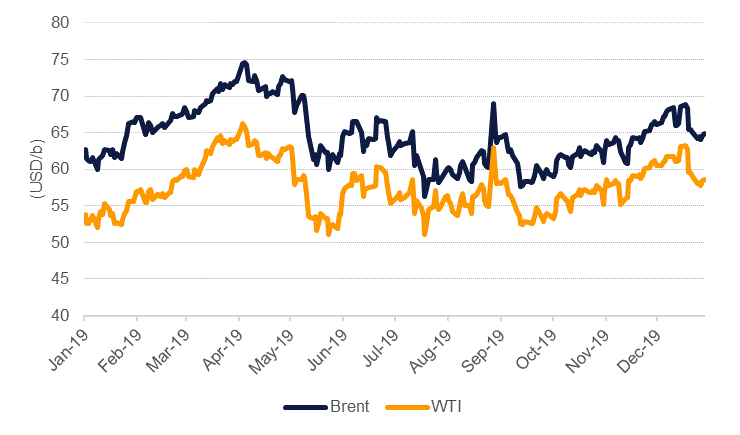

Oil markets held steady last week, recording modest declines in both Brent and WTI futures, as China’s slow GDP growth figures were largely anticipated by the market and agency forecasts affirmed market expectations of large supply growth outside of OPEC. Brent futures settled at USD 64.85/b, down 0.2%, while WTI gave up 0.85% to end the week at USD 58.54/b. While the year has only just begun, oil prices have failed to reap any of the benefit that risk assets have recorded so far this year. The S&P 500 index has gained 3.1% year-to-date, far outperforming the 4.1% year-to-date decline in WTI futures and 1.7% drop in Brent.

Fundamentals forecasts from the IEA and OPEC highlighted a large gain for non-OPEC suppliers this year—the IEA expecting 2.1m b/d of supply growth—and limited room for OPEC producers to increase production at any point this year. Both agencies looked through the recent escalation in geopolitical tension although the IEA has noted that Iraq’s production growth trajectory could be at risk from a prolonged period of hostilities. Nevertheless, demand and non-OPEC supply forecasts from both agencies imply a strong build in inventories in H1 2020, capping any upward moves in prices.

While the Gulf region has dominated geopolitics to start the year, North Africa will set the tone this week. Reportedly half of Libya’s oil production has been shut in as political rivals seek to exert influence over pending negotiations to end hostilities. The recovery in Libya’s oil production in the past year had been quite significant: average production in 2019 was 1.1m b/d, a 12% increase on 2018 levels. However, the country continues to endure political unrest that threatens the stability of supplies and exports. Hence, we assign a relatively low probability to Libya maintaining recent high production levels for most of 2020.

Unlike the circumstances in the Gulf, the tensions in Libya are actually affecting physical markets thus allowing a price rally to have more solid footing. In particular, a shortage of sweet (low sulphur) crude grades may exacerbate the sour/sweet spread developing as IMO 2020 regulations are now affecting shipping markets. The Atlantic basin, though, is hardly short of crude at the moment as the US consistently exports +3m b/d and Norway’s newest oilfield, Johan Sverdrup, continues to beat expectations in terms of output. A prolonged outage from Libya may be seized on by alternative producers.

Forward curves showed a divergence last week with a slightly wider backwardation at the front of the Brent curve contending with a modest contango at the front of the WTI curve. Spreads further along the curve in WTI have also weakened: 2-3 month spreads for WTI started the year in a backwardation of USD 0.36/b but settled at the end of last week at less than USD 0.10/b. Should a solid contango develop across more of the curve we would expect investors to dump more long positions. Last week speculators closed nearly 50k positions and added a substantial amount of shorts taking WTI net length down by more than 62k lots. In Brent overall net length was little changed and as a share of open interest long positions still remain relatively elevated.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.