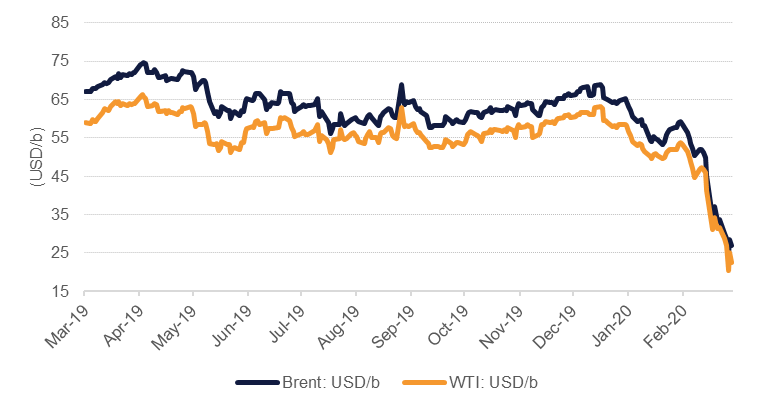

Extensive government and central bank support measures have failed to cauterize the bleeding in oil markets with both Brent and WTI futures recording another week of more than 20% declines. As markets steel themselves for what may be double digit declines in GDP for Q2 in the US, Eurozone and likely the UK, oil prices will continue to be pulled lower as economic activity vanishes. Data out of the US will start to hit markets in coming days and weeks that demonstrates how badly oil consumption is being affected in the world’s largest consumer. As a tangible immediate effect, road congestion in New York City was running at around 15% during peak travel times in the past seven days compared with 50-60% on average during 2019. Container ships underway are down by an average of 1.5% y/y in March so far as trade—already weakened by the US-China trade war—plummets.

The OPEC/Russia price war entered a new phase over the last few days as a senior energy market regulator from Texas was invited to participate in OPEC’s next meeting and proposed that the state would limit production by roughly 10% if OPEC members followed suit. However, the idea was quickly dismissed by many producers and US energy industry bodies. Given that OPEC+ with its 20 members was unable to come to an agreement to maintain production cuts we doubt how the literally thousands of companies that make up the exploration and production sector in the US would be able to reach any kind of consensus on the scale or duration of production cuts. To be sure, oil output in the US will start to fall as producers slash capex needed to maintain production steady. But widespread cooperation on cutting production is unlikely—and could be in breach of anti-trust regulations.

The rig count in the US has already shown signs of producers responding, falling by 19 rigs last week. That was the largest single weekly drop since April 2019 and brings the total number of working rigs down to 664. In Canada the cut backs were even more sever as 63 rigs were taken out of service last week out of a total of 115 a week earlier. Western Canada Select, a benchmark price for production in Alberta, is pricing at just over USD 10/b. The prospect of negative physical pricing is possible—the natural gas market in the US has encountered negative wellhead pricing several times—and could become a reality if inventories reach close to capacity. The EIA’s last estimate of net available storage capacity was 788bn bbl as of September 2019. With capacity fixed at that level, current US crude inventories would mean inventories were close to 60% full.

Forward curves remain depressed with Dec spreads for both Brent and WTI this year holding onto recent lows of a contango around USD 6/b. As inventories increase in the US we would expect to see more downward pressure on WTI, helping to keep it at a discount to Brent until there is a severe negative reaction in US production.

Source: Emirates NBD Research

Source: Emirates NBD Research