Oil markets have had a soft start to 2023 with both Brent and WTI futures pushing well below USD 80b and dropping by about 7% since the start of the year. Concern over near-term demand conditions in China, as the country endures a rapid increase in the number of Covid-19 infections since it dropped its stringent virus restrictions, are contributing to a negative picture for oil, and commodities more generally at the top of 2023. Also not helping matters are persistently hawkish messages from central bankers—both from the US and Eurozone—that more monetary tightening is on its way.

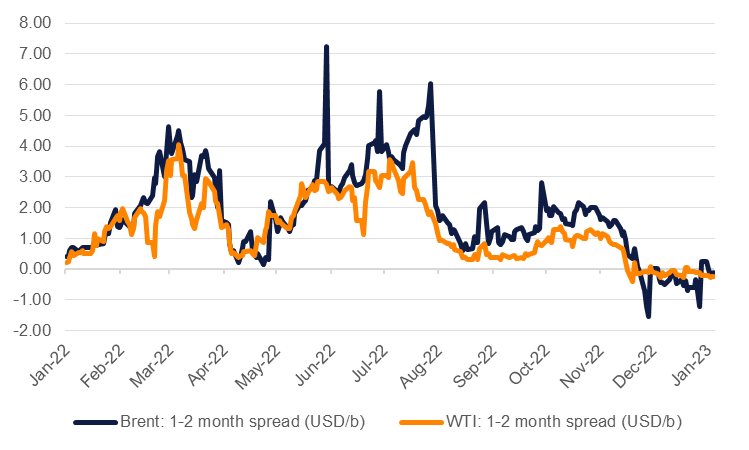

Beyond the drop in spot prices, market structures have also weakened substantially. Time spreads for the 1-2 month contracts in both Brent and WTI are now unequivocally in contango (near-term prices below longer-dated ones) after spending nearly all of 2022 in wide backwardations. The weakness in futures structures is also being backed up in the physical market with Saudi Aramco cutting its official selling to European and Asian markets on expectations of near-term demand weakness.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

We expect that oil markets may have to endure a little more pain before they get better as the rapid pace of infections in China will need to burn itself out before economic activity can stabilize. The upcoming Lunar New Year celebrations could create another bump in the level of infection and keep overall activity muted for much of Q1 2023. In addition, markets look to be waiting for some official acknowledgment that a recession is underway in markets like the US or Germany—indicators like PMIs do suggest activity is contracting—before we can hit a bottom.

The first quarter of 2023 always looked as though it would be tough for oil markets, and we project a modest market surplus of almost 200k b/d based on the IEA’s demand expectations. But beyond Q1, the macro conditions for oil markets still appear bullish to us. In particular, supply looks to be defined by constraint rather than availability in 2023.

OPEC+ has adopted a more market-responsive approach to production levels after having brought back—on paper at least—all the production it took out during the pandemic in 2020. In September and October 2022, the producers’ alliance announced production cuts to stem the drop in prices that was then underway and we can’t rule out that OPEC+ would again step in to prevent what they view as a disorderly sell-off. Any intervention may even come unilaterally on the part of Saudi Arabia to stop oil prices dropping too quickly. OPEC+ ministerial meetings will no longer take place on a monthly basis, meaning there will be fewer ministerial statements to parse through to gauge their assessment of oil market conditions but Brent prices below USD 80/b is hardly going to be welcome among OPEC+ leaders.

Russia, still a key member of the OPEC+ alliance, will be adjusting to a new framework for its oil exports as an EU embargo on seaborne imports is now in effect and will be expanded to cover refined products from February 5th. The G7, EU and a few other nations also supported a price cap mechanism of USD 60/b for Russian exports to avail of services like shipping and insurance. Russian exports did drop at the end of 2022 as the price cap and EU embargo came into effect and the country is likely to have cut output back further as a key export market remains closed to it.

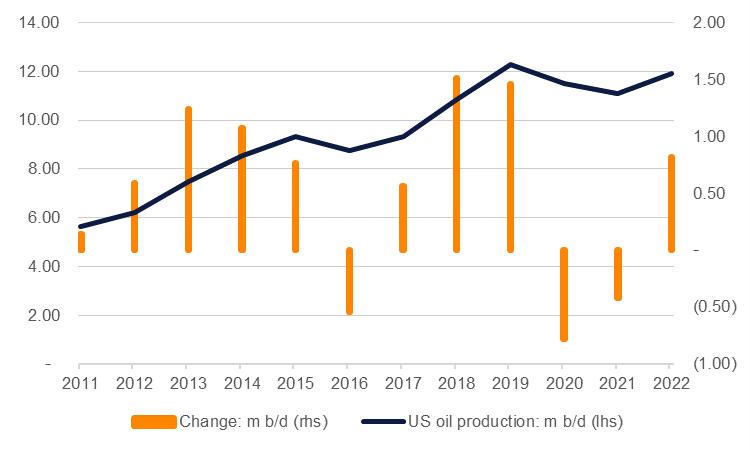

Finally, the other major wildcard for supply, the US, looks much less wild than it used to. Production increased by 820k b/d in 2022 based on initial EIA estimates of weekly output (that are likely to be revised in coming weeks). While that has helped to offset much of the losses caused by the collapse in prices resulting from the Covid-19 pandemic, the rapid pace of production increases the US has experienced previously don’t look set to be repeated. A Q4 survey from the Dallas Fed of oil and gas firms showed 39% of producers expected to increase capital spending only slightly in 2023 with supply-chain and inflation concerns the “biggest drag” on production plans.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Our expectation for oil prices this year remains for Brent to come in at an average of USD 105/b and WTI at USD 95/b, rising over the course of the year. Prices won’t be too far off where they came in on average in 2022: Brent at USD 99/b and WTI around USD 94/b. We would also expect that the current contango in markets will be reversed and for market structures to return to backwardation once a market deficit emerges from Q2 onward.

In terms of risks to this outlook, a deep and damaging recession or China showing an inability to manage living with Covid-19 would represent substantial downside risks for prices. But in that circumstance, we would expect to see OPEC+ intervention via cutting output to help support prices. On the upside, given that we see limited positive surprises for supply, a better-than-expected improvement in China’s economy or softer than feared recession could mean oil prices at a much higher trajectory given there are so few safeguards available in the market.