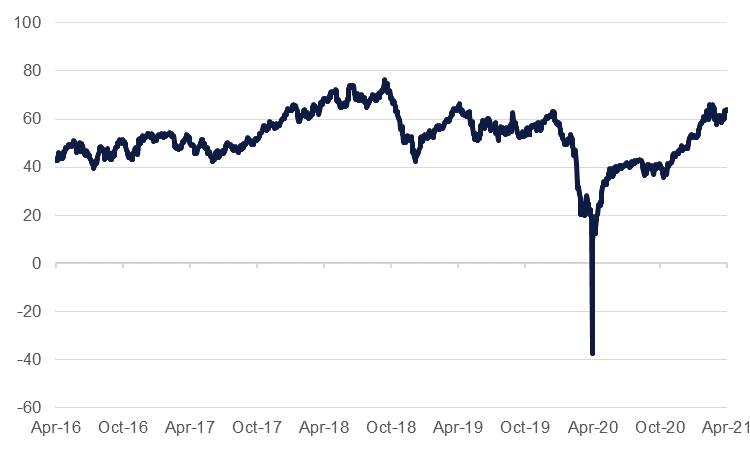

It’s been one full year since WTI futures recorded a negative closing price for the first time ever, closing at USD -37.63/b. Oil prices had been in free-fall from mid-February as the global economy came to a standstill caused by the Covid-19 pandemic while an OPEC-Russia price war during March and April 2020 exacerbated the over supplied conditions. Inventories had increased relentlessly and at the WTI pricing point of Cushing, Oklahoma, stocks had risen by almost 70% by mid-April compared with the start of 2020. Faced with nowhere to place expiring May 2020 WTI positions, which are physically backed, selling was unmatched and helped to push oil prices into negative.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Since then oil prices have recovered dramatically. WTI prices have added more than USD 100/b by mid-April 2021 to trade between USD 60-70/b while Brent futures, which didn’t go negative in April 2020, have still managed to gain almost USD 50/b from their lows. Enormous production cuts from OPEC+ have been a major contributing factor to the normalization of oil prices. In the initial phase of its landmark deal agreed in April last year, OPEC+ cut nearly 10m b/d out of production and phased volumes back into the market gradually. Along with the OPEC+ cuts, other producers also responded quickly to the weak price signals: US production fell from a stable level of around 13.5m b/d for the first three months of 2020 to around 11m b/d by early June, a level it has more or less held on to since.

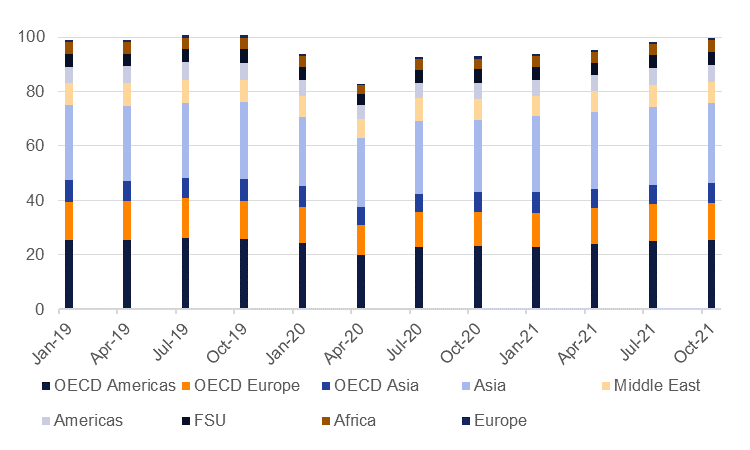

Oil demand had also reached its nadir in April 2020 as lockdowns were imposed globally, restricting movement and industrial demand for fuels. Total product supplied in the US fell to less than 14m b/d in early April 2020 compared with almost 22m b/d a month earlier. Demand is very much in recovery in major markets—the IEA expects to see Q2 2021 oil demand in the OECD at more than 44m b/d compared with 37.59m b/d in Q2 2020—but it still hasn’t returned back to levels seen prior to the Covid-19 pandemic.

Source: IEA, Emirates NBD Research

Source: IEA, Emirates NBD Research

A return to negative oil prices seems a distant prospect now and we expect to see oil market conditions tighten further in the second half of 2021, supporting prices at around their current levels of more than USD 65/b in Brent and USD 64/b for WTI. OPEC+ is reportedly considering downgrading its next ministerial meeting to a monitoring meeting, implying no change to production policy after the producers’ bloc adds roughly 2m b/d by the end of July. That should help to keep inventories drawing, provided that demand meets expectations.

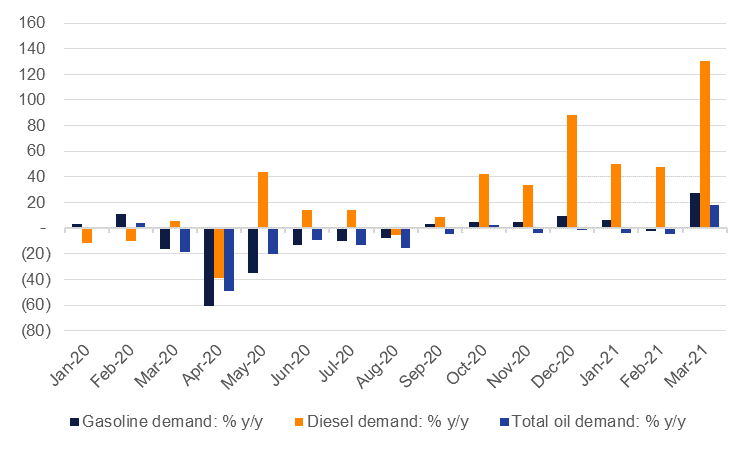

That is a major qualification and shouldn’t be dismissed lightly. While there are always the perennial issues of compliance with OPEC+ production targets or how quickly output will respond in the US, the spectre of Covid-19 lockdowns and their negative effects on demand is still very much in play in this market. In Q1 demand anxiety focused on European economies which had struggled to get their vaccine programmes up and running effectively. But Germany, which endured Covid restrictions in Q1 2021 that were more stringent than at any time in 2020, only accounts for around 2% of global oil demand. Now the focus will be very much on India, the third largest single consumer of oil and accounting for around 5% of global demand. As we outlined in our outlook for Indian growth this year, the parabolic rise in Covid-19 cases will weigh heavily on the near-term outlook for the economy. While the country has yet to institute a full-fledged nationwide lockdown, states that contribute majorly to the economy are effectively back in lockdown, hampering the outlook for oil demand.

Source: Petroleum Planning and Analysis Cell, Emirates NBD Research

Source: Petroleum Planning and Analysis Cell, Emirates NBD Research