OPEC+ quickly approved a plan to add another 400k b/d to markets in February at its early January meeting. Markets had been widely expecting OPEC+ to stick with its planned increases, agreed in July 2021, and oil prices have gained so far in 2022, seeming to take comfort in OPEC+ confidence that demand will be strong enough to absorb the additional barrels.

Unlike its December meeting where OPEC+ kept the session “open” amid volatile oil prices, this month’s meeting appeared far more assured in the outlook. The producers’ bloc seems prepared to accept that oil market balances will shift into surplus this year but that the scale of excess will be nowhere near what the market endured in 2020. Indeed, oil markets look set for a far more balanced year in 2022 after two years of wide swings between surpluses and deficits. Both supply and demand conditions are normalizing after enduring substantial disruption caused by the emergence of the Covid-19 pandemic in 2020 and subsequent reopening of the economy in 2021 and both are likely to get back to pre-Covid levels by the end of the year.

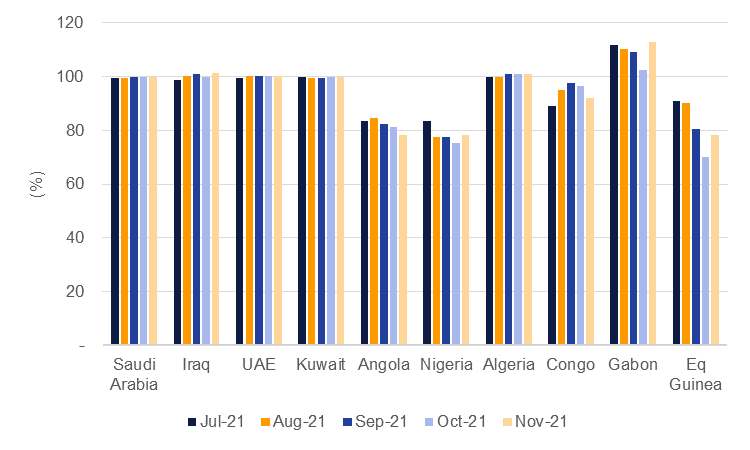

The producers’ bloc may benefit to a degree from some internal misses. There has been no statement from OPEC+ collectively that any production shortfall by members that fail to hit targets will be “made up” by producers with more flexibility or spare capacity. So while an increase of 400k b/d may be the outright target for OPEC+ on a monthly basis, the total level of output is likely to fall short.

Source: IEA, Emirates NBD Research. Note: production/output target.

Source: IEA, Emirates NBD Research. Note: production/output target.

The critical variable for OPEC+ this year will be the resilience of demand to exogenous shocks, like the still prevalent Covid-19 pandemic. After surging in 2021 by around 5.4m b/d, oil demand growth will slow to 3.4m b/d this year according to projections from the IEA. While demand growth is set to slow this year from the recovery-oriented boost from 2021, it will still allow oil demand to break back above the talismanic level of 100m b/d in H2 2022, recapturing levels last seen toward the end of 2019. Broken down by region, demand growth looks evenly split between both developed and emerging markets but within those regions some stark divergences are evident. In developed markets, North America—mainly the US—will account for the bulk of demand growth as OECD European and Asian demand decelerates to pre-pandemic levels of minimal growth. For emerging markets, Asia accounts for the bulk of demand growth. China’s oil demand growth is set to slow, but remain positive, and be driven largely by non-transport related fuels while in India the recovery in mobility will see an acceleration in demand growth in 2022.

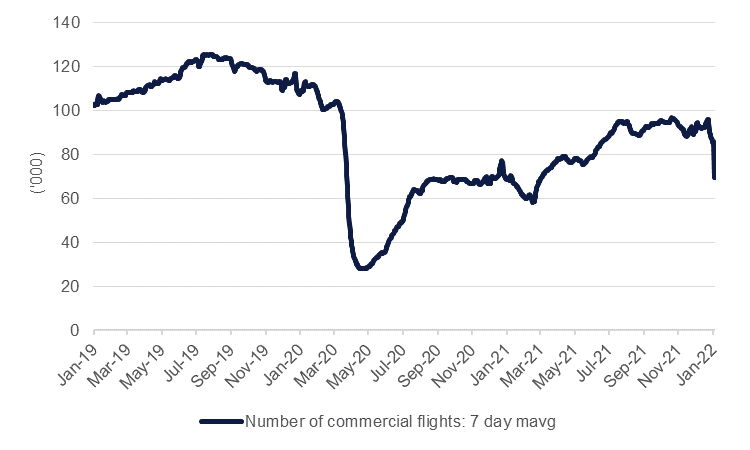

The threat of new variants of Covid-19, like the current wave of Omicron, represent a risk to oil demand growth, stunting the pending recovery in jet fuel in particular. Airline activity has dropped sharply in the last few weeks as passengers curtail travel and the spread of the virus limits the availability of staff.

Source: Flightradar24, Emirates NBD Research

Source: Flightradar24, Emirates NBD Research

Initial data seems to support the view that Omicron is less virulent than other variants of Covid-19 and thus the impact to growth, and oil demand, should thus be lower. But the throttling of demand will be linked to individual economies’ ability to absorb high virus case loads in their health systems, particularly in markets that have lower vaccination levels. High case numbers, even with a less dangerous variant of the virus, still could threaten to overwhelm hospitals and will likely mean governments keep some form of restrictions, whether on travel, full scale reopening of economic activity or social distancing, in place for at least H1 2022. With emerging Asian economies set to represent around 40% of total demand growth this year, tracking vaccine deployment across the region will be critical in assessing the resilience of oil demand to spreading virus case numbers.

With oil markets likely to be in surplus on average this year, particularly by the end of 2022, we still expect to see prices moving lower by the end of the year. But our targets for an average Brent price of USD 68/b this year is not far off the actualized level of USD 71/b hit in 2022. Should demand prove more resilient to the course of the virus this year or non-OPEC+ supply gains fail to deliver then there is scope for upside to our price targets.