Oil markets recovered strongly last week as OPEC+ production cuts began in earnest and more and more countries took steps to reopen their economies. Indeed, oil futures outperformed most other commodities and other risk assets which showed little conviction either to gain or lose. Oil market micro-factors appear to be in the ascendance in determining the near-term trajectory for prices even as broader fundamental data remain poor: the US ISM manufacturing index sank to 41.5 for April while consensus expectations for labour market data to be released at the end of this week is for a spike in the unemployment rate to 16% for April.

In isolation, and at least for the very short-term, conditions are looking better for the oil market than they have in some time. However, oil serves to lubricate the global economy and as economic conditions remain fragile—or worse—in many economies the overwhelming negative fundamentals will still exert substantial downward pressure on prices. The recovery in prices in this past week may be as good as it gets for some time unless there is a dramatic turnaround in economic fundamentals.

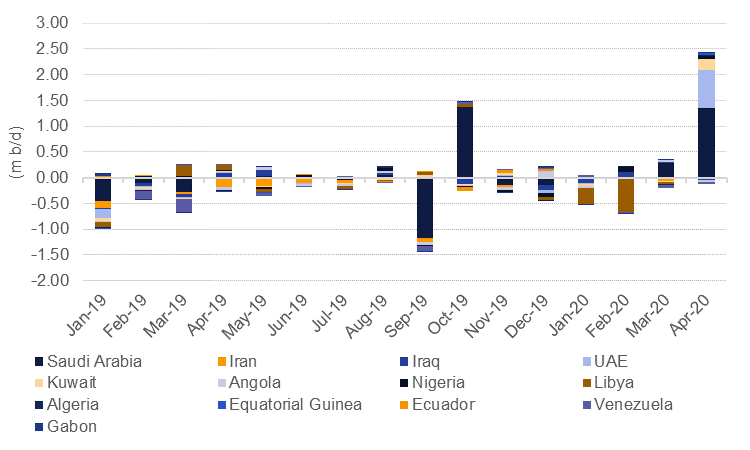

Initial estimates of OPEC production for April showed the extent of the price war strategy adopted by key members. Total output rose by 1.73m b/d in April, the largest monthly increase since September 1990. As expected, most of the increase was concentrated in Saudi Arabia (up by 1.4m b/d) while the UAE added almost 300k b/d and Kuwait another 150k b/d. Iraqi production actually dipped slightly and the political situation in the country appears to veering toward more deterioration as militant groups have stepped up attacks recently while centralized political stability is in question (Iraq has had three prime minister-designates in the last three months). OPEC countries are now on the hook to cut production as part of the OPEC+ agreement to remove 9.7m b/d from markets. For Saudi and the other Middle East producers the cuts will be abrupt and sharp: more than 6m b/d should come off in a single month. If oil markets remain fixated on commodity specific dynamics rather than the broader macro picture then a return to digesting how compliant (or not) OPEC+ producers are with their production targets will dominate market attention in the near term.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

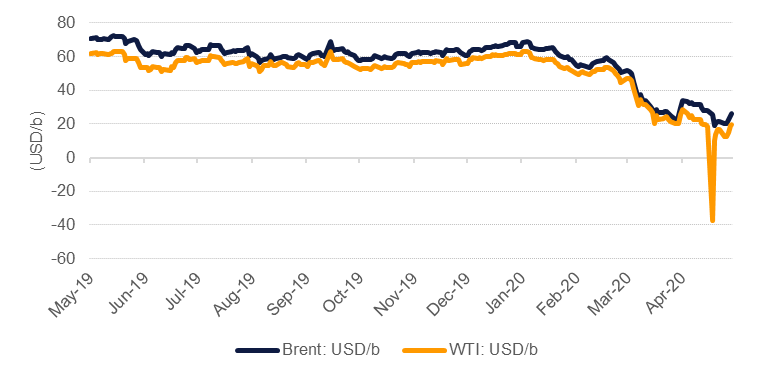

Spot prices rallied sharply last week. Brent futures gained more than 23% to close the week at USD 26.44/b while WTI settled not far off USD 20/b, up 16.8% over the week. Forward curves also reflected the apparent optimism that the oil market, while not necessarily tightening, may at least be becoming less bloated. Front month spreads in WTI narrowed to a contango of USD 2.51/b compared with more than USD 4/b a week earlier while in Brent the same spread closed the week at a little over USD 1.6/b compared with more than USD 3.30/b five days earlier.

Physical market pricing moved higher as well with spreads for physical barrels over WTI across US delivery points all widening considerably. Even beleaguered Western Canada Select managed to settle back above USD 10/b at the end of the week. Producers across the US continue to yank rigs out of service: another 53 were taken out of operation last week bringing the total decline since mid-March to almost 360. Oil companies, both large and small, continue to report execrable results while announcing major cuts to capex plans or dividends.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research