OPEC+ producers are coming under acute diplomatic pressure to accelerate their pace of production increases as high oil and gas prices threaten the sustainability of recoveries underway in major economies. US president Joe Biden specifically called out the OPEC+ alliance during an appearance at the COP 26 climate summit, saying that high oil and gas prices are a “consequence of…the refusal of Russia or the OPEC nations to pump more oil.” More directly, he noted “we’ll see what happens on that score sooner than later”.

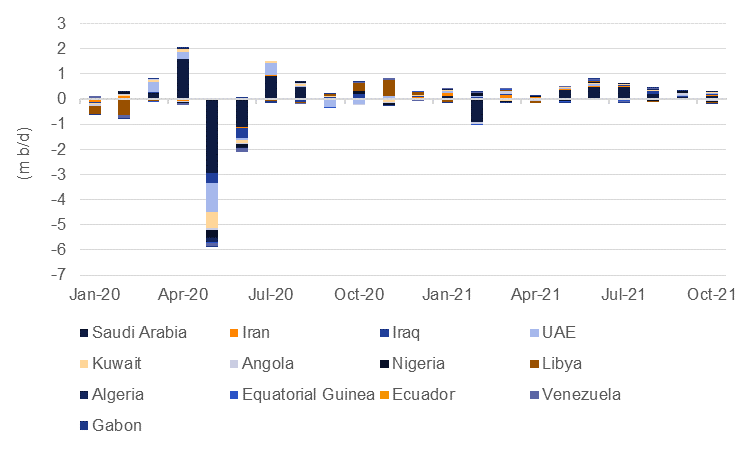

OPEC+ is carrying out its planned increases of 400k b/d per month that it began from August and will run until all the production cuts implemented during the peak of the Covid-19 pandemic in Q2 2020 are unwound, likely sometime in Q3 2022. However, chronic underinvestment and pipeline issues in some producers means that OPEC’s share of the production increases are coming in under target: Angola and Nigeria in particular saw output decline in October, failing to hit their targeted levels. Elsewhere, production from Saudi Arabia, the UAE, Kuwait and Iraq came in roughly in line with target levels for October 2021.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Public commentary from OPEC+ officials has been to favour keeping the 400k b/d target in place with Saudi Arabia’s energy minister, Abdulaziz bin Salman, saying at the end of October that oil markets weren’t “out of the woods” and Kuwait and Kazakhstan have also come out in favour of the moderate output increases. For Russia, a government spokesperson said that they would be “faithful” to OPEC+ commitments. On past experience, OPEC+ has opted to keep oil markets tight and prices high—not surprisingly given the enormous influence oil plays in most OPEC+ economies.

Diplomatic entreaties to increase at a faster pace have come from the US, Japan and India but with no seeming coordinated push. There are also few options for oil consumers to pressure OPEC+. The US could release crude from its strategic petroleum reserves (SPRS), in which it holds around 614m bbl, in an effort to push prices down or other consumers could draw on strategic inventories built up last year. But the argument against making use of SPRs is that there is crude oil capacity held offline by OPEC+ members on a policy basis alone, rather than because of some exogenous shock like a conflict or natural disaster.

The optics of calling on oil-exporting economies to increase production also runs at odds with US efforts to reclaim leadership of global climate change policy, currently underway at the COP 26 summit in Glasgow. The solution for the energy market shortages—not caused by oil markets initially—will be addressed in the near term by relying on precisely the kind of fuels that international leaders and climate activists are pushing against—namely coal, natural gas and oil.

For now, we still expect to see OPEC+ members remain in favour of keeping oil markets tight, taking advantage of the elevated prices to improve fiscal accounts. As a result we remain of the view that oil prices will stay high until the end of 2021 and likely bleed into the early parts of next year.