Oil markets have received some support in recent days in the hope that the US and Saudi Arabia may come to some form of alliance to help bring about an end to the current Russia-OPEC price war. Dan Brouillette, the US energy secretary, said it could be under consideration among other plans to try and end the current rout in prices. OPEC has even invited a senior official from the Texas Railroad Commission, the state’s energy regulator, to speak at its next meeting in June.

To be certain US oil producers are feeling the brunt of the current collapse in oil prices with capital expenditure plans from small to large operators being slashed. Even for some of the most efficient producers prices at current levels—WTI at USD 24/b—will be unbearable. We have already seen an impact on the drilling rig count in the US which fell by 19 rigs last week with Texas taking most of the cuts.

Will Texas join OPEC in a new round of production cuts to stabilize and help shore up oil prices? Industry bodies and leading producers in the shale patch have spoken out against the idea while senators from states with fast growing energy industries have called on the US administration to admonish Saudi Arabia or Russia for “dumping” crude onto the markets. We could also see a return of a NOPEC bill—where the US tries to sue countries like Saudi Arabia under anti—trust regulations. (Indeed, US anti-trust laws have their origins in breaking up monopolistic behavior in the oil industry, specifically targeting Standard Oil).

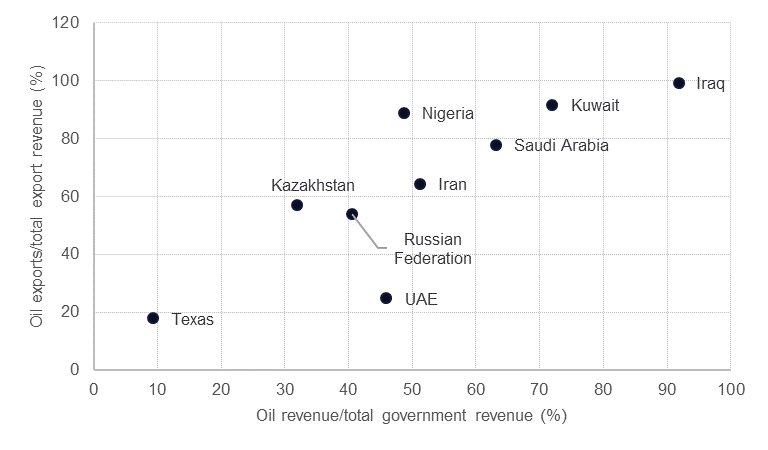

If Texas did indeed cut production in cooperation with cuts from Saudi Arabia and other OPEC members it would rehash the issues that OPEC faced with Russia. OPEC works best when countries look the most alike: a high dependency on oil for both their fiscal and external accounts. That way production decisions, and the impacts on prices, will be distributed relatively evenly. Russia was a beneficiary of the OPEC+ production cuts given its external and fiscal balances are much less dependent on oil income than say Saudi Arabia or Iraq. We estimate oil accounted for around 40% of Russian government income and 54% of export receipts. By comparison Saudi Arabia’s reliance on oil is much higher: more than 60% of government receipts and almost 80% of export income.

Source: IMF, USTR, Emirates NBD Research

Source: IMF, USTR, Emirates NBD Research

Texas, while dominating US oil and gas production, doesn’t look like an OPEC country. The state took less than 10% of its revenue from oil and gas taxes and oil and gas accounted for less than 20% of total state exports according to USTR data. As a share of the US total exports and fiscal revenue, oil and gas income would be even smaller.

Replacing Moscow with Houston would not solve OPEC’s challenge of trying to coordinate production among like-minded members. OPEC currently has 13 member nations, each with individual social, economic and political priorities that impact their oil market policies and often struggles to reach agreement on production levels. Cooperation with partners like Russia, Kazakhstan or Mexico stretched the profile base of OPEC+ even further, making agreement even more challenging.

There are 9,000 independent oil and gas producers in the US, each with their own reserve base, debt and profitability profile and corporate strategy. Getting consensus on production even among the largest producers of that group would likely be nigh on impossible.

The current rout in prices will almost certainly bankrupt many highly exposed producers in the US and will lead to a production adjustment. But US producers, among others around the world, are facing a crisis of capital not of technology or assets. During the last price crash in 2015-16 companies made significant efforts to improve efficiencies and bring down production costs, allowing the industry to grow faster once prices started to stabilize at higher levels. Rocks in the Permian Basin don’t care if they are developed at USD 5/b or USD 50/b and will still be there when efficiencies and technology allows them to be put into production.

.png)

Source: Emirates NBD Research

We can’t be certain when or if prices will return close to pre-price war levels. But profit-motivated companies facing demands from shareholders and lenders will keep trying to find ways to push opex and capex breakeven levels lower. Joining up with a producers’ bloc that sets rigid output targets will be a straightjacket that we doubt many in Texas and other producing regions will be all too welcome to try on.

Click here to Download Full article