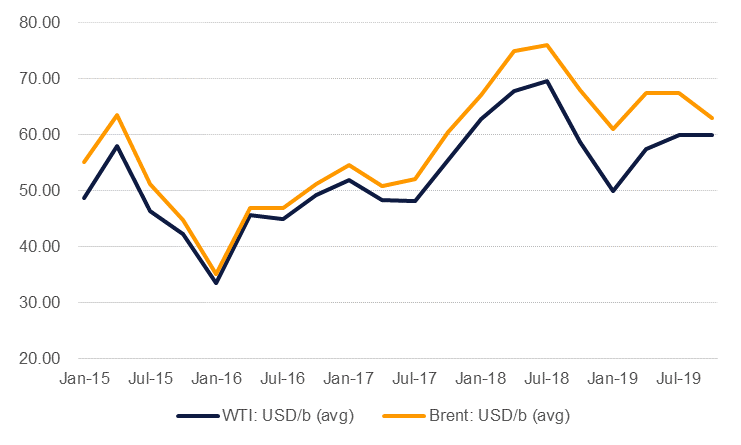

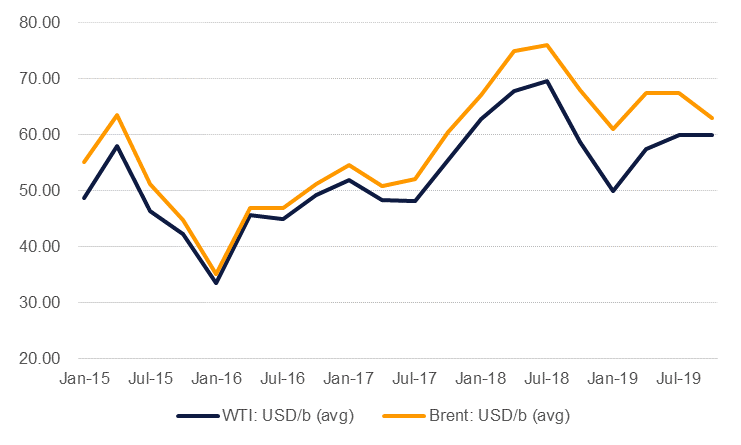

- We are revising our forecast for average Brent prices lower to USD 65/b (compared with USD 73/b previously). WTI prices are expected to record an average of USD 57/b (compared with USD 66/b previously).

- Demand growth is set to slow in 2019 and remain below its long-run averages. In major consumers oil demand is set for a considerably slower pace of growth.

- The US-China trade war hangs over oil and commodity demand generally with the scale of downside in a no-deal outcome more severe than any possible relief if an agreement can be reached.

- Persistent, and rapid, non-OPEC supply growth will offset OPEC efforts to balance markets. The US will remain the major contributor to supply growth in 2019, even if at a slower pace.

- OPEC forced into cutting production but scale of cuts as announced won’t be enough on their own to push market into deficit. On a historic basis, the new target levels still represent near record levels of production for several large OPEC members.

- Inventories will continue to build in 2019 and will account for more than 61 days of OECD demand compared with less than 60 estimated for 2018.

- Prices will be characterized by elevated volatility, particularly as major policy issues (US-China trade dispute, Brexit, Fed rates trajectory) remain uncertain.

- Brent/WTI spread to remain wide until H2 2019 when new pipelines will help to improve takeaway capacity from major producing regions.

Emirates NBD Research oil price assumptions

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.

Click here to Download Full article

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.