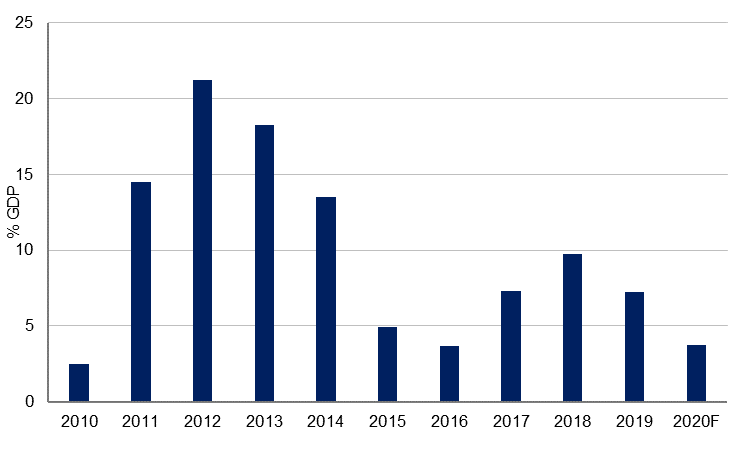

The UAE’s current account surplus narrowed to USD 29.6bn (7.2% of estimated GDP) last year from an upwardly revised USD 40.5bn (9.8% of GDP) in 2018. We had forecast a current account surplus of 7.5% of GDP in 2019.

Source: Haver, UAE Central Bank, Emirates NBD Research

Source: Haver, UAE Central Bank, Emirates NBD Research

As expected given the lower oil price in 2019, oil export revenues declined -16.1% y/y, which was the main reason for the smaller overall current account surplus. The services deficit widened slightly, but this was more than offset by higher investment income. Workers remittances, the largest component of the transfers account, were broadly unchanged at USD 38bn.

Overall the financial account recorded an outflow of USD 20bn in 2019, lower than the USD 34.5bn outflow in 2018. Inward FDI to the UAE increased by nearly a third to USD 13.8bn, but outward FDI was still larger at USD 15.9bn. Net portfolio inflows increased slightly to USD 1.1bn. The main reason for the negative balance on the financial account was outflows from banks, private non-bank capital and the public sector enterprises.

We expect the current account surplus to narrow further this year to 3.8% of GDP, assuming an average Brent oil price of USD 45/b in 2020. As with all our forecasts for this year, there is a high degree of uncertainty around this estimate and the risks are on the downside. Nevertheless, the UAE’s external position is solid, with central bank reserves having increased in eight of the last nine years. Net foreign assets at the UAE central bank stood at USD 110bn at the end of February. Moreover, the UAE has sizeable sovereign wealth reserves which are not reflected in the central bank’s balance sheet.