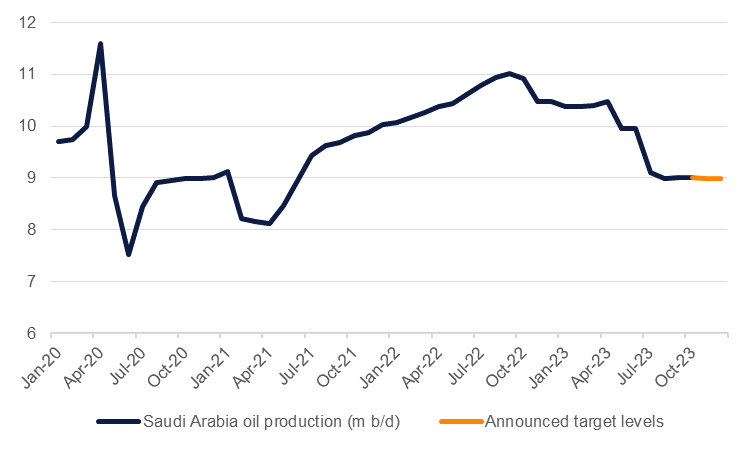

Saudi Arabia and Russia have confirmed that they will extend their voluntary additional production cuts and export limits until the end of 2023. For Saudi Arabia, that means keeping production at 9m b/d where it has been since July and is in line with our expectation on Saudi’s production targets for this year. Russia will continue to limit its crude oil exports by 300k b/d in addition to production cuts of 500k b/d agreed early this year.

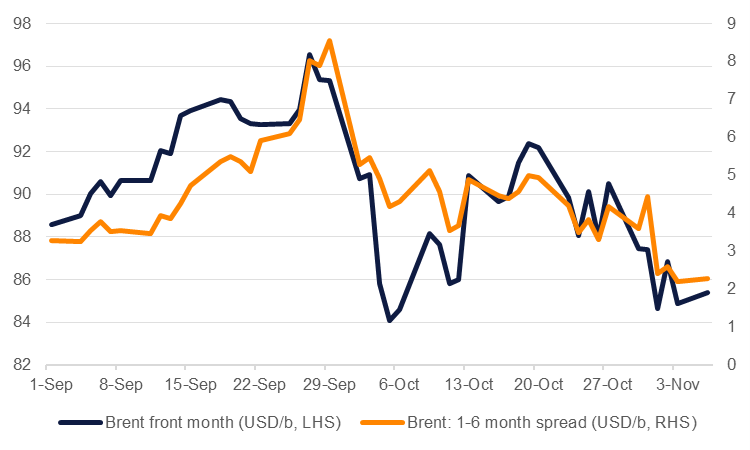

The Saudi and Russian production constraint, in coordination with that from the rest of OPEC+, is contributing to a deficit in oil market balances for Q4 2023. Based on the IEA’s demand projections for Q4 2023, we estimate a deficit of roughly 1.4m b/d this quarter. As the market looks ahead to 2024 the OPEC+ ministerial meeting at the end of November will come increasingly into focus. Spot oil prices have shown some substantial volatility in the last two months, trading as high as USD 96.55/b in the Brent market in late September before slumping to around USD 84/b a week later and then bouncing on geopolitical headlines related to conflict in Israel and Gaza. This scale of volatility will likely convince OPEC+ ministers to err on the side of restraint and keep output targets unchanged for most of the bloc.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research The biggest uncertainty is from Saudi Arabia and whether the country will extend its voluntary 1m b/d cuts into 2024. According to the Saudi Press Agency, the cuts will be “reviewed next month to consider extending the cut, deepening the cut or increasing production.” Extending the cuts is the most likely decision for Saudi Arabia as easing some output back into the market—250k b/d for example in Q1—would worsen a pending oil market surplus that may develop in H1 2024. Cuts could be deepened to help put a sturdier floor under oil prices but the cuts are having a negative impact on the performance of Saudi Arabia’s GDP which contracted by 4.5% y/y in Q3 23 with a 17% y/y drop in oil sector GDP.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

Time spreads are also showing an even steeper deterioration than spot prices with the 1-6 month backwardation in the Brent market contracting by more than 70% since the start of Q4 from more than USD 8/b at the end of September to a bit more than USD 2/b as of early November.