OPEC’s next meeting is shaping up to be a confrontational event as a split emerges between the producers’ bloc on whether or not to raise production and bring the current production cut agreement to an early end. OPEC’s production cut agreement with outside partners has been in place since January 2017 and with prices close to USD 75/b for Brent futures some members, most notably Saudi Arabia and Russia, are questioning aloud whether the market can absorb an increase in production.

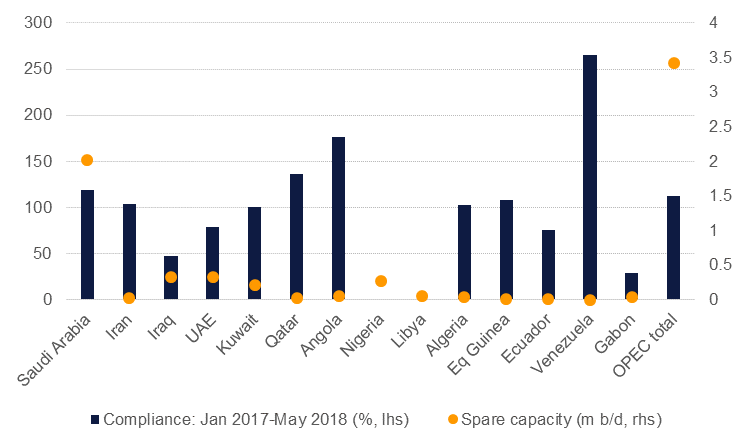

The division in OPEC+ (the 14 members of the producers’ bloc along with 10 other countries of which Russia is the most notable) lies largely between countries with the capacity to raise output and those that do not. Within OPEC, the bloc has around 3.4m b/d of spare capacity of which 59% is held by Saudi Arabia. The UAE and Kuwait have 550k b/d between them while Iraq and Nigeria are the only other countries with considerable spare capacity, although their ability to get it operable is likely to be discounted by the market. Iran, the third largest producer in OPEC, is essentially producing at full capacity and will face an erosion of market share if others raise output at a time when it faces the re-imposition of US sanctions.

Source: IEA, Emirates NBD Research.

Source: IEA, Emirates NBD Research.

Our expectation for the outcome of the meeting is that it will be fraught but that the current agreement will remain in place in theory. This is to us the least bad option for OPEC producers as it allows some to increase production but still remain within the terms of the agreement as they cease over-complying. Agreeing to a production increase beyond the targets of the deal will risk sending prices sharply lower and setting off a shift in sentiment that OPEC will struggle to control. However, while the outcome of the meeting is important as far as messaging goes, actual production levels are more significant.

Our forecast for OPEC balances for the remainder of 2018 is for production to decline from H1 levels but the loss in output will entirely be borne by Iran and Venezuela. The deterioration in Venezuela’s production looks set to continue as the country faces severe economic issues and state oil company PDVSA is unable to pay creditors or suppliers. There is a severe backlog in Venezuela’s oil exports and PDVSA is failing to meet contractual obligations with some of its term lifters. Venezuela is currently producing more than 700k b/d less than its baseline level compared with a targeted cut of 100k b/d.

In Iran, oil refiners in Europe and Asia are already beginning to move away from taking Iranian barrels in anticipation of US sanctions taking effect in November. We expect that Iranian output will decline by at least 500k b/d by the end of the year from Q1 levels as sanctions take their toll.

We expect that Saudi Arabia, the UAE and Kuwait will move to at least 100% compliance with the terms of the production cut agreement rather than the over-compliance they displayed in 2017. The scale of the increase from the most recent data is actually quite limited. Saudi Arabia already raised production quite sharply in May (roughly 90k b/d m/m on average across data from Reuters, Bloomberg, IEA and OPEC itself) and to hit 100% compliance implies an increase of just 34k b/d. If Saudi Arabia raises production beyond its targeted level it will bear the risk of sending prices much lower in the short-term which we believe is still a step too far for the Kingdom. For the UAE and Kuwait the increases are more negligible as they are effectively at 100% already.

We also expect to see compliance ebb at other producers although the volumes will be relatively smaller and less consequential for overall global balances. Iraq’s oil minister has been vocally opposed raising production quotas but opposition there may be more directly related to the risk of prices falling: Iraq’s compliance with the production cut agreement has been an average of just 54% in 2018. While most producers will actually see production increase in H2 from H1, it won’t be enough to offset the declines in Iran and Venezuela. For 2018 as a whole, OPEC volumes will be 400k b/d lower on average than they were in 2017.

Russia has been reasonably compliant with the production cut agreement, recording an average of 84% of its targeted cut of 300k b/d so far in 2018. Several major producers in Russia have been itching to get production back up to pre-cut levels and investment into new fields would help the country recover the roughly 250k b/d of production it is currently holding back. Even if OPEC rolls over its existing production agreement we suspect there is a strong likelihood that Russia will start to raise output on its own.

All of these variables—sharp decline in Venezuelan and Iranian production, increases from Saudi Arabia, Russia and others—along with fast levels of non-OPEC growth were already in place in our oil market balance forecasts and we still come up with a deficit in H2 2018. We doubt that Saudi Arabia would be willing to single-handedly reverse the market deficit story and erase much of the work that it has accomplished in turning around the trajectory for oil prices and thus believe there will be a limit on how much it will actually increase output. Higher output will inevitably squeeze OPEC’s spare capacity and further unplanned outages or persistent demand will keep a floor under prices over the medium term.