US oil producers, particularly those in the shale patch, will be caught up in the crossfire of the Russia-OPEC price war. With WTI prices plummeting to around USD 30/b the viability of the industry will again be called into question and the market will likely price in an impending bust of shale producers.

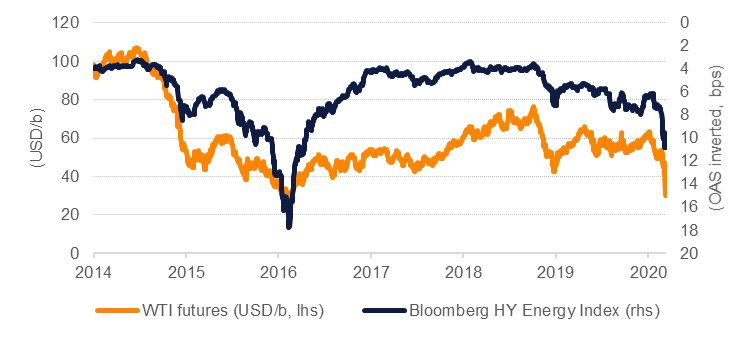

Credit spreads for high-yield energy firms—which includes a significant number of shale-focused producers—have widened sharply in line with the deterioration in oil prices, following a path they took during 2015-16. Were WTI prices to remain around current levels for several months, credit conditions for shale producers would tighten further, threatening capital spending plans. Indeed, the Dallas Fed’s most recent survey of oil and gas companies (December 2019) showed that the majority of firms were basing their capital expenditure plans for 2020 with WTI at USD 53-56/b, 70% higher than current WTI futures!

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

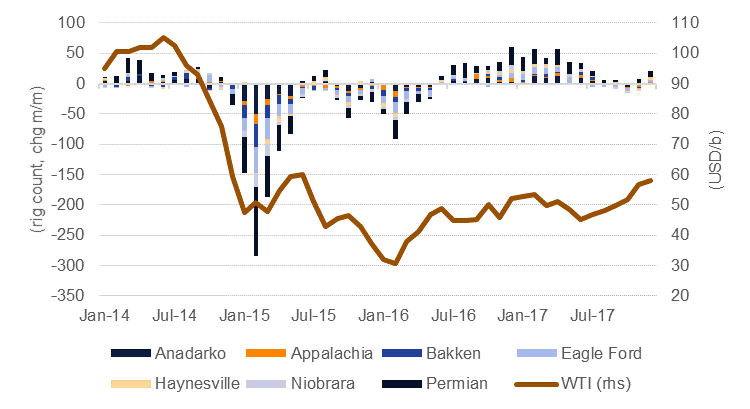

The last time OPEC adopted a market share strategy, specifically targeting the robust pace of growth in US production, the impact on US shale basins was immediate. Producers cut the drilling rig count nearly immediately as prices collapsed and production growth from shale basins lingered near 0 for almost two years. OPEC+ production cuts from 2017 onward helped to essentially subsidize the revival of the US shale sector which endured the challenging pricing conditions by driving operating and capital costs lower. From their trough in September 2016 at 5.2m b/d, shale basins in the US have managed to increase production by 78% to 9.2m b/d expected for this month.

Source: Bloomberg, EIA, Emirates NBD Research.

Source: Bloomberg, EIA, Emirates NBD Research.

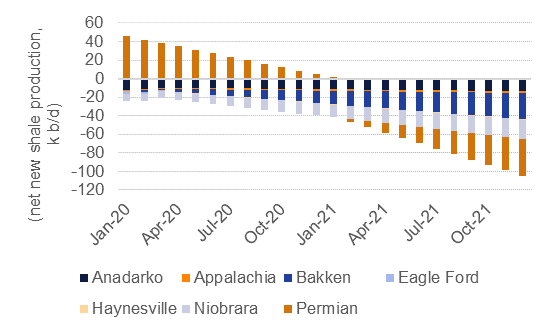

If we assumed a complete halt to capital expenditure and no new rigs added to the shale patch then production would peak near recent levels of 9.2m b/d by June 2020. The majority of the decline would be concentrated in regions with relatively higher break-even costs like the Bakken in North Dakota or Niobrara area of Colorado. Production from the Permian in Texas would still manage to increase month/month until February 2021.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

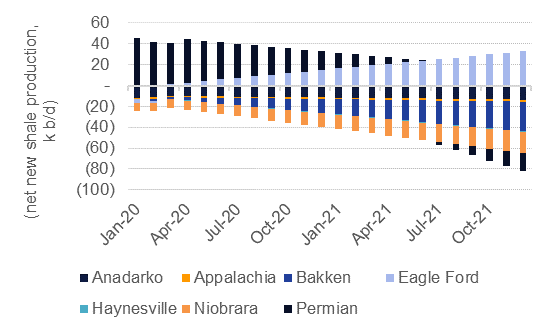

However, even modest changes to this forecast would set a very different production trajectory. Just one additional rig per month in the Eagle Ford basin (where breakevens range from USD 32-57/b) and one in the Permian (breakeven at USD 44/b according to Bloomberg estimates) along with an improvement in the new production per rig along 2019 averages would keep the US adding volume to the market well into the end of 2020.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

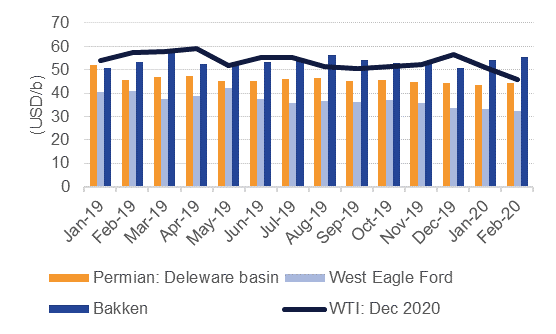

A critical variable for how the US production profile plays out is how much of 2020 was hedged forward. For much of 2019 breakeven levels in large basins were below December 2020 WTI futures, offering some headroom for producers to lock in margins for this year. If US production shows signs of stabilizing around current levels for Q2-Q3 that would suggest that producers did indeed take advantage of the hedging environment and will mean crude will continue to flow. However, as the demand environment remains highly subject to the effects of the Covid19 outbreak, inventories may be the first destination for much of this US crude.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.