A second difficult OPEC+ meeting in a row may be a sign of things to come as the producers’ bloc has moved to monthly ministerial meetings. Their session at the start of the week (Jan 4) ended without a decision on where to set February production levels after having agreed—eventually—in December to increase output at the start of 2021 by 500k b/d for January. The divisions among members seem to lie between Russia and Saudi Arabia, the two largest and most influential members, with Russia favouring the output increases and Saudi Arabia preferring to keep output steady or even lower than January’s level in coming months.

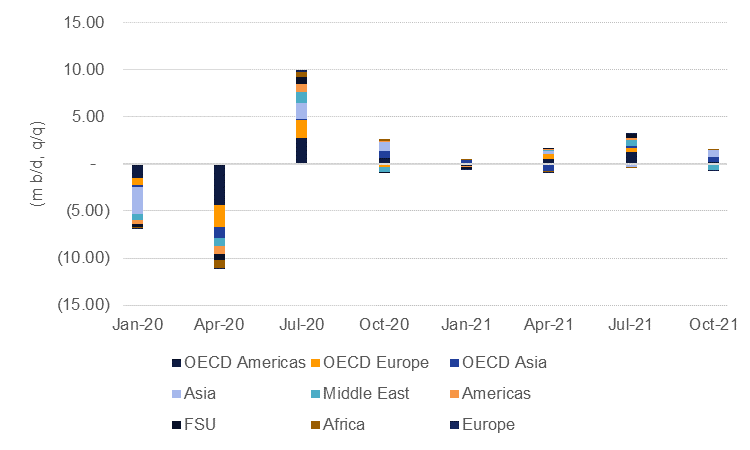

There appears to be little dispute among OPEC+ ministers that the short-term oil outlook is poor: more countries are needing to reimpose some form of lockdown measures, thereby restricting mobility, and vaccine rollouts are proceeding slowly in major economies. Oil demand growth in Q1 2021 is likely to be sluggish, with the IEA projecting it flat from Q4 2020 levels. OPEC’s own secretary general has warned that the “outlook for the first half of 2021 is very mixed”, a view reiterated by ministers from Saudi Arabia and Kuwait.

Source: IEA, Emirates NBD Research

Source: IEA, Emirates NBD Research

But even with the downside risks to demand so apparent, maintaining production levels at such low levels will be grinding against the serious economic challenges facing many OPEC+ members. Iraq, for example, has had to devalue its currency and signed a USD 2bn prepayment oil supply deal with a Chinese importer to shore up the country’s perilous finances. We have no doubt that OPEC+ will manage to reach agreement on the February levels as they extended their meeting for an additional day but we expect few members will be satisfied with the outcome for very long.

Moving to a monthly schedule of ministerial meetings will bring the divisions within OPEC+ into public scrutiny on a more regular basis. The disagreement between countries absorbing a large burden of the cuts, like Saudi Arabia, those failing to hit their targets, as Iraq has done and the UAE did for several months last year, or those members only publicly committing to the deal when prices are spectacularly low, which appears to be Russia’s approach, is at a high risk of boiling over. While current oil market balances support our view of prices holding around current levels and improving by year-end, we also can’t rule out a breakdown in oil market diplomacy and a return to the price-war conditions we saw in March-April 2020.

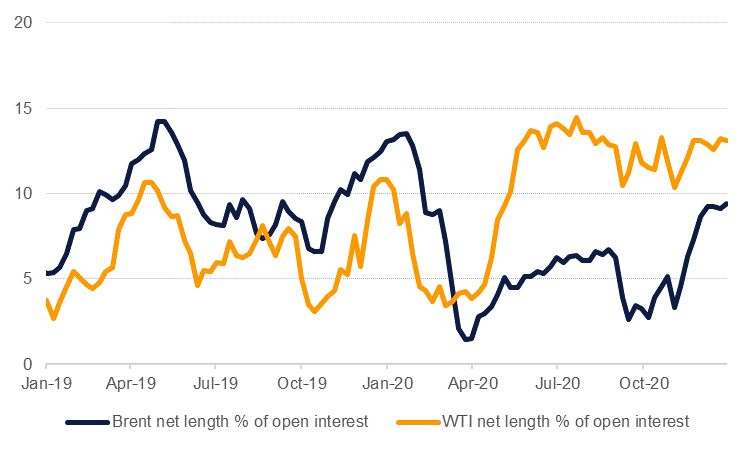

Oil prices did manage a strong rally in the final months of 2020 as the market cheered the advent of Covid-19 vaccines bringing an end to pandemic-induced economic lethargy. But the impact of vaccines is now well and truly priced into the oil market, taking spot Brent only up to current levels in the low USD 50/b range. Markets appear to be discounting downside risk to flat prices with put volatilities in both Brent and WTI well off 2020 peaks (not surprising given markets did record negative WTI prices in April last year). Moreover, speculative positions are relatively optimistic with net length holding around 9% and 13% of total open interest for Brent and WTI futures respectively. Any breakdown in oil market diplomacy could up-end markets substantially and quickly.

Source: Bloomberg, Emirates NBD Research. Note: speculative net length only.

Source: Bloomberg, Emirates NBD Research. Note: speculative net length only.