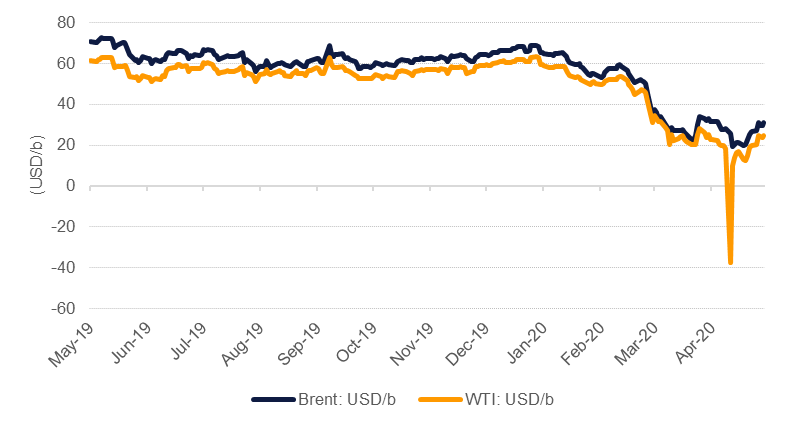

Oil futures managed to gain a second week running on signs of more and more economies reopening, whether cases of Covid-19 are under control or not, and early indications that supply restraint from OPEC+ is helping to take some excess crude out of the market. Brent futures added more than 17% and ended the week just shy of USD 31/b while WTI settled at USD 24.74/b, up more than 25% during the week. Brent futures have gained more than 60% since hitting their bottom of USD 19.33/b in mid-April while WTI’s turnaround from negative pricing has been tremendous. As we noted last week oil market microfactors appear positive even as the broader economic variables—the US unemployment rate skyrocketing to 14.7% for April or India’s April PMI in the single digits—remain dire.

This week markets will focus on assessments from the IEA, EIA and OPEC on the effectiveness of the OPEC+ production cuts, outlook for non-OPEC supply and, crucially, when demand will begin to show signs of sustainable growth. In their last market reports all major forecasting agencies sharply cut their demand expectations for this year with the IEA expecting a drop in demand for 2020 of 9.3m b/d as consumption plummets in Q2 before modestly improving by the end of the year. OPEC had expected a drop of almost 7m b/d while, as usual, the EIA was among the most bullish, anticipating “only” a 3.9m b/d drop in consumption. The IMF has notified markets that the global economy is actually looking worse than its sharply downgraded expectations released earlier this year so further cuts to demand outlooks may be on the cards.

There have been some signs of demand as some economies take tentative steps to reopen. Gasoline consumption in the US has gained for the last four weeks running, coming close to 7m b/d in the latest data from the EIA. However, it is still down by 27% year-on-year. Whether the US reopening major parts of the economy is premature is yet to be seen: a second wave of infection could cut short any putative recovery in oil demand nor is demand in the US likely to get its normal seasonal bump as the virus will likely limit summer driving holidays.

Saudi Aramco cut the discounts on its OSPs for delivery to Asian markets, at odds with market expectations for further cuts to pricing. The reversal in pricing strategy reflects Saudi Arabia’s participation in the OPEC+ production cuts: more cuts would have essentially sent a message that the country was still participating in a price-war/market-share strategy and could have prompted retaliation from other producers, notably Russia, Iraq or other MENA exporters that have steep obligations to cut output. However, the increase in pricing (narrowing of discounts) comes amid still elevated regional inventories and depressed refining margins: gasoil crack spreads for Dated Brent or Dubai crudes are at their lowest level in the past year. Regional refiners have limited flexibility to move away from Saudi barrels as part of their long-term agreements but they may nevertheless look for more competitive exporters if a perception grows that Asian refiners or consumers need to bear the brunt of OPEC+ economic policy adjustments.

.png) Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Even as headline pricing and to some extent wellhead pricing has improved, the North American oil patch continues to reel from the volatility and low overall price levels. The drilling rig count in the US fell by another 33 rigs last week, taking the total losses to 391 since mid-March. The unemployment rate for mining, quarrying and oil and gas extraction workers jumped to 10.2% in April from 6.2% a month earlier and up significantly from just 2.4% in April 2019.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research