Oil bulls hardly needed any more help following growing uncertainty over how well OPEC can balance markets in H2 2018 but this week’s EIA data helped the stampede carry on a bit more. US crude production held stable at 10.9m b/d while there were large draws in total crude stocks and at Cushing. Beyond the slump in inventories, demand indicators are still looking quite strong as we head into driving season. Refinery utilization jumped to 97.5% from its already elevated levels last week while US exports hit a new high of 3m b/d.

Source: Emirates NBD Research

Source: Emirates NBD Research

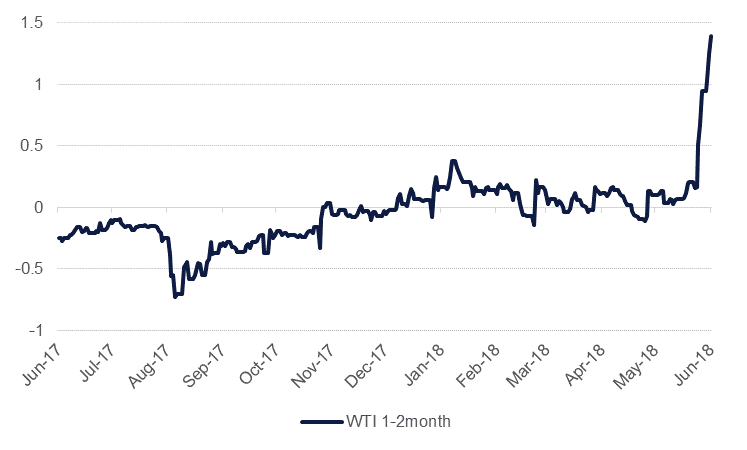

The front end of the WTI curve is being disjointed by disruptions to supplies from Canada, which the latest EIA data is reflecting through a drop in stocks. While this is a near-term tightening of US balances it is expected to pass through relatively quickly and output should resume to normal by July. Nevertheless, until output is restored EIA data will reflect the supply shortages and create strongly bullish signals in the short-term.