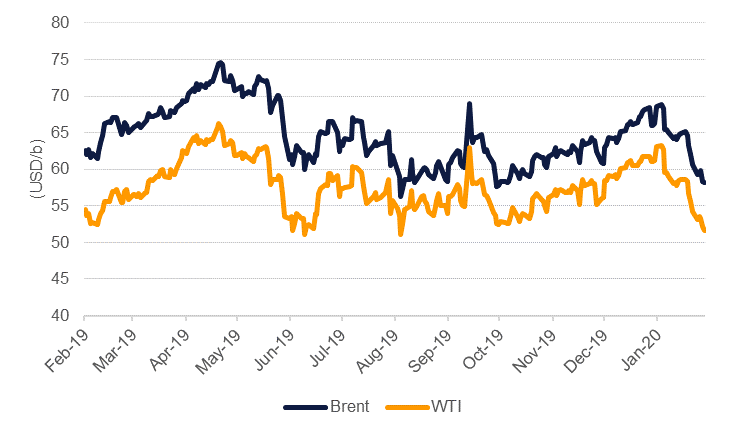

Oil markets continued to crumble as uncertainty over the oil demand impact of the coronavirus outbreak gives way to anxiety that China’s oil consumption growth, among others, will be severely curtailed. Brent futures for March expiry settled at USD 58.16/b, a weekly drop of 4.2% and taking Brent down nearly 12% year to date. WTI futures settled down at USD 51.56/b, a loss of 4.9% week on week and a decline of almost 16% year to date. The risk of oil futures starting the year in a bear market looks particularly acute as a move away from risk assets generally drags commodities downward.

OPEC+ is reportedly considering whether to bring forward its scheduled meeting from March to February in order to develop and deliver a strategy to counter the impact of the coronavirus on markets. However, with such an enormous uncertain variable—the impact of the virus on oil consumption—the risk of miscalculation is high. Headline oil market balances will have moved closer to balance in Q1 thanks to the interruption to supply from Libya. But a drop in China’s consumption would unwind most of the balancing effect from Libya’s drop in production. OPEC+ will need to calibrate any production change to ensure that it matches a drop in consumption and could accommodate a return of Libya’s production which remains subject to a political resolution in the country, rather than repairing destroyed assets.

The scale of cut adjustments may then need to be quite significant and would represent a substantial negative impact on OPEC+ domestic economies. A more immediate strategy would be to simply extend the deeper cuts agreed in December 2019 for the whole of 2020 rather than just the first quarter. Carrying the cuts forward for the whole year wouldn’t eliminate a surplus in H1 but would bring markets much closer to balance on average for the year.

Market structures slumped in line with the drop in front month prices. The WTI curve is now in contango for the first three months while the backwardation in Brent is continuing to shrink. December spreads have displayed a substantial weakening with Dec 20/21 spreads closing in a backwardation of just USD 0.7/b in Brent (compared with USD 4/b in early January) while in WTI the same spread closed last week at just above USD 1/b. Risk reversal structures (25 delta) for April Brent futures have still not priced in much downside risk with puts trading at a relatively muted premium to calls.

Investors began closing out long positions in both Brent and WTI markets last week with net length in Brent down by 26.6k contracts and more than 56k lots in WTI. Positioning in WTI is normalizing but Brent still appears to be relatively long considering the multitude of downside risks. As market structures threaten to weaken toward contango in Brent there is likely to be more of an exodus out of long positions.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.