What has OPEC+ agreed?

- The group of 20 oil-dependent economies has agreed to significant production cuts to try and restore the oil market closer to balance and bring about some stability in prices. The deal will run from May 2020 until April 2022. For the first two months production will be cut by 9.7m b/d, then by 7.7m b/d from July 2020-December 2020 and then 5.8m b/d for the remainder of the deal.

- G20 producers, essentially the US but with Canada, Brazil and others such as Norway lumped in, will contribute to cuts as well but without an official target. Market forces (low prices) will lead to production declines as producers slash capex, shut in wells or in some cases go bust.

How did OPEC+ manage to reach a deal?

- OPEC+ outlined a deal at the end of last week for 10m b/d which would have represented a 23% cut from baseline levels spread out across each of the 20 members. Mexico rejected that demand and only offered to cut by around 6% (roughly 100k b/d from its baseline level). OPEC+’s initial statement insisted that Mexico be part of the deal.

- Intensive oil diplomacy apparently helped get the deal across the line with the US offering to take up the ‘excess’ 17% of Mexico’s cuts (around 300k b/d) as part of its own market-forced decline.

- We thought a deal was unlikely and we got that wrong. We didn’t think Russia and Saudi Arabia could come to an agreement but at least on a political level they have. The US, however, is not officially part of this deal on a government-government basis.

What will be the immediate impact of the cuts?

- The cuts are the largest that OPEC(+) has ever agreed to and will help to offset some of the enormous oversupply in oil markets. Oil demand has plummeted as a result of coronavirus-related economic lockdowns and the scale of decline is likely far larger than the 9.7m b/d cuts agreed. Oil markets will remain in surplus in Q2 and likely for Q3 as well as economic activity remains depressed. The outlook beyond then remains contingent on how economies recover from the effects of coronavirus but we doubt that a sharp uptick in oil demand is likely at any point this year and may even be delayed in 2021.

- The overall impact on prices from the cuts is relatively low. The immediate reaction to the deal should allow prices to stabilize around current levels (mid USD 20s in WTI and low USD 30s in Brent). But physical market indicators continue to remain very weak. Differentials for physical pricing in North America are at sharp discounts to headline prices: WTI Midland is USD 5.55/b below futures while West Canada Select is at a discount of more than USD 19/b. Downside risk remains high even with almost 10m b/d of crude coming out of markets.

- Given the oversupply in oil market balances for the moment, the cuts won’t allow prices to rally going forward and will remain at depressed levels relative either to the socio-economic breakeven costs of OPEC economies or the capex/opex requirements of private producers, particularly for unconventional producers in North America.

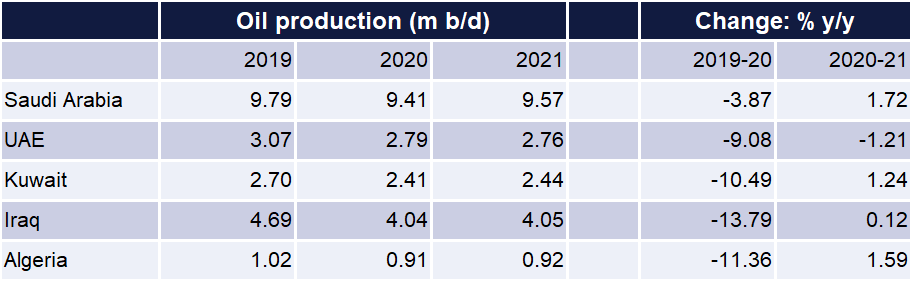

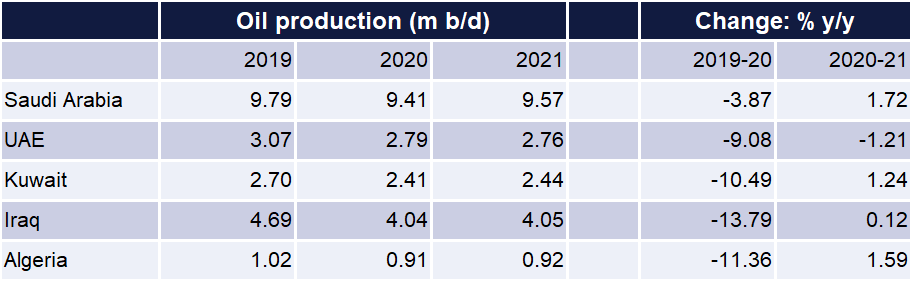

- For producers in the MENA region, the impact of the cuts will be severe if they are adhered to strictly. Official country level targets for the duration of the deal have not been released but by applying the level of cuts proportioned out to each country suggests regional production will decline by 1.7m b/d y/y in 2020 compared with 2019.

Source: Bloomberg, OPEC, Emirates NBD Research. Note: production is annual average.

- OPEC+ will now need to return to monitoring individual country compliance with the level of production cuts. Given the scale of cuts required (Russia is due to cut by 2.5m b/d for example) we expect that cheating or low compliance will work against the effectiveness of the deal. OPEC+ still lacks any enforcement mechanism to punish recalcitrant members, aside from the self-damaging tool of higher output from producers with spare capacity.

What will be the legacy of the deal?

- The US is notably going to participate via the ‘natural’ or market-forced decline of its production. There is no US target for production levels although the EIA’s projections of a 1.7m b/d between Dec 2019 and Dec 2020 may give an indication of how much output is due to come off.

- There are also no limits placed on the US or other so-called G20 producers (like Canada or Norway) in terms of their reaction to any improvement in prices. As we outlined in previous reports, the assets that have allowed the US to emerge as the world’s largest oil producer have not gone away and will be able to be developed once companies calibrate costs to the new pricing environment. We have no clarity over the length of that calibration but we have no doubt it will happen.

- The production cut deal thus renews the bust/boom cycle that has characterized oil markets since 2015: OPEC floods the market ► the entire market endures the pain ► OPEC cuts ► flexible producers benefit from higher prices and available market share ► OPEC floods the market, etc.

- Oil market diplomacy will also be more fraught going forward. Relations between Saudi Arabia and Russia will likely remain tense even if they have come to an agreement. However, the US may adopt a more forthright position with respect to OPEC+ given it now has more to ‘lose’ from the impact of low prices. Several US senators from major oil producing states openly criticized Saudi policy in a call with the Kingdom’s energy and deputy defence ministers.

What is the economic impact for GCC oil producers?

- There is an even bigger double-blow for GCC oil producers, as the impact of lower oil prices on government revenues will be compounded by lower production volumes. Saudi Arabia, the UAE, Kuwait and Oman will likely see headline GDP contract this year on the back of the oil production cuts.

- In Saudi Arabia, where the hydrocarbons sector accounts for 38% of the economy, we were assuming growth 3.3% in oil and gas output but we are now likely to see a contraction of the same magnitude. This would shave -2.5 percentage points (pp) off headline GDP growth, without making any other adjustments or taking into account second round effects on government spending and non-oil sector growth.

- In the UAE, we had assumed 2.5% growth in the hydrocarbons sector this year. However, the new OPEC+ agreement implies a 9% y/y decline in crude oil output. Even if this is partly offset by increased investment and higher natural gas production, we are still looking at a 7.5% contraction in the hydrocarbons sector this year, which accounts for around 30% of the economy. This 10pp swing in hydrocarbon sector growth would shave nearly 3pp off headline GDP growth this year, with all other assumptions unchanged.

- Kuwait would be particularly hard hit in terms of GDP this year as the economy is less diversified and hydrocarbons account for around 54% of real GDP. The shift from 3.2% growth to a 10% contraction in the oil sector would knock 7pp off our previous GDP growth forecast for this year.

- Lower GDP estimates for this year will also result in bigger budget deficit metrics across the GCC, where these have already widened in absolute terms on the back of lower oil revenues.