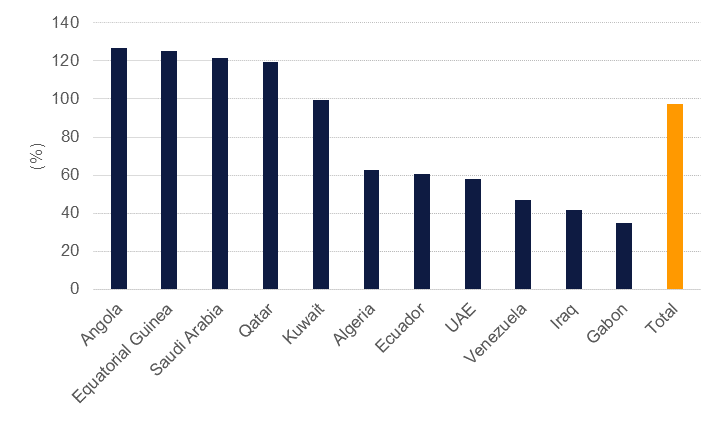

OPEC members’ compliance with production targets set in the December 2016 agreement has been strong this year and one of the main contributors to oil prices rising significantly from 2016 levels. Production estimates from the IEA pin overall compliance among the OPEC producers that are party to the cuts at 97% on average from January-September and from its partners at around 63%. Adherence to the deal has been declining, however, from more than 115% in January to 88% in September from the OPEC producers.

The strong aggregate levels of compliance has been achieved by some countries over-cutting and taking on more than their expected share of the burden. Saudi Arabia’s average compliance in 2017 has been around 120% as it has slashed output to less than 10m b/d for several months, while Angola has also been an over-achiever, although this is largely down to naturally declining output at older fields. Compliance across the rest of MENA has been more mixed, ranging from effectively 100% in Kuwait and Qatar to low levels in the UAE and Iraq.

We estimate that overall compliance among OPEC members of the deal will average 91% this year but that compliance will have fallen to just 74% in Q4 largely as a result of the ‘over-cutters’ moving closer to 100%. Already in Saudi Arabia’s case the impact of lower production is having a significant effect, pushing the economy into recession in the first half of 2017 as growth in the non-oil sector remains too small to offset the decline in oil production.

Source: IEA, Emirates NBD Research.

Source: IEA, Emirates NBD Research.

The oil market appears to be pricing in an extension of OPEC’s current production cut agreement for all of 2018, beyond its current expiry in March. However, ensuring compliance is at or above 100% will be all the more essential in 2018 as non-OPEC supplies are expected to recover strongly next year (by more than 1.5m b/d according to the IEA compared with around 700k b/d in 2017). Demand growth is also expected to slow to 1.4m b/d from over 1.6m b/d in 2017, taking it closer to long-term growth rates. Neither of these dynamics allow OPEC to enjoy any ‘headroom’ of excess production.

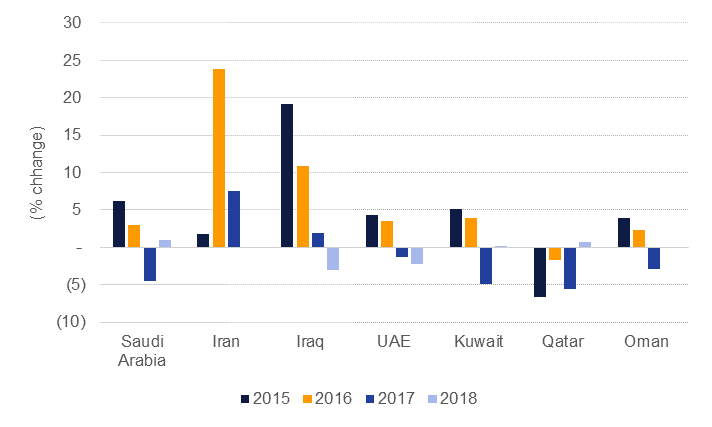

Considering the size of the oil and gas sector in most OPEC economies and its overall contribution to fiscal receipts, we doubt that policymakers would be prepared to endure two consecutive years of declining production if there was not a strong belief that the gains from a rebalancing market (such as higher prices) outweighed the loss of production and exports. Among countries that are part of the agreement (including Iran, which is allowed to increase production), hitting 100% compliance in 2018 would mean output of 29.92m b/d, a decline of 0.7% on 2017 production which we estimate will have declined by 1.5%.

At a country level, however, 100% compliance would result in a divergent picture. In Saudi Arabia, oil production would actually increase by nearly 1% or around 100k b/d as it stops over-cutting. Production would remain slightly above 10m b/d compared with record high of near to 10.7m b/d recorded in Q3 2016. In Kuwait, production would essentially be flat on 2017 levels as it has been close to 100% compliance already while output in Qatar would edge up slightly (however, an increase Qatar’s crude oil production would have a negligible impact on global balances). Outside of OPEC, Oman has demonstrated strong compliance with the cuts (97% on average January-September) and 2018 output growth would be essentially flat as a result.

Source: IEA, Emirates NBD Research

Source: IEA, Emirates NBD Research

The UAE and Iraq would face the largest declines among Middle East producers when measured against IEA data. In the UAE, output would decline by 70k b/d from 2017 levels (2.2%), taking overall production back below 2.9m b/d. In Iraq, production would need to decline by nearly 3% (130k b/d) to reach its full target.

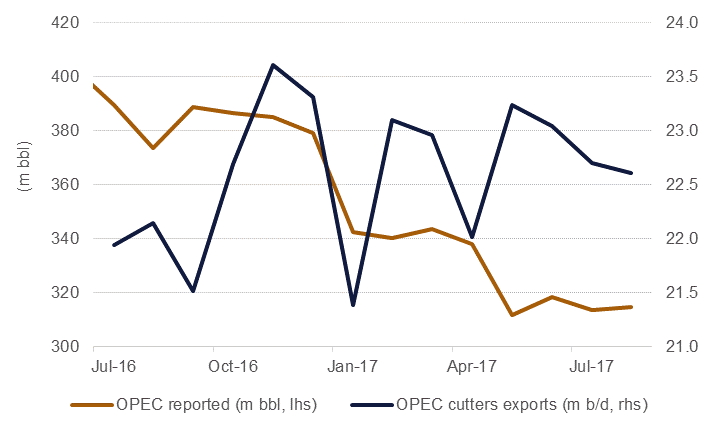

A change in production alone, however, would not be sufficient to impact global balances unless it was matched by a decline in export volumes. After a sharp drop-off in January, exports from the OPEC countries that have cut production have actually been trending higher, staying roughly flat year-on-year. Exports have managed to hold relatively steady thanks to a decline in stocks in OPEC countries and sluggish domestic demand. Messaging from OPEC NOCs points to lower export volumes in coming months as producers try and improve compliance with targeted levels and we would expect exports to follow production if OPEC achieved its target levels. However, the size of the decrease in exports would likely be less severe as slow oil demand growth in OPEC economies would free up more oil for export while the battle for market share remains in full swing.

Source: JODI, EIKON, Emirates NBD Research

Source: JODI, EIKON, Emirates NBD Research

Would these cuts be enough to push oil prices onto a sustainably higher footing? In our core forecast we estimate that the cuts in 2017 will have contributed to a market deficit for Q2-Q4 2017 but that the market will move back into surplus next, albeit at a lower level than the excess seen in 2014-16. If OPEC achieved 100% compliance in 2018, it would push the oil market into an average deficit of 200k b/d all other factors remaining unchanged (non-OPEC supply growth and demand remaining in line with IEA expectations). A deficit of this size would help draw inventories downward but would have a minimal effect on stocks when measured against expected demand.

We doubt that a deficit of this size would be enough to push Brent prices up above USD 60/b for a prolonged period as it would invite active hedging from producers outside OPEC and could dampen demand growth prospects. Were OPEC then to follow through on 100% compliance we would expect prices to settle in a range between USD 55-60 for most of 2018.

The recent rally in oil prices to above USD 60/b for Brent is a negative risk for compliance in the short run. Oil producers may see the rally and backwardation in the Brent curve as a strong sign that the market can withstand more oil and undo some of the impact of the cuts in short order.

The cut in crude oil production since November 2016 has weighed on GCC growth this year, and we downgraded our real GDP growth forecasts for both 2017 and 2018 when the agreement was extended in June through to end Q1 2018.

The case against extending the cuts to the end of 2018, or in favour of lower compliance, is that extending the production cuts would again weigh on real GDP growth for oil exporters in the GCC in 2018. Our baseline forecasts assume that oil production in the GCC will rise once the current OPEC agreement expires in Q1 2018, and that this will contribute to faster overall GDP growth next year.

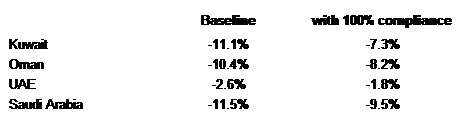

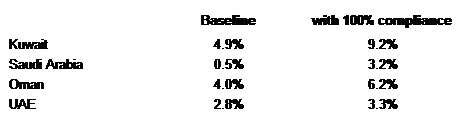

Our analysis suggests that if the agreement was extended to end-2018 and compliance is 100%, the biggest impact would be on the UAE, where growth would slow from a currently estimated 3.4%, to 2.0% next year (-1.4 percentage points). However, for the other oil exporters in the GCC, the downward revision to 2018 growth forecasts is likely to be more modest, ranging from 0.2 percentage points (Saudi Arabia) to 0.5 percentage points (Kuwait).

Source: Emirates NBD Research

Source: Emirates NBD Research

Year-to-date, the UAE has overshot the production level agreed with OPEC (i.e., compliance has been less than 100%). Our base case scenario assumes a 1.8% rise in crude oil production from Q2 2018. If the deal was extended to end-2018 and the UAE were to become fully compliant, this would imply a significant further cut from current production levels. As a result, the impact of an extension and full compliance would have a significant impact on the UAE’s headline GDP growth rate next year.

Kuwait is already meeting its production target, so if the agreement is extended then it would simply maintain this rather than increasing output as assumed in our base scenario. Oman is not an OPEC member but has agreed, along with countries like Russia and Mexico, to limit production. We assume that production would remain unchanged if the agreement is extended.

Saudi Arabia has been producing below its OPEC agreed target so far this year, so in order to be 100% compliant in 2018, it would need to increase oil production by around 1% from current levels. We have assumed a slightly larger increase in Saudi Arabia’s oil production in our base scenario. Overall, the impact of extending the OPEC agreement to end-2018 and reaching 100% compliance is relatively small for Saudi Arabia’s headline growth.

While headline GDP growth would be lower if 100% compliance was achieved, our analysis suggests that there would be benefits in terms of reducing fiscal deficits and improving external balances (i.e., current accounts). This is largely because the lower volume of oil produced (and sold) would be more than offset by the higher price achieved by complying fully with production cuts in 2018.

Source: Emirates NBD Research

Source: Emirates NBD Research

Kuwait’s budget would benefit the most if 100% OPEC compliance is achieved in 2018, as its budget revenues are the least diversified in the GCC (nearly 90% of total budget revenue comes from oil), and Kuwait’s crude oil production is already close to 100% compliant with its OPEC target. As a result, it would benefit the most from a higher average oil price in 2018, with no further cuts to production volumes required.

Similarly, Kuwait’s current account is likely to see the biggest boost from higher oil prices in 2018, in a scenario of 100% OPEC compliance. However, even countries that would have to cut oil production further in 2018 to become 100% compliant with their OPEC production limits would benefit from doing so, as higher average oil prices would help to reduce the budget deficit and improve the current account surplus.

Source: Emirates NBD Research

Source: Emirates NBD Research