OPEC has agreed to extend its production cuts into the first quarter of 2020 and will get support from non-OPEC countries, such as Russia, in restraining output. Cutting production has had a measure of success in drawing down inventories and supporting prices but its effectiveness is starting to wane and may have a limited impact on balances heading into 2020. Factors well outside the control of OPEC+ will exert a significant drag on oil prices over the next 12 months, limiting Brent to an average of USD 60/b in 2020.

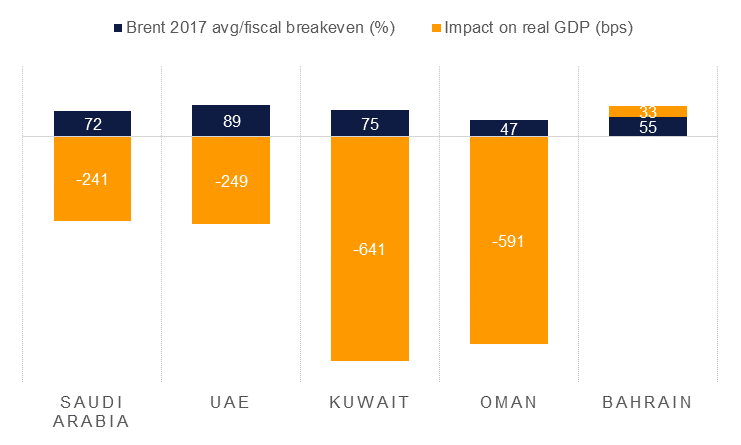

The strategy from OPEC+ (OPEC members plus partners like Russia, Kazakhstan and Mexico among others) since 2016 has been to forgo a market share battle with alternative producers like the US shale patch and instead focus on draining excess inventories and pushing prices closer to fiscal breakeven levels, particularly for OPEC members from the GCC. Cutting production is a heavy-handed tool which directly impacts GDP performance in OPEC+ economies given their dependence on oil production to fuel growth. In 2017 when Saudi Arabia cut oil production by 4.4%, the delta in real GDP growth was -240bps. In producers with less diversified economies the impact on growth was even more significant (see chart below).

The improvement in prices that was partly attributable to OPEC+ cuts helped cover around two/thirds of average fiscal break-even levels for GCC producers. Cuts in 2019 have helped in moving prices closer to average fiscal break-even levels but only in the UAE—where we estimate fiscal break-even costs at USD 62.50/b—does the year-to-date average Brent price (USD 66/b) cover costs.

Source: Emirates NBD Research

Source: Emirates NBD Research

Cutting production can be very effective in draining excess inventories. Between 2014 and 2016 more than 440m bbl of crude were added to OECD stocks as the market endured rapid growth from the US shale patch and an OPEC strategy aimed at crashing prices and pushing marginal producers to the wall. From 2017 until the middle of 2018 when OPEC+ engaged in their first round of production restraint (the Declaration of Cooperation cuts), inventories fell by 187m bbl and moved from a peak of 67 days of OECD consumption back toward a long-run average of 60 days.

The direct impact from production changes on oil prices also appears to be concentrated during periods of market fixation on supply issues. From 2014-18—the period when oil prices crashed and OPEC adopted several strategies to deal with the collapse—there is a distinct, if limited, relationship between increases in output and lower prices (and vice versa). As the market is increasingly moving off non-supply related issues (eg trade war concerns, outlook for Fed rates) this relationship may start to weaken. Indeed, over a longer run period there is little discernible pattern from OPEC production levels and changes in benchmark prices.

Source: IEA, Eikon, Emirates NBD Research.

Source: IEA, Eikon, Emirates NBD Research.

But OPEC+ production represents a limited, and declining portion, of global oil market balances and producers outside the bloc exert a significant influence on the trajectory for crude prices. The 37% gain in Brent futures between the start of 2017 and mid-2018 (when the first round of cuts ended) was as much a result of limited production growth in non-OPEC+ countries as intentional cuts. Production growth outside the bloc was limited to just 0.75m b/d in 2017 as the industry adjusted to lower prices. Looking into 2020, production from non-OPEC+ is set to expand by more than 2m b/d, including a gain of more than 2.5m b/d in Q1 alone.

OPEC+ influence over producers outside the bloc is limited to shifting the forward curve for oil downward which itself feedbacks negatively into lower export and fiscal receipts in highly oil-dependent economies. Moreover, producers in countries with limited state involvement in oil production have maintained a high pace of efficiency improvements, allowing for production growth at lower costs. Production per well in the Eagle Ford shale basin in the US has increased by a factor of more than 30 in the last 10 years and almost 18 times in the Permian basin, the largest source of production from US shale. The oil industry outside of OPEC+ producers is arguably more reactive to market forces, allowing for the absorption of underperforming firms into companies operating with greater efficiencies. The pace of supply additions from alternative producers, particularly in the US, may slow thanks to high base level effects but it is unlikely to go negative in the short term barring a major disruption to the industry.

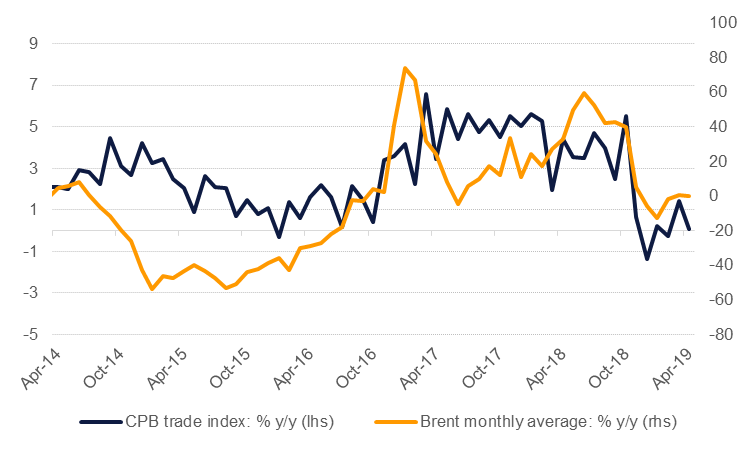

Demand is another significant uncertainty for the remainder of 2019 and into 2020. OPEC received another helping hand from an upswing in consumption in 2017 when demand growth accelerated essentially everywhere. This year the outlook is far less promising as the global economy endures slower growth and the spectre of a trade war between the US and China continues to hang over markets. The IEA’s latest demand growth forecasts of just 1.18m b/d this year are a sharp downward revision from expectations of 1.43m b/d as recently as January 2019. The impact of marine fuel regulations (IMO 2020) notionally should be supportive for higher refinery runs toward the end of the year as more gasoil is required to replace fuel oil. However, the impact of the change will be muted if global trade growth carries on the negative trend it has held since the start of the year.

Source: CPB, Eikon, Emirates NBD Research.

Source: CPB, Eikon, Emirates NBD Research.

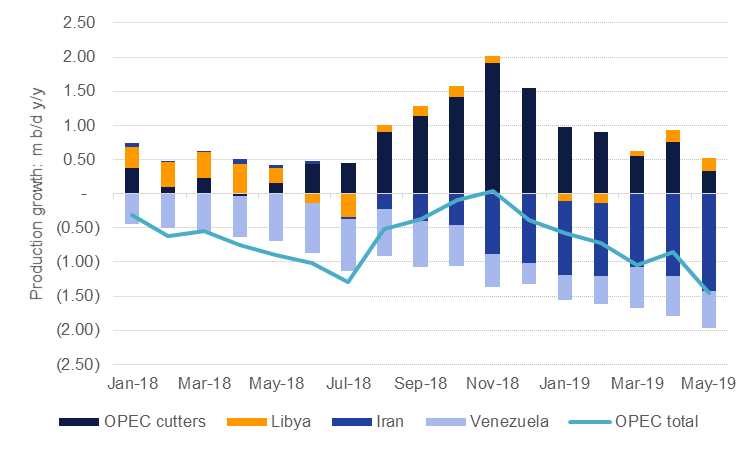

Oil market balances will also remain subject to sanctions on major producers. Both Iran and Venezuela face US sanctions on their oil industries which are helping to tighten heavy, sour crude supplies in particular. On a y/y basis, Iran and Venezuela have been responsible for most of the decline in OPEC production in 2019 so far while members that are subject to cuts have actually supplied more oil than they did in 2018. The political position of the US remains hostile toward both Iran and Venezuela but the mercurial nature of the Trump administration’s foreign policy could see attitudes change quickly. Hence, while sanctions have done much of the work to tighten markets this year they are an unreliable variable to depend on.

Source: IEA, Emirates NBD Research

Source: IEA, Emirates NBD Research

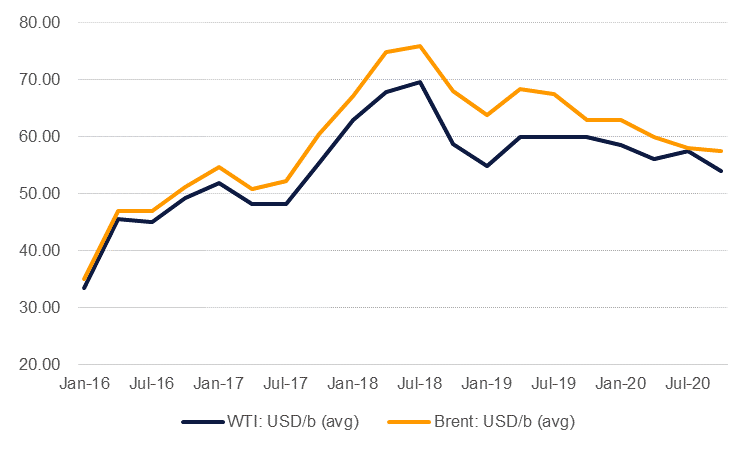

Our expectation has long been that OPEC producers would start to increase production in the second half of 2019 to prevent domestic growth from deteriorating further. NOCs in the Gulf region in particular will also want to reassure offtakers over their reliability as suppliers in an elevated geopolitical environment. Thus our forecast for oil markets to move into surplus in Q4 remains unchanged even with the extension of cuts. For 2020, we expect to see a steady pattern of mixed compliance—Saudi Arabia for example over-delivering while Iraq underperforms—but ultimately that OPEC+ will produce close to its target level. As non-OPEC+ supplies are set to remain high we expect market balances to remain in surplus next year, capping any upward move in prices. Our expectation is for Brent to average USD 60/b in 2020, moving from USD 63/b in Q1 on average to USD 57.50/b in the final months of the year. Prices for WTI should follow Brent lower and average USD 56.50/b in 2020.

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.