EIA data is showing the market has moved past the impact of hurricanes at the end of August and earlier this month. US crude stocks fell for the first time in September although they still managed to gain at Cushing. Stocks across the rest of the barrel were more mixed but gasoline showed a build of over 1m bbl. US production continues to move back to its more confident footing, reaching over 9.5m b/d last week, effectively moving back to the pre-hurricane trajectory.

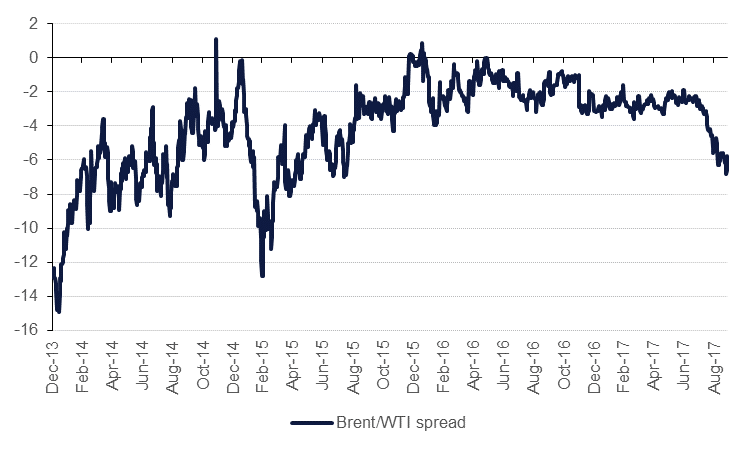

While the market’s attention this week has been on Brent’s meteoric rise up to nearly USD 60/b we suggest it should be paying closer attention to the wide discount of WTI to Brent, closing at USD 5.76/b yesterday. The spread needed to widen to take account of the impact of hurricanes on the US but its persistence at the widest levels since 2015 leads us to think the rebalancing story is not as clear cut as headlines would have the market believe.