US crude stocks continue to hover around their five-year average, declining by 1.4m bbl last week. A healthy draw in gasoline inventories and tick-up in refinery utilization helped to send a relatively positive signal about demand as we head into the stronger summer months. The stand-out data, however, was exports. US crude exports recorded a new record high of 2.57m b/d last week, and have averaged over 2.2m b/d in the last four weeks.

Source: Eikon, Emirates NBD Research. Note: USD/b

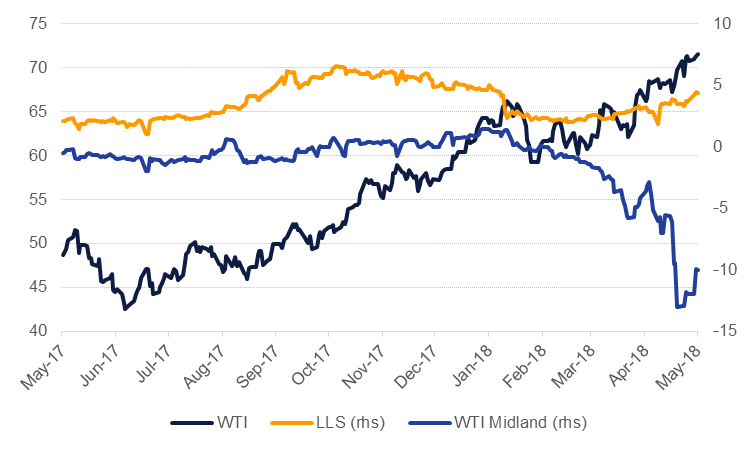

Source: Eikon, Emirates NBD Research. Note: USD/b

We would expect to see further solid performance from US exports as producers seek access to the higher value seaborne markets. WTI Midland continues to trade at a wide discount to WTI. Pipeline capacity may keep export levels topped out at around current levels but considering the growth in US production, we expect US exports can be sustained if pricing remains attractive.