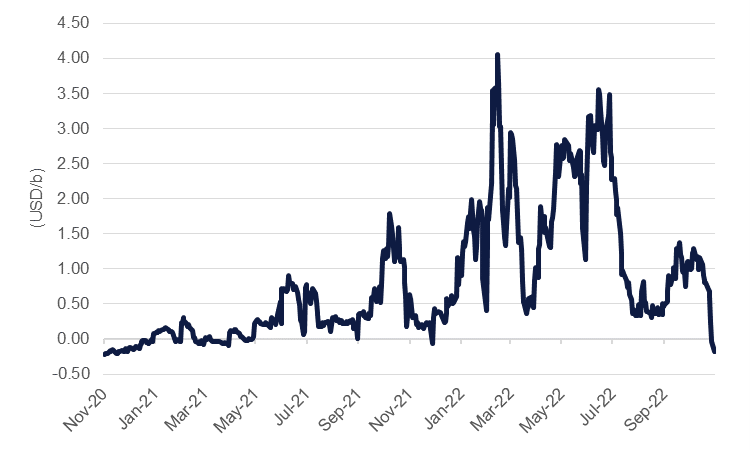

Oil prices have slumped in the last few weeks as markets focus on the prospect for demand to deteriorate in line with a slower global economy and as China dithers on easing its restrictive stance on Covid-19. Brent futures have tumbled since hitting a high of USD 99/b in early November, falling to around USD 86/b as of the middle of the month. Beyond the signal from spot prices, forward curves have also moved sharply lower. After starting the month at more than USD 1/b in backwardation, the 1-2 month spread in WTI futures has now fallen to a small contango of about USD 0.2/b, the first time the curve has been in contango since the end of 2020.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Expectations for a slowdown in global growth have been in place for some time though the data is only now starting to materialize; PMI indicators from major economies out over the next fortnight are anticipated to show a further weakening at the start of Q4 2022. But beyond the hard economic data, market sentiment around China’s Covid-zero policy will be the biggest near-term drag on oil prices. A recent surge in new Covid-19 cases in the country will mean little chance of China adopting a more open stance on the virus, exacerbating the weakness in oil consumption in the country. The IEA estimates China’s oil demand will drop by 3% this year (-473k b/d) with transport fuels—gasoline and jet fuel—taking the brunt of the decline. For 2023, the IEA is more optimistic, forecasting a 5% increase in broad oil demand in China, provisioned on some easing in coronavirus restrictions.

But it’s not just from China where policy stances are acting as a drag on sentiment. Central bankers in the US and Eurozone continue to push back against any easing in their monetary policy stance, with all seeming to support erring on the side of too much tightening rather than not enough. While the pass-through from higher rates to oil is indirect, the tone around restrictive monetary policy won’t help sentiment toward oil.

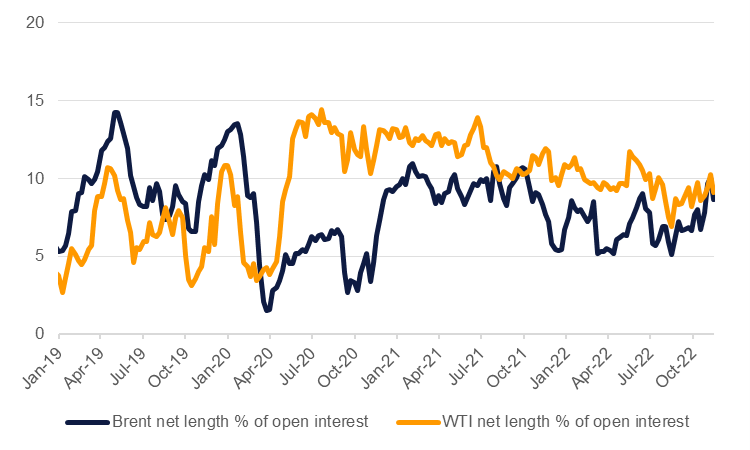

Investors have also turned against oil futures in the last week with net length in Brent and WTI futures and options falling by more than 50k contracts, its first week/week decline in the past four weeks. As a share of total open interest, positions in either contract don’t appear over-stretched in either direction which means that selling pressure could increase from here.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Buttressed against the negativity around demand, though, is the uncertainty over supply. From December 5th, the EU will be enforcing an embargo on seaborne cargoes of Russian oil and G7 nations will implement a price cap on Russian oil exports. Details of the level of the price cap are expected to be released later this week. If the price cap is too low, aligning with the EU’s geopolitical objectives of isolating Russia, then oil exports from the country may drop sharply and leave oil market balances short, even with an anticipated decline in demand. Prices closer to current market levels are meant to ensure that Russia continues to export crude though officials there have indicated they will not sell to countries participating in the price-cap mechanism.

OPEC+ also holds its next meeting, coincidentally, the day before the EU sanctions are due to take effect. At its last meeting at the start of October, OPEC+ announced a 2m b/d cut in production targets for November and December and prices have faded since then. When prices were on a similar downtrend in July-August this year, OPEC+ officials intervened at first verbally to try and support markets then in action with a modest cut to output levels announced at the start of September. We would expect that OPEC+ could step in again at its next meeting, keeping oil production targets limited in line with a faltering global economy. OPEC+ has shown an apparent desire to prevent oil prices from falling excessively and an implicit target of around USD 90-100/b in Brent markets may be the objective of any near-term intervention.

Weighing the risks against each other, we suspect that in the immediate term negativity around demand and the global economy will be the stronger force. However, as we move into the final weeks of the year and into 2023 it will become clearer how tight supply conditions are with few buffers available in the way of strategic inventories. We still hold to a bullish case for oil prices in 2023.