OPEC+ managed to outline an agreement to cut production to try and restore some stability to oil markets which have been distorted by a collapse in demand caused by the coronavirus and a surge in supply from major producers. The terms of the deal are complex and lengthy: OPEC+ has apparently agreed to maintain production restraint until April 2022 and the scale of cuts will be the largest OPEC has ever proposed.

To begin with from May OPEC+ will cut by 10m b/d from October 2018 levels although both Saudi Arabia and Russia will measure their cuts from a baseline level of 11m b/d each. Those deep cuts will last for two months, followed by six months of 8m b/d of cuts then 6m b/d for the remainder of the deal. That OPEC+ was able to come to the outline of a deal is a positive step for oil market diplomacy. Saudi Arabia and Russia apparently managed to get over their differences that derailed the March OPEC+ meeting. We had thought that positions had hardened substantially between Russia and Saudi Arabia to prevent OPEC+ coming to terms last week.

But is there actually a deal in place? Following the OPEC+ meeting, the G20 held a summit of energy ministers but its statement didn’t offer any explicit terms on how to restore balance to oil markets nor provide commitment from the US, Canada or Brazil in support of production restraint. Moreover, Mexico, which is part of OPEC+, didn’t agree to the level of cuts agreed by the rest of the producers’ bloc. Mexico’s production is largely protected from low prices thanks to a sovereign oil hedging programme and thus can ride out the storm of lower oil prices better than other oil-dependent economies. US president Donald Trump has offered a compromise where the US would take up part of Mexico’s burden through the decline US production prompted by low prices but that has yet to win Saudi support.

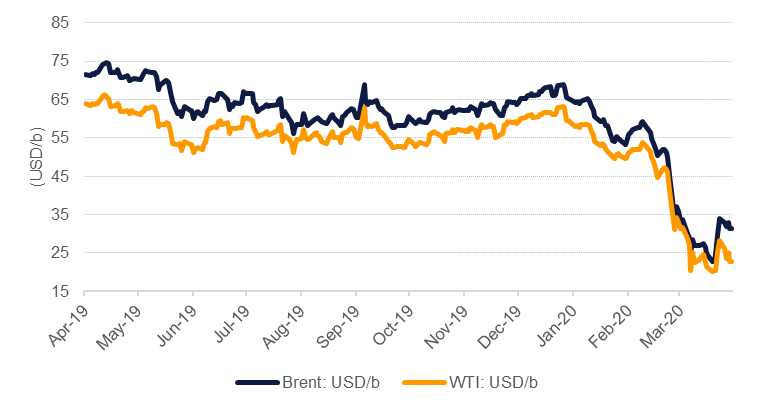

Markets are thus left with a confused message as to whether production cuts will actually start happening over the coming weeks. Reaction has so far been negative. Both Brent and WTI declined on Thursday, the final day of a holiday-shortened week, and were down on the week by 7.7% and almost 20% respectively. The negotiations over a deal remain live and we will provide updated views as dynamics change.

Meanwhile, the oil market continues to suffer from the enormous collapse in oil demand. Both the IEA and OPEC will provide their latest views on oil market fundamentals this week with demand projections likely to be slashed, although both have been more conservative than private sector forecasters. Forward curves have weakened considerably in the last week: WTI 1-6 month spreads fell to a contango of USD 11/b while the same spread in Brent is just over USD 6.50/b. Producers in the US continue to pull rigs out of service—taking 58 out last week—and a total of 179 since the price-war strategy began in early March. Canada now has the fewest rigs operating—35—since H1 2016, the last time OPEC adopted price-war strategy.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.