US oil production hit 11m b/d for the first time ever last week. Production growth continues to accelerate, up 1.57m b/d compared with the same time last year. Data generally across the report was relatively bearish despite a drop in gasoline inventories. Refinery utilization decreased while overall crude stocks rose. Exports dipped and that may have helped contribute to an increase in inventories.

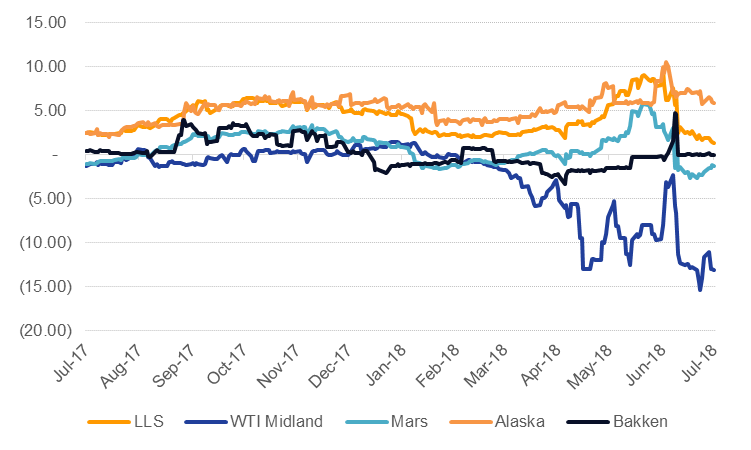

Source: EIKON, Emirates NBD Research. Note: USD/b against WTI.

Source: EIKON, Emirates NBD Research. Note: USD/b against WTI.

Pricing in the key growth centre—the Permian basin—has resumed its downward path and was holding on to levels around USD 56/b. This barely leaves enough headroom for producers in the region to develop new wells as breakeven costs estimate by the Dallas Fed are roughly USD 53/b. The EIA projects that Permian basin production will hit over 3.4m b/d in August, growth of 73k b/d m/m.

.png) Source: EIA, Emirates NBD Research

Source: EIA, Emirates NBD Research