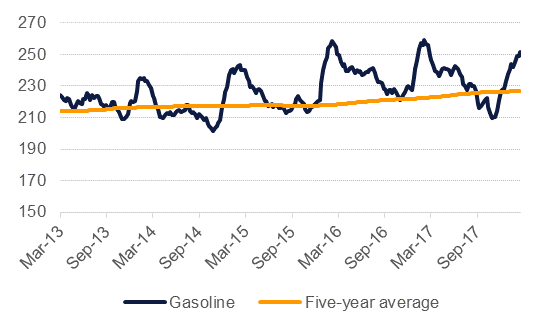

Builds in overall crude stocks and gasoline, along with weaker refinery utlisation should also send negative signals about US demand as we enter March. Stocks rose more than 3m bbl last week gas gasoline inventories were up by nearly 2.5m bbl. Production continues its march higher, adding 13k b/d last week to take US total output to over 10.28m b/d.

The EIA is expecting the US to break above 11 mb/d as early as this year which will unwind some of the work OPEC and its partners have done in cutting back on excessive inventories. As we have noted in the past, because US oil data is so timely it has an overweight influence on global oil markets, even domestic balances in the US are at odds with fundamentals elsewhere in the world.