Attacks on the Abqaiq processing facility and the Khurais oil field in Saudi Arabia over the weekend present an enormous upside risk to oil prices as production shuts down while damage control and repairs are carried out. How high oil prices move will depend on the extent of damage and how long any repair work will take but markets will now incorporate geopolitical risks into oil prices at a much higher level, adding support to spot prices for crude.

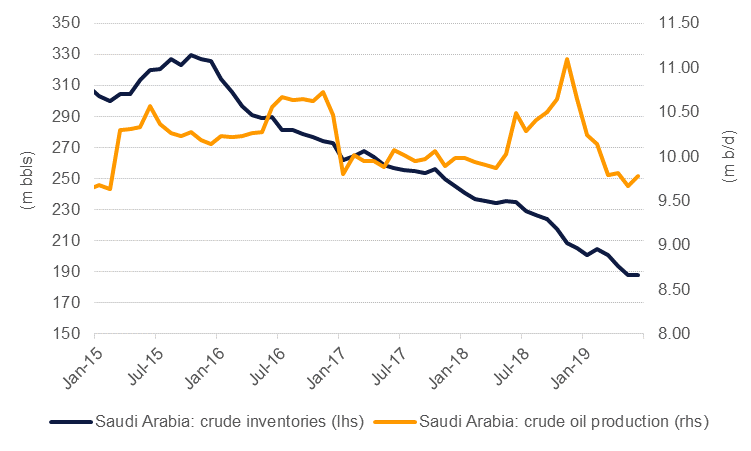

According to official statements from Saudi Arabia, production has fallen by 5.7m b/d as a consequence of the attacks. Saudi Arabia had already been producing more than 1m b/d below its 2018 peak level in accordance with the OPEC+ agreement so the attacks will substantially amplify the effect of production curtailment. Prince Abdulaziz bin Salman, the Kingdom’s new energy minister, said that importers of Saudi crude would receive supplies from inventories. However, crude stocks in the Kingdom have been run down steadily since 2015 as Saudi Arabia more actively intervened in crude markets and at 188m bbl in June, stocks were 20% lower than the same period in 2018.

Source: JODI, Emirates NBD Research

Source: JODI, Emirates NBD Research

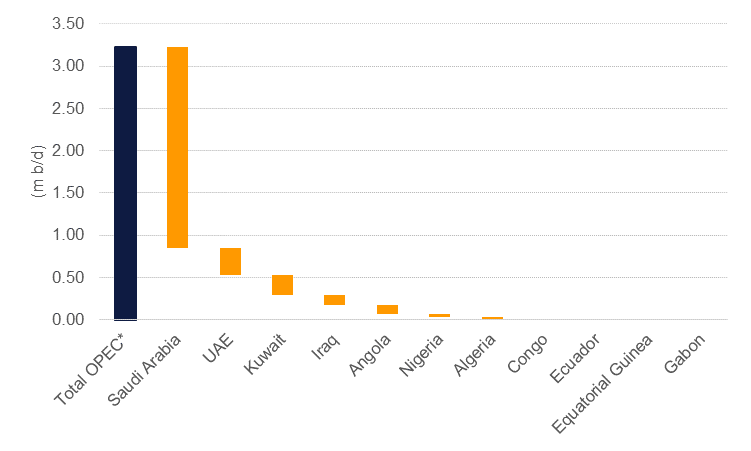

The oil market has limited options to replace the Saudi crude in the short term. Thanks to the OPEC+ production cuts that have been in place since the start of the year, spare capacity in OPEC producers appears relatively high, estimated at around 3.2m b/d in July according to the IEA. However, spare capacity is overly concentrated in Saudi Arabia. Of OPEC’s total, almost 75% is held in the Kingdom with the next biggest share in the UAE (9.9%). The UAE, Kuwait and Iraq could together raise output by close to 700k b/d to help accommodate markets but the increase falls well short of the drop in Saudi production. Russia is also producing below recent highs and could increase output by around 300k b/d. US sanctions on Iran and Venezuela mean we discount their production from our assessment of spare capacity. No producers outside of OPEC+ normally operate with spare capacity so ramping up production from the US, for example, would take time and be limited by export infrastructure constraints (eg, tanker access to Gulf of Mexico ports).

Source: IEA, Emirates NBD Research. Note: only OPEC countries not under sanctions.

Source: IEA, Emirates NBD Research. Note: only OPEC countries not under sanctions.

Geopolitical risks had not sparked a sustained move higher in prices so far this year as broader macroeconomic concerns over demand, such as the US-China trade war, have weighed down on the outlook for oil. But the attacks on Saudi Arabia are of a different nature than previous incidents of geopolitical risk—an attack on a flow of crude rather than individual cargoes—and will raise concern over stability of supply and the physical security of oil facilities in the country. The attacks will be among the first challenges for Prince Abdulaziz and he will likely need to spend the first few weeks on the job reassuring importers over the security of supply from the Kingdom.

In response to the attacks, the IEA noted that inventories globally remain well supplied and should be able to compensate for any drop in supplies. Moreover, the US Department of Energy announced it was ready to release stocks from the country’s petroleum reserve if required. An inventory response, however, may not be required while demand expectations remain soft. The IEA expects demand of just 1.1m b/d this year and noted that prices 20% below their year-ago levels (Brent prices were close to USD 80/b in Sept 2018) would be a “support” for consumers. Were oil prices to spike back up to USD 70-80/b in response to the attacks, any fleeting marginal demand would dissipate and help prices normalize at a lower level. Accordingly, until we get a clearer picture of how damaging the attacks have been, and a timeline for repair, we are leaving our expectation for Q4 Brent average of USD 63/b unchanged.

Outside of spot price moves, market reaction will be highly evident in Dubai-market time spreads, which could see a much wider backwardation than the USD 1.73/b for 1-3months currently. Time spreads peaked this year at above USD 2/b in May around when the US failed to renew Iran sanctions waivers. The Brent/Dubai EFS is also likely to narrow on the disruption to supplies from the Gulf. The spread did converge on parity in February-March this year as OPEC+ production cuts, along with political risk in Venezuela and Iran, helped to remove heavy, sour barrels from the market. The attacks on Saudi Arabia appear to have most directly affected Arab Light and Extra Light which may prompt some higher bidding for comparable grades from the North Sea (Forties or Oseberg) or Murban (UAE).