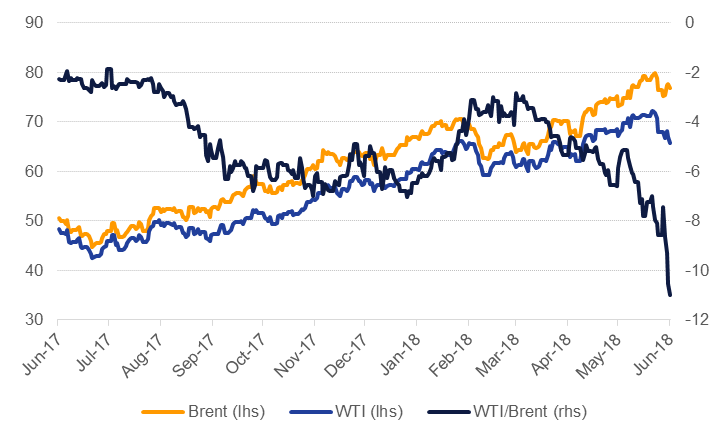

The WTI/Brent spread widened at the end of last week to nearly USD 11/b, its widest level since Q1 2015. After peaking at over USD 72/b, WTI has lost nearly 9% and has shown little sign of tempering its downward move while Brent has fallen by less than 4% from its peak close of USD 79.80/b.

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.

The increasing gap reflects factors specific to the international crude market and the US domestic industry. Brent prices continue to be affected by uncertainty around OPEC decisions with respect to their production cut agreement and whether it will be endorsed again or amended at their upcoming meeting later this month. The latest market surveys show OPEC production of just 32m b/d in May, its lowest level since the production cuts took effect and lowest level since November 2015. Venezuela’s apparent perpetual decline appears to be behind the consistent drop in OPEC production. Iranian production fell slightly in May, by 20k b/d, but we expect a sharper decline by the end of the year once US sanctions on the country come into full effect.

As we noted previously, we don’t expect OPEC and its partners will fully come to the rescue to offset declining production in some of its members. Ensuring the market remains tight helps to achieve twin OPEC goals of keeping prices elevated and allowing space for production to eventually resume increasing. We expect that there will be some increase in production from key OPEC members in H2 2018 but at an insufficient level to push the market back into surplus.

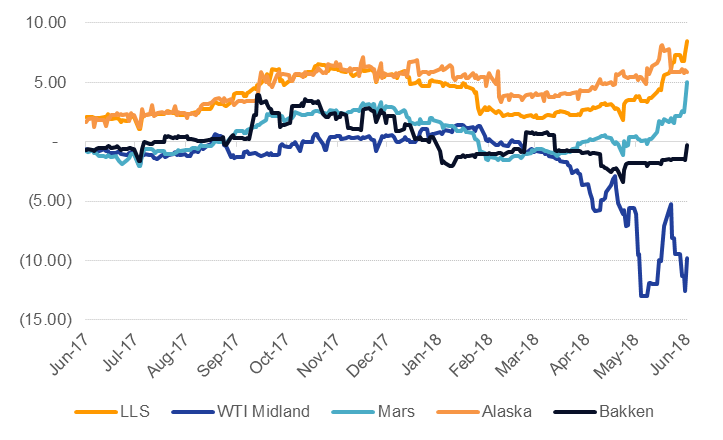

In the US a lack of pipeline capacity is acting as a drag on WTI prices. Spreads to WTI by producing region show most of the blockages are taking place in the Permian basin where WTI priced at Midland was at USD 56/b at the end of last week, a USD 10/b discount to Cushing and more than USD 20/b to Brent. Takeaway capacity will hit the market from 2019 leaving producers exposed in the near term to pricing that only covers new well development cost with very narrow headroom. The Dallas Fed’s most recent survey of oil and gas companies pins new well breakeven costs at USD 50/b in the Permian.

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.

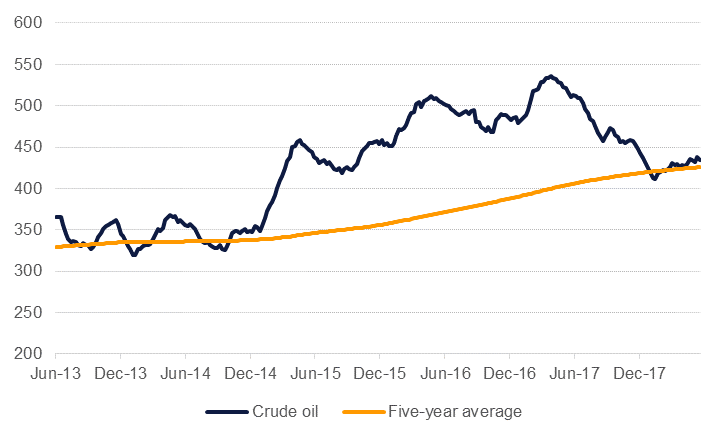

EIA data last week showed US production at 10.77m b/d, up 1.43m b/d on year ago levels which is a faster pace of growth than the EIA expects for the US this year. E&P companies continue to add rigs, up 2 last week and 34 over the month. With limited ability to get crude out to the higher value seaborne market we would expect to see inventories in the US maintaining their level around their five-year average and likely moving higher in the remainder of the year if production growth carries on its current pace.

Source: EIKON, Emirates NBD Research. Note: m bbl.

Source: EIKON, Emirates NBD Research. Note: m bbl.

As we expect the OPEC decision at its upcoming meeting may disappoint bearish positions and see no slowdown in the pace of US production growth or exploration activity yet, there is a high risk that the current WTI/Brent spread will stay wide or expand further this year. Over the long-term the spread does show a strong mean reversion tendency but only following significant investment in pipeline capacity.