The latest market surveys of OPEC production showed collective output rose to 32.5m b/d in September, its highest level since October last year. At the individual country level most increases were reasonably small: Saudi Arabia raised output by 80k b/d m/m while the UAE kept output flat after four consecutive monthly increases. More of the market’s focus, however, lies on the OPEC members where output appears to be locked in a terminal decline. Production in Venezuela dropped by 70k b/d to 1.26m b/d, its lowest level since a strike disrupted output in 2002/03. Iranian production also fell last month, by 140k b/d, as the country faces a shrinking list of purchasers in the face of the imminent imposition of US sanctions.

OPEC has repeatedly come under pressure from US president Donald Trump to raise production to dampen down oil prices that have now hit their highest level since 2014. At USD 85/b Brent futures are more than 50% higher than they were at the same time last year but OPEC’s collective production in September was still lower than it was a year earlier. President Trump has directly appealed to King Salman of Saudi Arabia to address the current move in prices after lambasting OPEC at the UN General Assembly in September, saying the bloc was “ripping the world off”. Pressure from Trump on oil prices will stay high in the weeks leading up to US mid-term elections in November as any surge in domestic gasoline prices will be laid at the feet of an incumbent administration. Anxiety over rising oil prices is high enough that the US Congress is currently debating a bill that would allow the government to sue OPEC for collusion on oil prices.

We believe there are several reasons why OPEC has so far been reluctant to completely open the spigots and acquiesce to Trump’s demands for higher production.

Higher oil prices are a welcome boost to OPEC economies, particularly those in the Middle East, that have endured several years of wide fiscal deficits and weak growth. An increase in oil production from the levels set by the 2017 production cut agreement will broadly underpin growth in most of the GCC and higher oil prices will help governments accelerate growth further though more fiscal spending. We expect that the UAE’s fiscal balance will move back into surplus in 2019 on the back of higher oil prices even as the government increases spending.

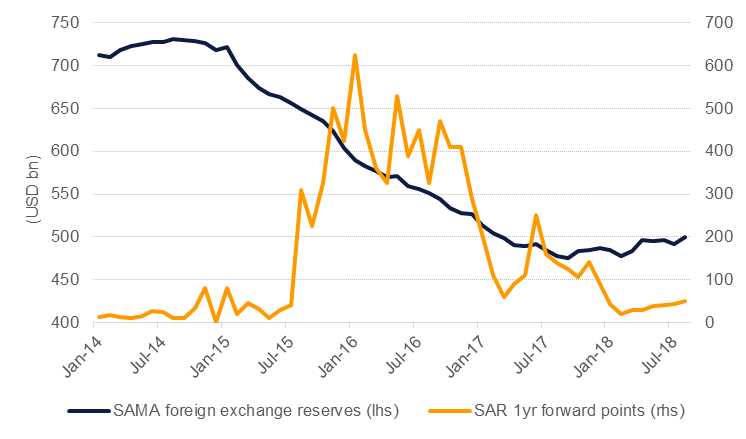

The improvement in oil prices will also help to shore up regional foreign exchange reserves. As oil prices fell regional governments and corporates turned to international bond markets to replace lost oil income. Improvements in foreign exchange holdings will help to accommodate some of the region’s growing external liabilities and ease pressure on governments’ ability to maintain currencies pegged to the USD.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research

OPEC has managed several years of successful oil market diplomacy. At its June meeting the producers’ bloc agreed to raise production to offset declines from Venezuela where output is suffering from a lack of investment and a widespread deterioration in economic conditions. However, OPEC and their partners to the 2017 production cut did not set specific country quotas and instead agreed to a ‘collective’ target. This fudge allows producers that can raise output room to do so while not having OPEC officially endorse a transfer of market share between members, particularly away from Iran.

Production in Iran has already begun to decline as importers move away from taking Iranian barrels ahead of US sanctions coming into effect next month. We expect this vocal deference to ‘collective’ OPEC targets will continue until Iran’s production hits bottom and then producers with limited spare capacity will raise production to compensate for the lost barrels.

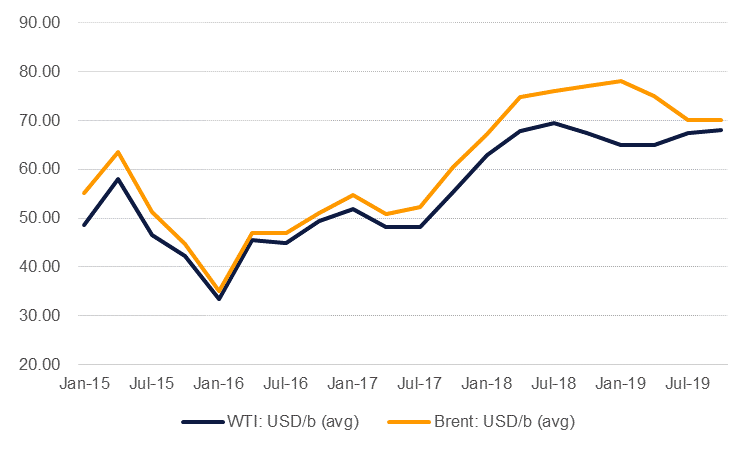

As the scale of the dropoff in Iranian production is the greatest unknown variable at the moment, oil markets are recalibrating and pushing prices higher as a result. Once it becomes clearer how much Iranian oil will be held off the market we expect prices will ease back from any spike up toward potentially as much as USD 100/b.

Cooperation with Russia has also increased to the point where the country is effectively an additional member of OPEC. Saudi Arabia and Russia between them produce more than a fifth of the world’s total oil supply and policy alignment between these two producers will exert considerable influence on the trajectory for prices in the short-term. The dynamics of this Saudi-Russia oil alignment will be particularly critical for European and Asian oil consumers, the main consumers of these producers’ crude.

The production cut agreement that OPEC and its partners held in place for 2017 and for the first six months of this year achieved its primary goal of cutting down the excess crude inventories that had accumulated between 2014-16. Ensuring the market remains as close to balance as possible or in a deficit position will now be OPEC’s primary objective to avoid another period of sustained stockbuilds and prices crashes. As a result production levels from Saudi Arabia, Russia and others are likely to be much more responsive to medium-term market signals rather than seeking a fixed share of global markets and keeping production steady at levels that could contribute to a global surplus.

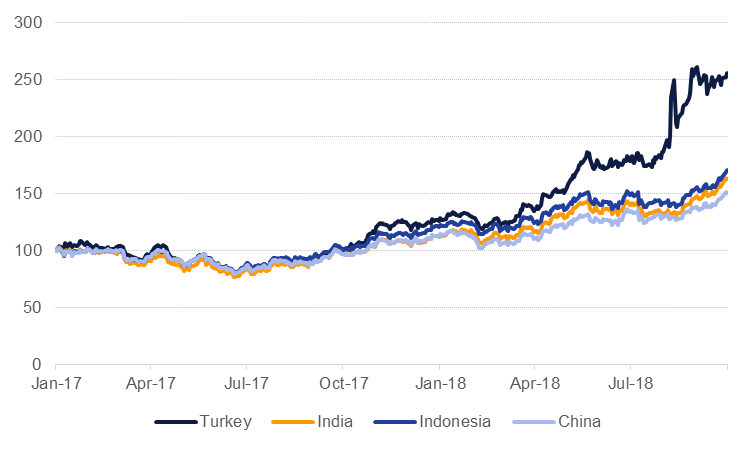

The broader global economic outlook for 2019 remains highly uncertain. The US business cycle is growing very long in the tooth even as labour and financial market conditions still appear robust. Meanwhile the economic, and oil demand, implications of the US-China trade war have yet to filter recognizably into a sustained slowdown. Nevertheless the risk of weaker global growth appears high and OPEC may end up flooding markets with unnecessary oil if they raised output now. The scars of the 1997-98 Asia financial crisis still linger on many OPEC policymakers. OPEC raised output during that downturn and prices fell 60% from peak to trough, bottoming out at less than USD 10/b. That oil prices are rising to elevated levels at the same time as emerging market currencies hit record lows will be a flashing signal to OPEC members that demand may be at risk of a sharp correction.

Source: EIKON, Emirates NBD Research. Note: Front month Brent futures denominated in local currency. Jan 2017 = 100.

Source: EIKON, Emirates NBD Research. Note: Front month Brent futures denominated in local currency. Jan 2017 = 100.

High oil prices certainly help the fiscal and external positions of OPEC producers but we have long argued that stable oil prices would be a much better target for OPEC economies. Oil prices in a narrow range would allow for clearer budgeting and force the development of non-oil revenue sources, such as the introduction of VAT in the UAE and Saudi Arabia this year, and also insulate the economies from an inherently volatile income stream. An upward spike to USD 100/b would be notionally positive for GCC economies but could also prompt just as sharp an adjustment downward.

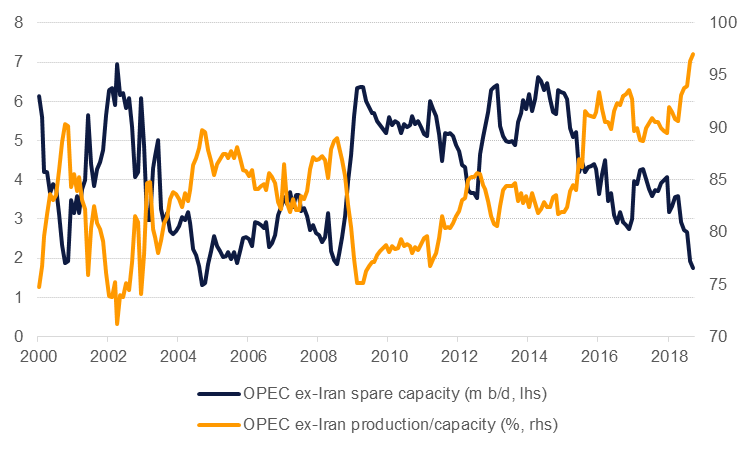

An increase in OPEC production now could help to limit the gains in prices but would end up exposing the oil market to much higher volatility in the coming months. OPEC’s ability to respond to market spikes is effectively measured by the spare capacity some of its producers hold off markets, most of which is held in Saudi Arabia. Collective spare capacity fell to just 2.25m b/d in September, according to market estimates, but excluding Iran whose barrels will be under US sanctions in November, spare capacity is a much tighter 1.76m b/d. OPEC ex-Iran is currently producing at 97% of its total capacity meaning it already has very limited headroom to accommodate an upward jump in prices. Thus while an increase in production now may help to prevent oil from spiking, OPEC would have no ability to respond if prices kept rallying in H1 2019.

Source: Emirates NBD Research

Source: Emirates NBD Research

Our projections are for a modest increase in production from key OPEC members—mostly from Saudi Arabia, the UAE, Kuwait and Iraq—but not one that completely offsets the decline in production from Iran and Venezuela. Trying to perfectly balance markets is near impossible and the oil market routinely swings from feast to famine over the long run. We see next year as no exception and OPEC appears prepared to let markets run tighter for longer. However, once markets manage to recalibrate away from the drop in Iranian production and demand sees some marginal erosion from trade wars and EM wobbles, prices should compress back to a lower range. We expect Brent prices will average USD 73/b in 2019, moving from a Q1 average of USD 78/b to USD 70/b in the final months of the year.

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.

Click here to Download Full article