Crude inventories in the US fell last week by more than 2m bbl while there were also draws in gasoline and distillates. Product supplied also picked up and is now more solidly above 20m b/d and have averaged around 5% higher y/y so far this year. US crude exports fell back slightly but nevertheless remain near the top of their recent range.

Source: Emirates NBD Research

Source: Emirates NBD Research

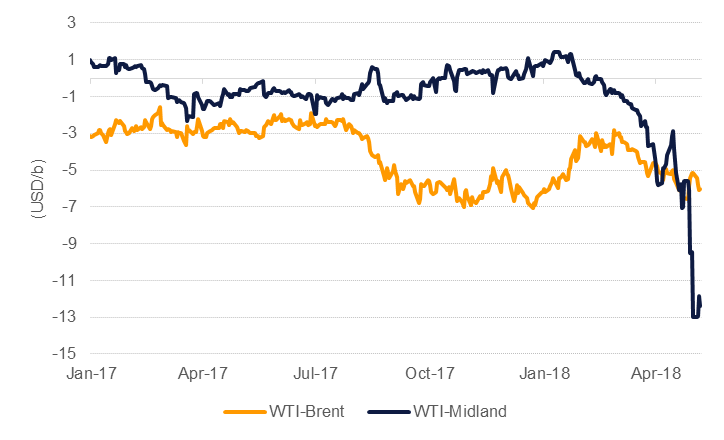

Crude production gained 84k b/d last week, taking total US output to over 10.7m b/d. Compared with a year ago, US production is now closer to the EIA’s target for supply growth in 2018 and the average y/y supply growth for 2018 has been accelerating. It now stands at 1.22m b/d compared with 1.18m b/d at the end of March. Even with the US pulling out of the Iran nuclear deal we don’t see too many corks popping in Texas just yet thanks to the jump in spot prices. WTI Midland’s discount to WTI has actually been getting worse in recent weeks and the grade now trades at a discount of over USD 12/b to WTI. Prices are actually drifting closer to the minimum break even for new wells estimated by the Dallas Fed.