After an enormous quarterly decline of more than 12m b/d in Q2 oil demand will recover over the remainder of 2020 with growth of more than 13m b/d in Q3 and an additional 2m b/d in Q4. As economic recovery takes hold in many markets oil demand will track alongside it, although the gains across geographies and products are unlikely to be evenly distributed.

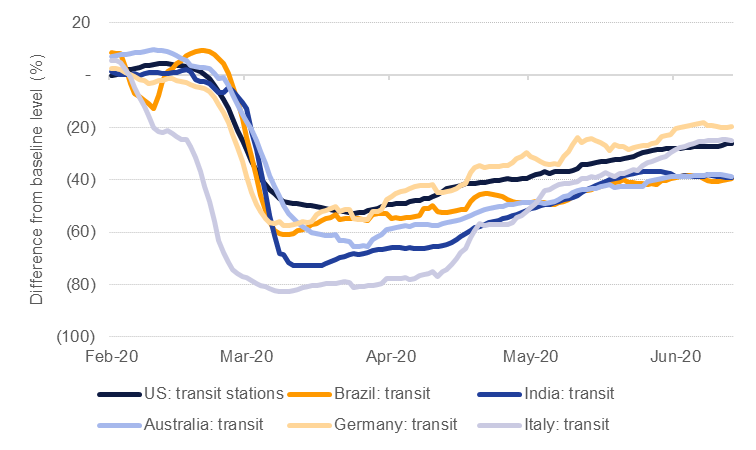

Mobility data from Google shows activity is still far below pre-coronavirus levels even in countries that have had relatively more success in containing and managing the virus. Germany has seen a much stronger improvement in transit activity (only down around 20% from baseline levels) compared with Brazil or India where the gap is closer to 40% below. In the US transit has also trended higher as individual states reopened even as cases were not under control.

Source: Google, Emirates NBD Research. Note: 7-day average.

Source: Google, Emirates NBD Research. Note: 7-day average.

Australia’s experience may provide an example of how recovery in activity—and oil demand—could play out. After imposing severe lockdowns and getting control of the virus, activity across Australia recovered. However, a recent uptick in cases of Covid-19 has put a brake on activity recovering with the state of Victoria now having to re-impose lockdown conditions. Governments would likely be able to target lockdowns more precisely to contain localized outbreaks of Covid-19 but the risk of whether a new wave of infections could overwhelm economies means we are cautious in becoming too over-confident on the scale of demand recovery.

Source: Google, Emirates NBD Research. Note: 7-day average.

Source: Google, Emirates NBD Research. Note: 7-day average.

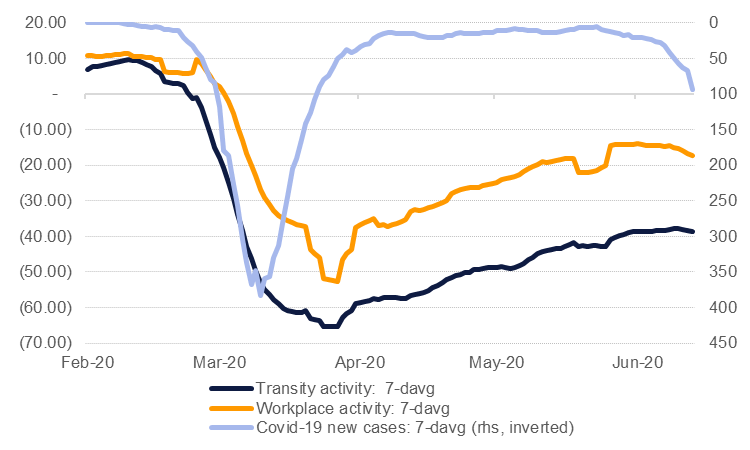

There are few available sources of hard data on oil demand but the mobility numbers from Google provide an indication of how oil demand may play out over the rest of the year. Product supplied data from the US government’s EIA provides the closest to hard consumption numbers and figures there show gasoline consumption in the US has jumped 69% from the lows recorded in early April when lockdowns were in full effect across the country. However, distillate use has risen by a relatively weaker 39% from its lows likely as consumers prefer private vs public transit. The recovery in workplace activity—likely gasoline supportive—had been outpacing transit activity—more likely to support diesel—until recently when new cases of coronavirus have begun to accelerate.

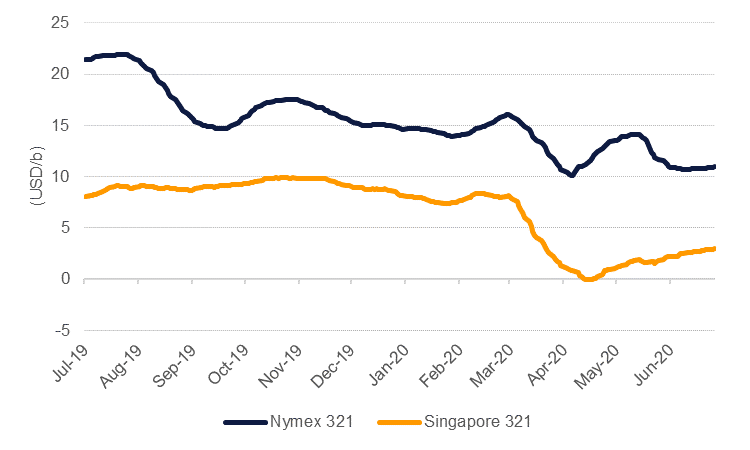

Beyond consumption figures, refining margins also point to relatively tepid demand conditions. Crack spreads based either on NYMEX futures or Singapore swaps have shrunk as product prices have fallen in line with the downward move in crude. While crack spreads in Singapore have at least improved from being negative they are still down more than 60% from the same time last year.

Source: Bloomberg, Emirates NBD Research. Note: 30-day average.

Source: Bloomberg, Emirates NBD Research. Note: 30-day average.

The significant improvement in oil prices in Q2 was largely down to major supply side adjustments. OPEC+ has had some early success in achieving its production cut targets—compliance among OPEC members was around 100% in June—while the sharp drop in production from countries like the US or Canada has also helped to restore confidence in the oil outlook. However, the influence from the supply side of the oil market is going be limited from here on.

From August OPEC+ is actually set to gradually increase production as its output cuts are tapered. Aggregate levels will still be far off pre-coronavirus levels (around 36m b/d in December 2020 compared with more almost 44m b/d that OPEC+ used as its baseline) but the ‘bazooka’, to borrow from the ECB’s terminology, has already been fired. For OPEC+ going forward the challenge will be maintaining compliance so that any additional production does not overwhelm the tentative recovery in consumption.

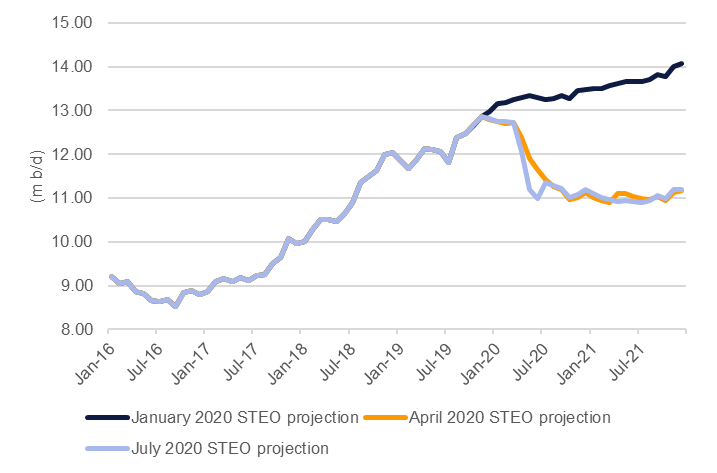

Likewise in more market oriented producers the major drop in production has already occurred. The EIA’s projections expect that May 2020 will have borne the brunt of the decline in US output and that from June 2020 until the end of 2021 production will hold relatively flat at around 11m b/d. The recent tapering off of the US drilling rig count would suggest that most of the blood-letting has already happened in the US and that stabilization, if not necessarily growth, will be the trajectory for the next several months.

Source: EIA, Emirates NBD Research.

Source: EIA, Emirates NBD Research.

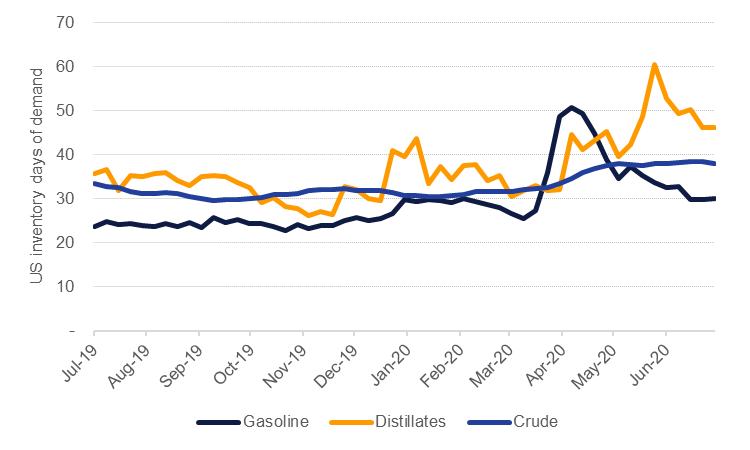

Even as demand is improving off its bottom and supply has been adjusted oil markets will need to fight through an enormous wall of inventories that has accumulated. In Q2 the IEA estimates the market surplus to have been more than 11m b/d, adding over 500m bbl to OECD inventories. Stocks globally, whether for products or for crude, are either at or near their record levels and will act as a significant alternative ‘supplier’ to producers.

Source: EIA, Emirates NBD Research.

Source: EIA, Emirates NBD Research.

Measured against consumption we estimate that OECD stocks would have accounted for more than 100 days of demand in Q2, a record level, and correlating with enormous downward pressure on prices—indeed Q2 2020 will be long remembered as when oil futures recorded their first negative close when WTI settled at –USD 37.63/b in mid-April. OECD stockpiles are unlikely to return to pre-coronavirus levels of below 3bn bbl until Q4 2021, capping the upside potential for oil prices in our view.

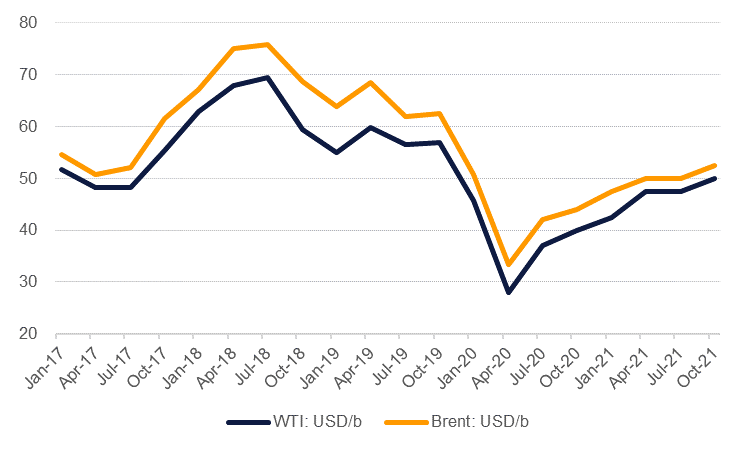

Our oil price assumptions for the rest of 2020 are now higher but we don’t expect a substantial rally beyond current levels. We now assume Brent at an average of USD 42/b in Q2 and USD 44/b in Q4, taking the annual average of USD 42.55/b, a drop of 34% y/y. For 2021 we expect Brent at an average of USD 50/b. For WTI we have revised our 2020 projection to an average of USD 37.70/b while for 2021 we expect prices to average USD 47/b.

Source: Bloomberg, Emirates NBD Research. Note: quarterly average.

Source: Bloomberg, Emirates NBD Research. Note: quarterly average.

Upside risks to our forecasts relate to coronavirus concerns abating—either thanks to the development of a vaccine or manageable social distancing behaviours—as well as no further economic shocks. Downside risks include coronavirus cases getting out of control in key markets, and forcing a lockdown of economic activity again, as well as OPEC+ failure to stick to its production targets.

The long-run outlook for oil prices is more muted in our view. The US, Saudi Arabia and Russia have cut production collectively by 8.2m b/d from their respective peak levels this year while curtailments from the rest of OPEC+ or producers like Canada would take that figure even higher. As demand undergoes a recovery over the next several years the increase in marginal consumption can be met by resuming production at fields already developed and integrated into the oil industry’s infrastructure rather than exploration and development. Hence the cost of meeting that additional demand should be capped by the current highest OPEX costs, not CAPEX. Suncor, a major producer in the Canadian oil sands, estimates that its opex costs were just CAD 25/b for 2020.

Even as headline oil market balances will likely remain in deficit for the rest of 2020 and into 2021 we are sceptical that the forward curve for either Brent of WTI will be able to shift meaningfully into backwardation. Tentative pushes in the Brent curve to flip have been beaten back in recent weeks and admittedly the flip into backwardation has only occurred at the front end. Longer-dated spreads, and December spreads in particular, have narrowed from their excessive contango levels in March and April but haven’t shown any inclination to move into backwardation. Uncertainty over the near-term sustainability of demand while the coronavirus continues to impact economies as well as the mountain of inventories all weigh against either the Brent of WTI curve flipping. The backwardation that has developed in the Dubai swaps market in recent weeks should also dissipate over the coming months as OPEC+ tapers its production cuts.

As OPEC+ begins to moderate its production cuts from August onward we expect to see the recent premium for heavy, sour crudes compared with light, sweet grades to narrow and mean revert back to a discount. Production cuts from Gulf producers—a major source of heavy, sour grades—along with politically-disrupted production in Iran and Venezuela has helped Dubai-linked crudes gain a premium in 2020. As the cuts unwind—and as consumer prefer gasoline-powered transport over diesel—we expect light, sweet grades to reap the benefits.