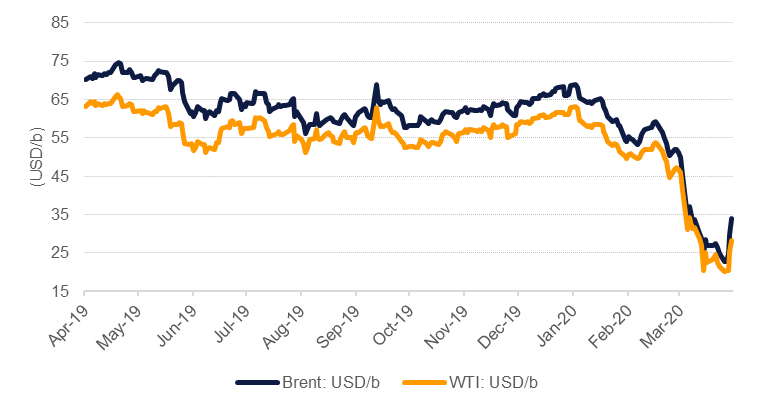

Oil markets endured another week of extreme volatility as US President Donald Trump claims to have brokered a deal that would bring an end to the current price war and see producers like Saudi Arabia, Russia and others cut production to restore balance to markets. Following the President’s tweet prices on Thursday shot up almost 50% to USD 36.29/b in Brent futures before settling and closing on the day up “only” 21%. WTI saw similar extreme moves, with prices closing that session up almost a quarter. That oil prices could gain so much and it not be the dominant driver for financial markets suggests that attention remains fixated on the economic damage being wrought by the coronavirus pandemic. Trump’s plan, where he ‘hoped’ that Saudi Arabia and Russia would cut production by as much as 10m b/d, may not even be large enough to offset the enormous build in inventories this quarter that will be a result of an absolute collapse of demand.

OPEC+ is meant to hold an emergency meeting this week to discuss cutting production. Initial plans were for a meeting to be held on Monday but bellicose diplomatic exchanges between Saudi Arabia and Russia appear to have put paid to an early meeting. While the collapse in prices may have sharpened minds as to the need for production restraint, we don’t see a significant change in the positions that OPEC+ members had ahead of their March meeting which failed to result an agreement. Saudi Arabia will not accept the burden of single-handedly cutting production and its increase in output and exports in the past few weeks shows that it is prepared to back-up its position with action. Meanwhile, Russia is unwilling to cut if the US doesn’t participate. The position of Trump is that the US would not need to cut production but state regulators appear much more amenable to cutting output—in any case production will decline thanks to companies shutting in wells at current low prices.

This Thursday’s meeting represents another inflection point for crude markets and a failure to get an all-encompassing deal that leads to lower volumes would probably mean oil prices pushing back to the USD 20/b level. Were all parties to sign up to production cut deal, spread out across all producers then prices would likely stabilize around current levels in the low USD 30/b range. In a discouraging sign, though, on the odds of a deal being reached later this week, Aramco has reportedly delayed notifying the market of its monthly OSPs for May and may use them as another broadside to secure market share should a production cut deal remain elusive.

When all of last week’s hysteria ended, Brent futures closed up 37% over the week at USD 34.11/b while WTI settled at USD 28.34/b, up nearly 32%. Forward curves also adjusted sharply with the contango in Brent markets narrowing by more than 50% at the front of the curve while WTI saw a roughly 30% improvement in 1-2 month spreads. However, contango across the curve still remain wide at well over USD 1/b at the front end and more than USD 5/b in 1-12 month for both Brent and WTI futures. In the US, the drilling rig count continues to plummet, down by 62 rigs last week alone and more than 120 since mid-March.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research