The rally in oil prices has started to stall as an acceleration in the number of Covid-19 cases globally threatens the viability of demand recovery. The reopening of several major US states has been put on hold as Covid-19 cases are increasing and in some instances posting record single-day numbers. Brent futures fell by 2.8% over the past week, setting at USD 41.02/b while WTI closed at USD 38.49/b, a more than 3% drop. Last week was only the second weekly decline for benchmark oil futures in the past nine weeks and falls in line with dissipating momentum in other risk assets—the S&P 500 index fell almost 3% last week while emerging market bond and equity indexes slowed their gains considerably.

Were the US to go through another extensive lockdown period the impact on demand would likely follow what occurred in April: a steep drop in gasoline and diesel consumption along with a near complete collapse in jet demand. However, we doubt state governments would be ready to order as severe a shutdown of their local economies only a few weeks into reopening, despite the risks to public health. The US is also not the only country to see a resurgence of virus cases; Australia and South Korea have seen localized increases after having gotten control of the number of cases. As the spectre of lockdowns hangs over the oil market this year, rallies are likely to only be supported by supply side adjustments as demand will be held in check by public health considerations.

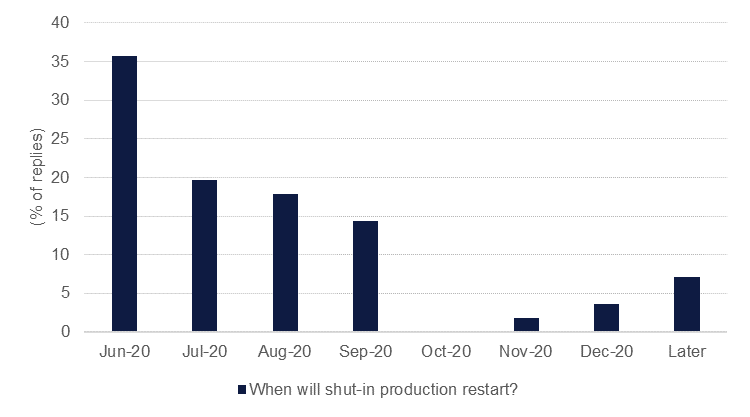

The dramatic decline in the US drilling rig count appears to have found a near-term floor with exploration and production companies only taking one rig out of operation last week with the total number levelling off a little below 200, mostly concentrated in the Permian in Texas. A survey from the Dallas Federal Reserve revealed that a majority of oil and gas companies expected to restart shut-in production by the end of July and that nearly 90% anticipated restarting output by the end of Q3. The survey was taken during a period when WTI prices were at an average of around USD 38/b on the front month—and not much higher further along the curve. A pending restart of US production at a time when OPEC+ has extended its deep cuts could undermine a significant level of the rebalancing underway in markets. Over the coming weeks results from US-focused oil companies should give a clearer indication of strategies for the rest of 2020, including their outlook on whether they can operate at the current low level of prices (the same Dallas Fed survey pointed out that companies expect to restart production at prices between USD 36-40/b).

Source: Dallas Federal Reserve, Emirates NBD Research.

Source: Dallas Federal Reserve, Emirates NBD Research.

Forward curves weakened in line with spot prices with longer-dated spreads all showing a wider contango last week. Front month Brent spreads are distorted by the pending expiry of August futures at the end of June. Dec spreads for 2020-21 widened to USD 2.37/b last week from less than USD 2/b a week before while in WTI the same spread increased to USD 1.46/b from around USD 1/b a week earlier.