OPEC managed to come to an agreement at its latest meeting which was a more constructive outcome than had been widely expected. The statement given by the producers’ bloc stressed that members will “strive to adhere” to their target of 100% compliance with the production cut agreement that has been in place since January 2017, rather than the over-compliance that has helped oil markets tighten quickly. However, the official statement appears to have been left intentionally vague with no specific country allocations nor is there a timeline for how quickly production will be raised. This has left the market guessing as to how much output will end up coming back online and how quickly.

Ahead of the meeting we had expected that OPEC would keep the existing deal in place and that in theory, 100% compliance would be the ceiling for any production increase. On this metric we called the outcome of OPEC correctly. However, OPEC’s intentional vagueness leaves much for interpretation and there have already been differing views as to how much output will actually end up on the markets. This ambiguity was politically necessary for OPEC to get to an agreement as Iran and several other producers were opposed to an official endorsement of an increase that cannot be shared between members.

Source: IEA, Emirates NBD Research.

Source: IEA, Emirates NBD Research.

Saudi Arabia’s energy minister, Khalid al Falih, expects a notional increase of 1m b/d while Bijan Zanganeh, Iran’s oil minister, conceded that as much as 500k b/d will be added to markets. In terms of messaging to the market the difference in estimates are sizeable and allowed for a surge in prices in response to the OPEC statement.

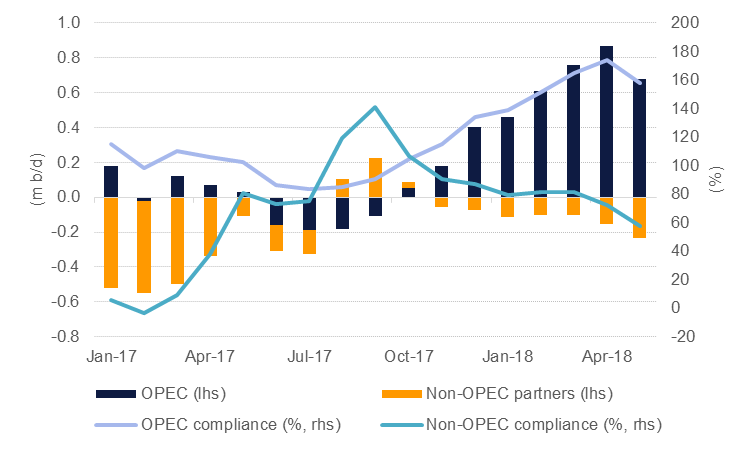

For OPEC to achieve 100% collective compliance with its production cut, it has space to raise output by around 700k b/d from its production levels in May (according to IEA estimates). Part of OPEC’s over-compliance is down to intentional cuts beyond targeted levels by Saudi Arabia and a few others but most of the ‘extra’ decline this year is due to unplanned outages from Venezuela, Angola and, most recently, Libya. Saudi Arabia is already signaling that it has raised production significantly, by as much as “hundreds of thousands of barrels” according to al Falih.

Meanwhile for OPEC’s partners in the deal, hitting 100% compliance would imply a decrease in output of around 230k b/d from May levels as compliance between the 10 countries has only averaged around 70% during the tenure of the deal. Sharp declines in production from Mexico have been more than offset by increasing output from Kazakhstan and middling compliance by Russia in recent months. Between the 24 countries that are part of the deal, an additional 500k b/d would mean aggregate compliance of 100%, some way off from the Saudi estimate of a 1m b/d increase.

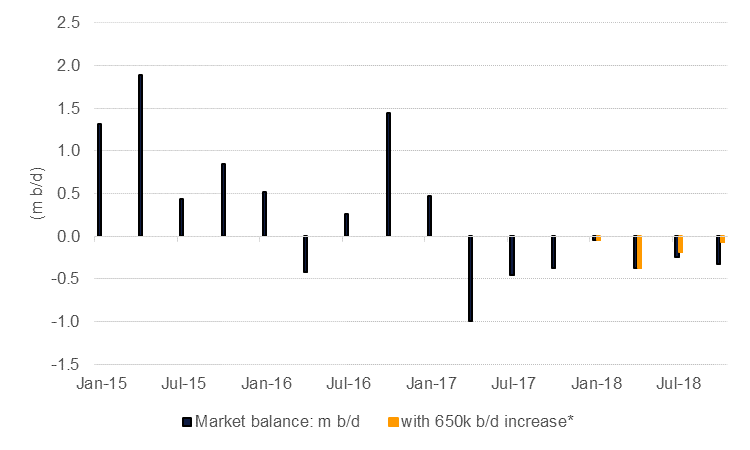

What accounts for this gap? OPEC and its partners may be expecting production from Venezuela and Iran to decline significantly by the end of the year, allowing for extra room to increase output. We expect that production from Venezuela and Iran will be around 650k b/d lower in 2018 compared with 2017. However, the deterioration in Venezuela’s production is accelerating and our forecast of a 470k b/d decline may be too conservative and thus allow for a bigger increase from OPEC+.

Source: IEA, Emirates NBD Research. *Shared between Saudi Arabia, Russia, UAE and Kuwait.

Source: IEA, Emirates NBD Research. *Shared between Saudi Arabia, Russia, UAE and Kuwait.

OPEC did not revise specific country quotas at its meeting to avoid officially sanctioning a transfer of market share between members. But there are few countries with available capacity to raise production and any increase in production would be borne most significantly by Saudi Arabia, the UAE and Kuwait. Between them these three countries have around 2.75m b/d of spare capacity, accounting for around 85% of OPEC’s total, according to IEA estimates. Our oil market balances had already incorporated an increase from these producers in H2 but we would now highlight some upside risks to their production. Even if between the three of them they raised output by 500k b/d (from Q1 to Q4) it would still not be enough to push OPEC compliance meaningfully close to 100% or the market into substantial stock-building. Taken with an increase in Russian production of around 150k b/d over the same time frame, oil markets would still be just shy of balancing in Q4, supporting our view of prices in a range between USD 65-70/b for Brent for the remainder of the year.

OPEC plans to next meet in December and we would expect that the production cut agreement will be allowed to lapse at that time. Were members to resume output at 2016 highs, oil markets would likely shift back into surplus (although at a more muted level than 2015-16 levels). But any increase in output would further erode OPEC’s spare capacity—which has already been in decline since 2015—and help to set a longer-term floor under prices. Perhaps one of the most bullish statements that emerged out of last week’s meeting was Saudi minister al Falih’s warning that Saudi Arabia’s long-term strategy of maintaining spare capacity of 2m b/d was “very high” and “very expensive.”

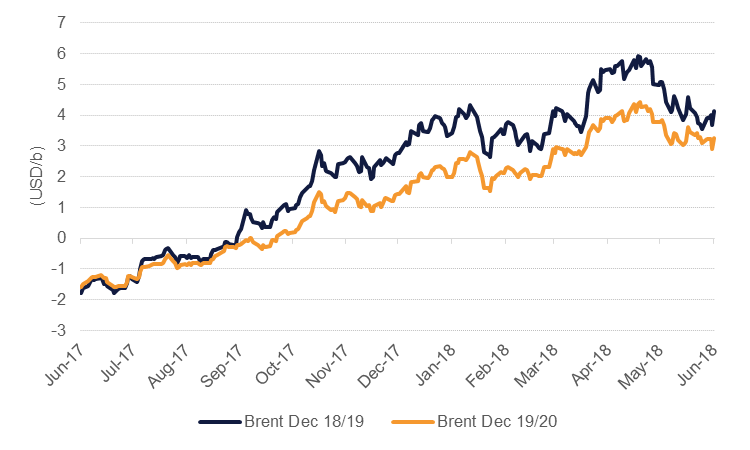

Brent time spreads had been softening going into the OPEC meeting with Dec 18/19 closing last week at around USD 4/b compared with closer to USD 6/b only a month earlier. We expect there is a strong risk time spreads could widen out again as this issue of spare capacity is nowhere close to being resolved and the market is likely to remain in deficit for the forthcoming quarters.

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.