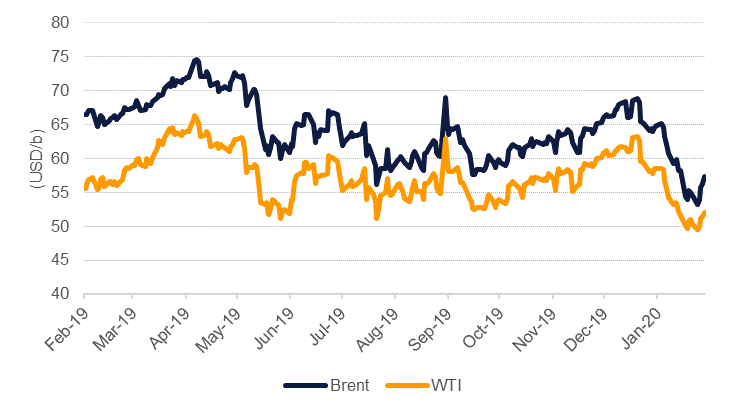

Oil prices managed to stage something of a recovery last week despite downgrades to demand expectations from major forecasting agencies. Brent futures gained 5.2%, snapping five consecutive weeks of decline, to close at USD 57.32/b. WTI ended the week at USD 52.05/b, up 3.4%. Commodities in general were bid higher as differing projections on the number of Covid-19 cases hit the markets. For oil, the rally largely appears to be on the back of expectation that OPEC+ will indeed take some action to stem the decline in prices.

So far though there has been no official OPEC+ announcement to endorse further production cuts or even an extension of the current level of deeper cuts that are due to expire at the end of March. Both the IEA and OPEC’s analysis body seemed to give the producers’ bloc room to cut output by cutting their demand forecasts for 2020: the IEA expects oil demand growth to come in at just 825k b/d this year, its slowest pace since 2011 according to the agency’s latest monthly report. Annual demand growth will be negative in Q1, the first contraction since the global financial crisis. OPEC cut its outlook for 2020 demand by 200k b/d, expecting growth of just 990k b/d this year.

The longer the market waits for a clear signal from OPEC+ on how it plans to deal with Covid-19’s impact on demand, the greater the risk oil could slip again. While there are signs the pace of the outbreak is slowing and some Chinese refineries have reportedly been bargain hunting given the drop in prices, a forceful message from OPEC+ would help to stabilize a floor under oil prices. Meanwhile, Saudi Arabia and Kuwait plan to restart production at the neutral zone where fields with as much as 500k b/d of capacity are set to come back into production.

Anticipation of a change to production levels helped to alter the structure of forward curves at the end of the week with Brent moving back into backwardation at the front of the curve. Time spreads in the 1-2 month contracts closed at USD 0.12/b in backwardation while Dec spreads moved back above USD 1/b for 20/21. WTI, however, remains in contango across much of the front-end of the curve. Dubai swaps also stayed in contango at the end of the week and will be highly susceptible to a shift should OPEC+ indeed chose to cut output.

Investors remained negative on crude futures and options last week with aggregate net length in Brent and WTI declining by more than 78k contracts last week. In the last three weeks more than 163k long positions have been closed out as investors panicked over how badly oil consumption would be impacted by the outbreak of Covid-19.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research