Despite enormous appetite from refineries in the last week US crude inventories jumped against market expectations. Total crude stocks rose by 6.8m bbl last week, including a gain of 1.6m bbl at Cushing. There were builds across nearly all products expect for a small draw in gasoline. But the real highlight of this week’s EIA report was refinery demand running at 98.1% utilization compared with a five-year average of 90.8% and refinery intake of nearly 18m b/d. Even with refineries running flat out, production is clearly swamping US oil balances and as part of a broad weakness in commodities yesterday WTI futures fell by over 3%.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research

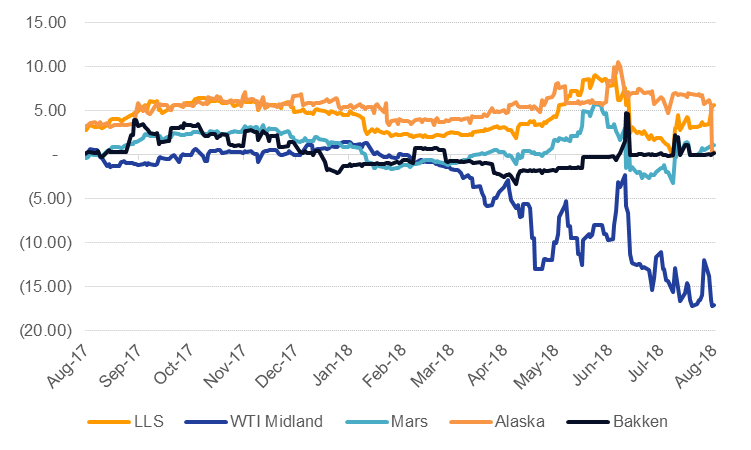

Earlier this week the EIA published its Drilling Productivity Report where it expects further increases in production in all shale basins for September. Total shale production will hit 7.5m b/d next month, nearly 70% of total US output. The Permian basin alone will provide 3.4m b/d even with physical pricing still remaining at a sharp discount to WTI (USD 17/b overnight).