OPEC+ meets next on September 5th amid a near-term change in direction for oil. Oil prices declined for much of July-August as markets focused on burgeoning global recession fears and what that could mean for demand. Brent futures for instance hit a low of around USD 91/b in mid-August but have since recovered around 15% to the end of the month to trade around USD 105/b.

The principal catalyst for the improvement in oil prices has been commentary from Saudi oil minister, Prince Abdulaziz bin Salman, who said that oil markets were enduring “extreme volatility” and that “paper and physical markets have become increasingly more disconnected.” To take those two points in turn, the volatility in question appears to be related to the downside move in oil from a peak of USD 139/b in early March, not long after the Russian invasion of Ukraine, to the low of USD 91/b in mid-August. Oil market volatility in the last few months has been high by the standard of the last several years but it is considerably lower than what the market endured in the early phase of Russia’s war in Ukraine.

Physical and futures markets have also been moving in more or less synchronized patterns, although the absolute level and swings in time spreads are considerable. Brent futures spreads for 1-2 month contacts have eased from a backwardation of more than USD 7/b at the end of May to slightly less than USD 2/b now. In the North Sea physical market, contract for differences at the front end of the pricing schedule (a kind of very short-term swap) have also narrowed from more than USD 10/b in mid-July to about USD 1.40/b at present.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

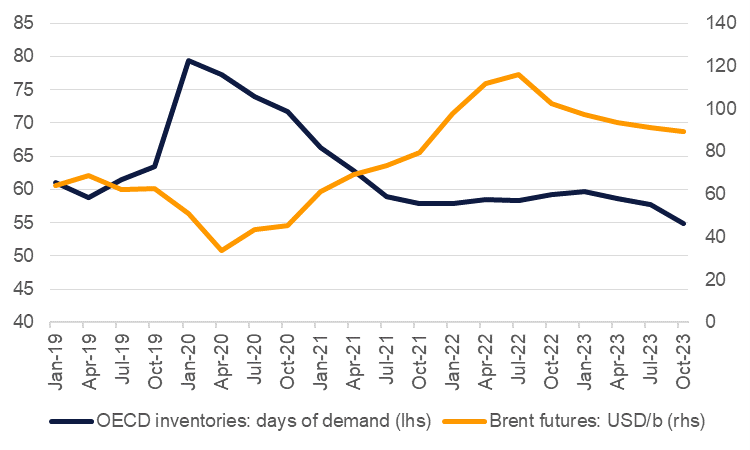

The downward move in oil and commodity prices over the Northern Hemisphere summer months has been largely down to adjustments in demand expectations. If China maintains its Zero-Covid policy, it’s a negative for oil, copper and iron ore. If central banks in the US, UK and Eurozone tighten as much as may be needed to deal with decades high inflation, it’s also a negative for oil, copper, and iron ore. Easing of shipments of grain out from Ukraine’s Black Sea ports has provided some welcome relief to wheat prices, though that may only last for the duration of the current season.

To protect against any further downside in oil, OPEC+ may look to cut production at upcoming meetings, as cautioned by Prince Abdulaziz. OPEC+ may not need to actually approve a cut in production at next week’s meeting but rather just rollback the planned production increase for September or keep target levels unchanged for October onward. The producers’ bloc was already failing to hit target levels in the last few months so letting the natural work of well depletion and underinvestment help to adjust oil market balances could set a floor under prices, even without a large—say 500k b/d to 1m b/d—cut in production.

As oil markets move into Q4 the effect of sanctions on Russia’s oil production will start to be felt much more. EU sanctions on imports of seaborne Russian crude oil take effect from the start of December while sanctions on product imports will take hold in Q1 2023. There may be few options for Russia to divert its energy trade away from Europe should China’s economy take time to recover from the country’s Zero-Covid policies or other emerging economies are caught up in a global downturn. That may provide some buffer for the market, that demand and supply could decline in tandem, but inventories have also been drained and spare capacity is limited. The current oil futures curve implies a general move lower in prices over 2023. But given the tight supply picture over the coming quarters, oil markets may need to prepare for more considerable upside shocks.

Source: Bloomberg, Emirates NBD Research. Note: Brent futures are average of quarters as of 08/30/2022.

Source: Bloomberg, Emirates NBD Research. Note: Brent futures are average of quarters as of 08/30/2022.