US PPI data was released yesterday, rising by 0.3% m/m in March, compared to analyst expectations of 0.1%, and a February rise of 0.2%. The inflation was broad-based across a range of sectors, and US treasury yields rose modestly on the news. All eyes will now be on the CPI data released later today, to see if it confirms this inflationary bias, and the Fed minutes released later tonight, to see how close the FOMC came to changing its outlook at its last meeting. The risk of a trade war between the US and China appears to be subsiding, with US President Donald Trump praising the ‘kind words’ by Chinese President Xi Jinping at Boao yesterday. This is a more positive outlook than the report that talks broke down last week over Chinese support for hi-tech industries as part of the ‘Made in China 2025’ programme. Xi made no promises over cutting this support in his speech, but did pledge to open up the economy more.

The Iranian government is taking drastic steps to try and stem the rial’s rapid depreciation on the parallel market, yesterday announcing a devaluation of the official exchange rate, and harsh penalties for anyone selling the currency at any other rate. The new official rate for the rial is IRR42,000/USD, compared to IRR37,830/USD previously. The black market rate for the rial fell to as low as IRR60,000/USD in some sales yesterday, having only breached the IRR50,000/USD for the first time at the end of March. Fears over renewed sanctions related to Iran’s alleged nuclear weapons programme have contributed to the freefall.

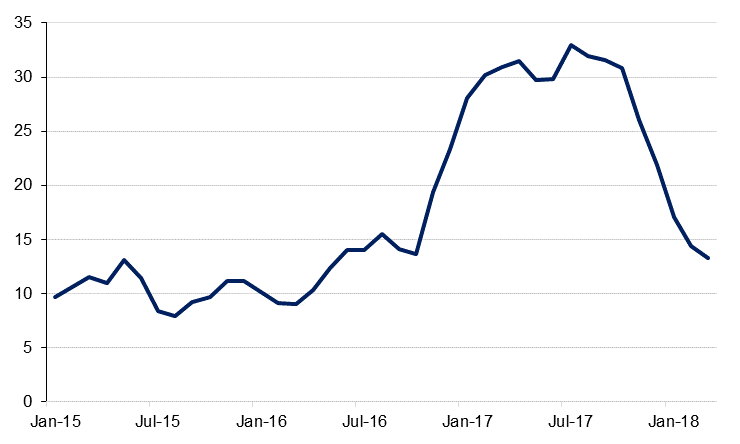

Egypt’s headline CPI inflation fell to 13.3% y/y in March, from 14.4% in February. This marked the slowest pace in nearly two years. The ongoing fall in inflation is a positive for the Egyptian economy following the levels of over 30.0% recorded through much of 2017. Although the pace of the decline is set to slow as subsidy cuts planned for the new fiscal year will exert renewed inflationary pressure, we nevertheless expect two further cuts of 100bps each to the key policy rates over the remainder of the year, further to those seen in February and March.

US treasuries closed lower with the curve flattening as equities rallied. Yields on the 2y UST, 5y UST and 10y UST closed at 2.30% (+3bps), 2.62% (+3 bps) and 2.80% (+3bps). Bunds dropped sharply following comments from Nowotny on quantum of possible rate hikes but pared their losses after comments were downplayed by the ECB. Yields on 10y German bunds closed 2bps higher at 0.51.

Regional bonds closed lower amid plenty of supply from the sovereigns. The YTW on the Bloomberg GCC Credit and High Yield index rose +2bps to 4.29% and credit spreads remained flat at 173bps.

Saudi Arabia raised USD 11bn in a three-part bond sale. The government raised USD 4.5bn in 2025s at 140bp over USTs, USD 3bn in 2030s at 175bps over USTs and USD 3.5bn in 2049s at 210bps over USTs.

S&P lowered Doha Bank’s ratings to BBB+ from A-.and retained negative outlook.

AUD and NZD have softened against the other major currencies in the Asia session following softer than expected Chinese inflation. Economic data showed that consumer price inflation slowed from 2.9% y/y in February to 2.1% in March, while during the same period producer price inflation slowed from 3.7% to 2.6%. As we go to print AUDUSD is trading 0.1% lower at 0.77548 and remains vulnerable while the price remains below the 0.7790 zone, close to the 50 and 100 day moving averages of 0.7794 and 0.7788 respectively. NZD has fared less well and NZDUSD trades 0.18% lower at 0.73475, with support likely to first be found at 0.7280, not far from the 50 day moving average of 0.7282.

Developed market equities closed higher with the S&P 500 index and the Euro Stoxx 600 index adding +1.7% and +0.8% respectively following an underplaying of trade concerns by the Chinese President in his speech.

Most regional markets closed higher with the ADX index adding +1.0% and the Qatar Exchange gaining +0.8%. Egyptian equities continued to outperform the region with the EGX 30 index rallying +1.7%. This was on the back of inflation data which came in at its lowest level since 2016.

Oil markets jumped overnight in response to news that Saudi Arabia is explicitly targeting an oil price of USD 80/b. Brent futures rose 3.5% to close above USD 71/b for the first time since 2014. WTI futures added 3.3% to close above USD 65.50/b. This is the most specific target the market has heard from Saudi Arabia as it seeks the funds to reform its economy and create positive conditions for the IPO of Aramco. Escalating geopolitical tensions in the Middle East are also adding a bid to oil markets. Time spreads widened in response to the gain in spot prices with the backwardation in 1-2 month WTI back around USD 0.1/b and in Brent more than USD 0.6/b.

The EIA revised higher its expectation for US supply growth for 2019 to an increase of 750k b/d and slightly lowered its call for this year to still strong growth of 1.37m b/d. The US will surpass Russia as the world’s largest producer next year according to the EIA projections.

ADNOC has announced it would offer six oil and gas blocks for exploration, its first competitive bidding round. Four of the blocks are onshore and may contain ‘substantial amounts’ of oil and gas, according to the company. ADNOC will take the offering on a roadshow over the next few weeks with bids expected by the end of the year. The announcement follows Bahrain’s recent announcement that it had discovered as much as 80bn barrels of oil reserves in an offshore shale formation.