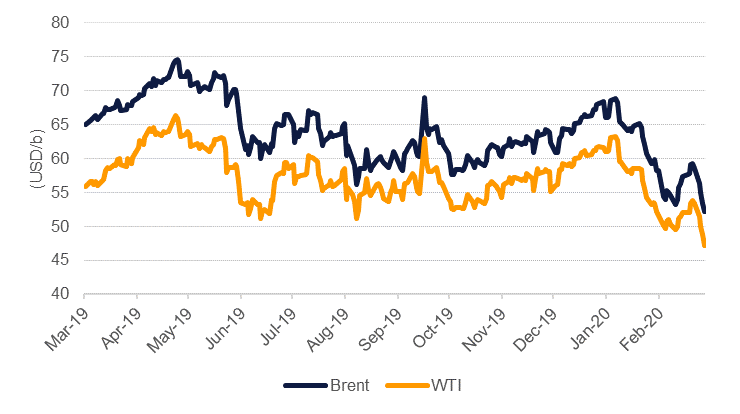

Oil markets crumbled last week as the coronavirus spreads and entrenches outside of China. The economic impact of the virus has been severe with China’s official manufacturing PMI falling to 35.7 for February while the services sector PMI collapsed to 29.6. The virus has just begun to become rooted in other markets such as Italy and while the economic hit may not be as sharp as in China’s case it will nevertheless be significantly negative. Commodity prices reflected the sizeable risk-off sentiment with Brent futures falling almost 14% over the week while WTI was down more than 16% at less than USD 45/b.

The fixation for oil markets this week will be the OPEC meeting taking place on March 5th, followed by a meeting with partners outside the bloc the next day. OPEC+ is largely expected to endorse more production restraint and we will outline the options available to the bloc and the impact on markets later this week. At a minimum, they may choose to extend the current level of deeper production cuts beyond the end of March, when they are due to expire. Getting to a larger production cut remains a challenge while volatility in oil markets remains high. Saudi Arabia has reportedly mooted a cut of as much of 1m b/d in cooperation with the UAE, Russia and Kuwait, according to press reports. It seems apparent that this week will end with less OPEC+ oil planned for the year rather than more.

Forward curves were pummeled by the collapse in oil market sentiment. The WTI curve closed in contango for the next 24 months while the Brent curve has moved into essentially the same position. Dec spreads for Brent 20/21 fell to USD 1.2/b in contango and WTI at USD 1.08/b. While the market remains focused on how badly demand is being impacted we see little chance of the contango structure being reversed at the moment. In the physical market, the Dubai curve also returned to contango with the 1-3month spread in Dubai swaps closing at USD 0.28/b.

Despite the collapse in prices, speculative net length in both Brent and WTI rose last week as investors may have been anticipating crude prices had hit a bottom. In Brent, nearly 13k long positions were added taking speculative net length as a share of open interest to over 9% while in WTI net length rose by 27k contracts thanks to significant closing of short positions. As many of these new long inflows will have burned by the price decline last week we may see another round of selling pressure in the coming days if doubts grow about how committed OPEC+ is to limiting production.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.