Oil prices managed to recover last week with both WTI and Brent futures reversing the prior week’s losses. WTI closed at USD 39.75/b, up 9.6%, while Brent closed 8.9% higher at USD 42.19/b. A resurgence of Covid-19 cases in Beijing and consequent shutting down of some activity shook market confidence during several trading sessions that demand would face a difficult outlook for the rest of the year but a still buoyant risk rally helped to pull commodities higher.

OPEC+ held its joint market monitoring committee at the end of last week and agreed specific targets for countries that failed to hit their production cut targets during the initial months of the OPEC+ agreement. Iraq and Kazakhstan outlined how much they would cut to make up for their earlier misses while Nigeria and Angola will make their proposals this week. The JMMC did not recommend any short-term adjustments to the OPEC+ deal and will next hold its monthly meeting in mid-July. From August OPEC+ is to taper its production cuts and the producers’ bloc will be cautious to avoid its own ‘taper tantrum’ if demand is still at risk of Covid-19-related shutdowns.

Brent time spreads at the front of the curve settled in backwardation for the first time since February last week with August/September Brent closing at USD 0.05/b. While the spread is minimal it does mean that oil markets have tightened considerably, and quickly, from their depths in March and April when the front-month spreads widened to as much as USD 4/b in contango. The WTI curve remained in contango at the end of the week but at a negligible USD 0.08/b compared with USD 0.35/b at the start of June and more than USD 2.50/b at the start of May. In the Dubai swaps market, the 1-3 month spread also settled in backwardation of USD 0.34/b and is likely to be propelled wider should Iraq follow through on its pledges to cut output further.

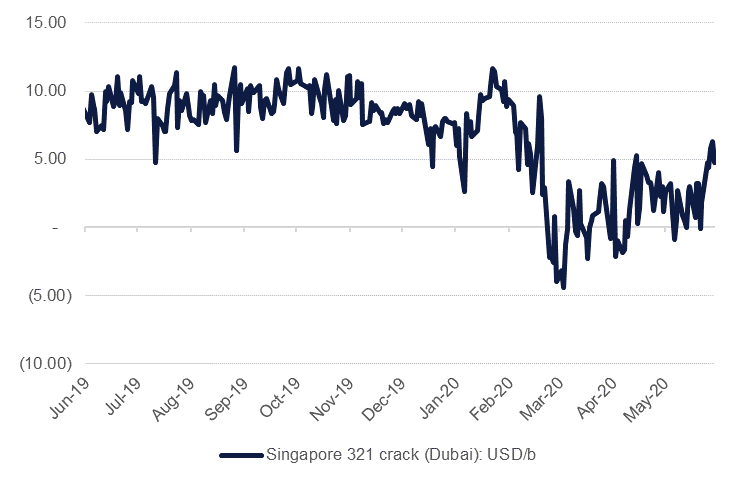

Refining margins are also steadily improving. WTI/RBOB cracks ended last week close to USD 14/b for front month futures, compared with less than USD 11/b a week earlier. Singapore margins also improved with a notional 321 crack of Dubai crude settling last week not far off USD 5/b compared with less than USD 2/b a week earlier. Improving gasoline prices—RBOB added more than 13% last week compared with crude’s 9.6%--are helping cracks improve. Consumer preferences for private over public transport should help to underpin a near-term bid for gasoline even as inventories remain elevated (across the US, ARA and Singapore) and overall demand remains below year ago levels.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.