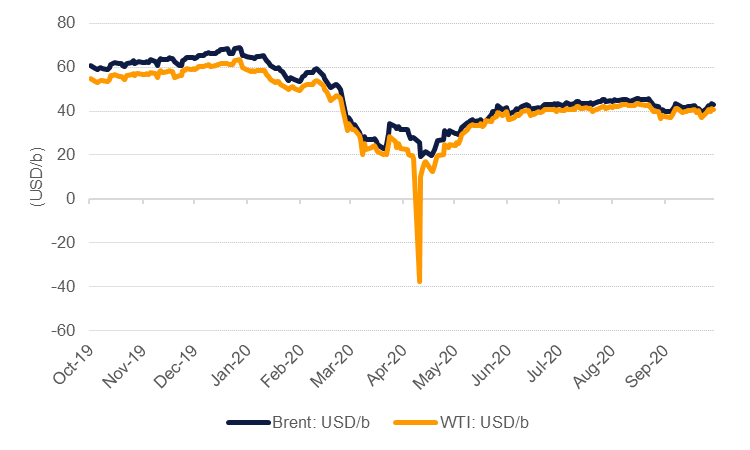

Oil markets recorded one of their strongest weeks in recent months thanks to disruptions to supply along the US Gulf Coast as Hurricane Delta shut in production, and anxiety over a strike among Norwegian oil workers that affected around 8% of the country’s production. Brent futures gained 9.1% to settle at USD 42.85/b while WTI closed the week at USD 40.6/b, a rise of 9.6%. The return of US president Donald Trump to the White House after his treatment for Covid-19 along with growing market expectations that a Biden victory as part of a ‘Blue Wave’ of Democratic control of Congress will unleash mega stimulus is also helping to support risk assets, including commodities.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Attention this week will turn to both the OPEC and IEA oil market monthly reports. The IEA has been increasingly cautious in its expectations for demand to return to pre-pandemic levels and has warned it is more likely to downgrade its demand growth forecasts, rather than revise them higher. OPEC released its longer-term projections this past week and expects demand to recover to pre-pandemic levels only by 2022 but that the producers’ bloc will have a greater share of the market given the damage done to higher marginal cost producers such as the shale patch in the US or oil sands in Canada. OPEC also pegged peak oil demand at around 2040, far later than many IOCs expect.

More salient to current market conditions is whether OPEC+ can afford to increase production in January as it is expected to as part of the agreement reached in April. The UAE’s energy minister reiterated that the country would comply with its level of production cuts after several months of over production while Iraq’s oil minister has also pledged to stick to the deal. Despite the constructive messaging from OPEC members—as well as higher OSPs from Saudi Aramco for November—any positive outlook for oil markets still remains tentative and an additional 2m b/d from January 1st 2021 could sink prices.

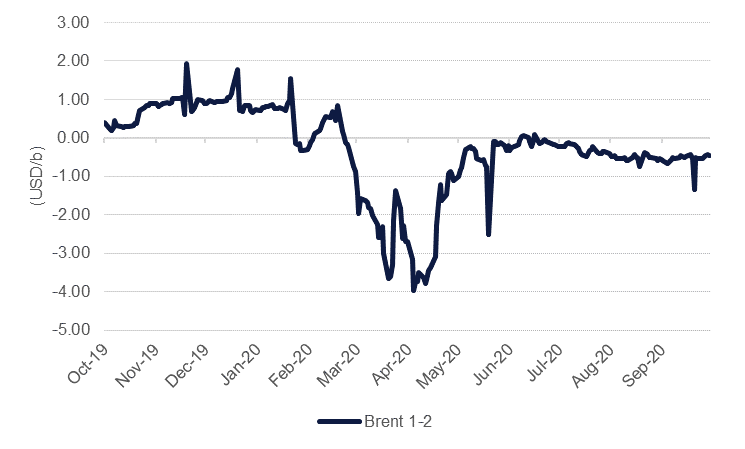

Time spreads across both the WTI and Brent curves have improved but remain in contango for both markets and remain in a relatively wide contango compared with data going back to 1990. Front month (1-2 month) spreads in Brent closed last week at USD 0.47/b in contago, among the 80% percentile for time spreads dating back to 1990. WTI spreads are stronger on a historical basis, likely a reflection of fewer avenues for crude supply to come back as easily as the Brent market (for example, OPEC+, Libya, Norway).

Source: Bloomberg, Emirates NBD Research. Note: front month spreads.

Source: Bloomberg, Emirates NBD Research. Note: front month spreads.

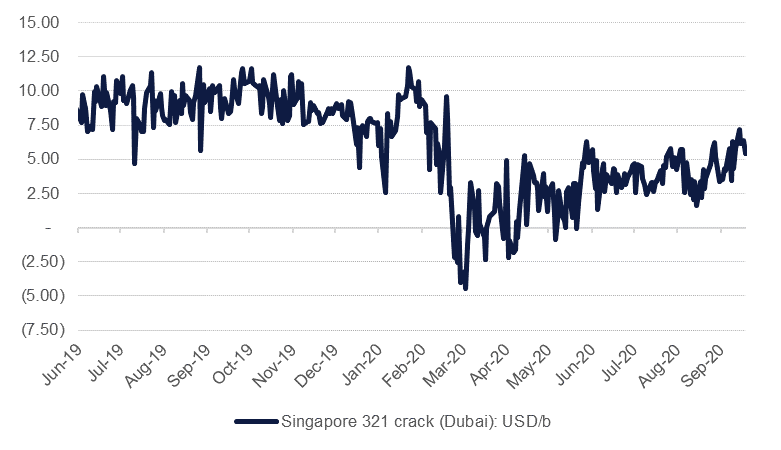

Conditions in physical and refining markets are also treading water with Dubai time spreads (1-3 month for swaps) holding in the contango range they have been in since June while refining margins (hypothetical 321 Singapore on Dubai) are still almost 50% lower y/y. The recovery in product prices has been uneven with diesel and jet still lagging gasoline. A “whole of the barrel” improvement in product prices would provide a much stronger indicator of healthy oil market conditions.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research