OPEC+ meets this week amid enormous geopolitical tensions following Russia’s invasion of Ukraine. With the conflict involving one of the world’s largest oil exporters—Russia accounts for around 12% of global oil exports—oil markets have moved to price in substantial supply insecurity. Front month Brent futures have pushed back up above USD 100/b and with sanctions from the US, EU, UK and others tightening on Russia, the country is likely to have material challenges in exporting oil.

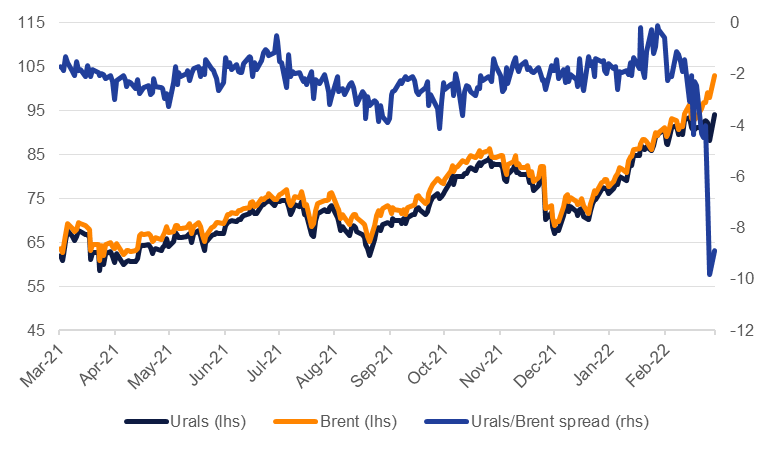

We expect that OPEC+ will endorse its plan to increase production for April by 400k b/d, in line with its strategy of returning all production taken out of the market during the peak of the Covid-19 pandemic. In terms of oil market balances, conditions now are essentially the same as they were a few weeks ago. Balances are tight, helping to keep spot prices high and supporting a wide backwardation in the futures curve. Russian oil and gas exports have not been directly targeted by sanctions though the threat of financial penalties may discourage trade in Russian commodity exports. Differentials for Urals, a major export grade of Russia crude, have moved to as much as USD 9/b below spot Brent futures, its widest discount on record.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

OPEC+ officials have suggested they are planning to keep their production increase on pace for April, not making up for missing targets in past several months or to compensate for any potential disruption to Russian exports. It is worth remembering that Russia remains part of OPEC+, indeed it is the second largest producer in the alliance after Saudi Arabia, and its share of total production quotas is set to increase from May this year when new baseline levels are applied.

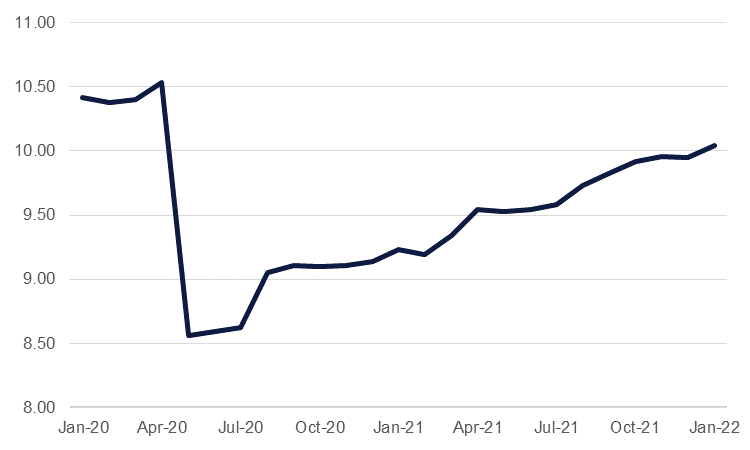

Were producers that have capacity to increase output consider doing so, Saudi Arabia or the UAE for instance, we would expect Russia to push back aggressively to defend its share of the oil market. The last price war between Saudi Arabia and Russia occurred only in March-April 2020 and exacerbated a dramatic sell-off in oil markets prompted by the Covid-19 pandemic. But Russia’s ability to flood markets with crude appears limited. The country is already be producing up against its capacity limits, having fallen short of production quotas in the last two months. The IEA estimates Russia’s sustainable capacity at 10.2m b/d, around 200k b/d higher than its January production levels.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

OPEC+ will also need to consider the flow of negotiations around the resumption of the JCPOA, the Iran nuclear deal. Negotiators have filled headlines with commentary that a deal is imminent or close for the last several weeks, a refrain that has been repeated several times in the last year. But the impetus for reaching an agreement is now more urgent given how high oil prices are feeding into inflation pressures globally. Iran has more scope to increase production than Russia likely does and higher output from the country could help to dampen down prices.