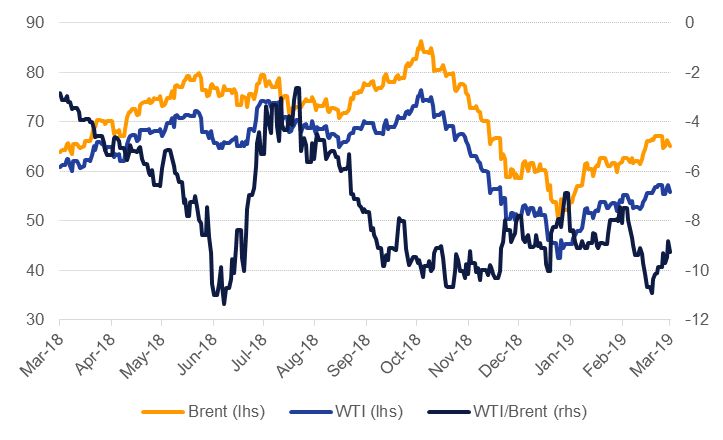

Weak data out of both the US and China weighed on oil prices last week even as market surveys showed OPEC cutting production by more than required in February. PMI data in China showed a third consecutive month of contraction in the manufacturing sector in February while in the US the ISM index index fell to its lowest level since November 2016. Both benchmark oil futures fell last week with WTI losing 2.5% to close at USD 55.80/b and Brent closing at USD 65.07/b, down more than 3% over the five days.

OPEC achieved compliance of 101% with its production cut targets in February, according to a Reuters production surveys. Most of the heavy lifting was borne by Saudi Arabia (159% compliant), the UAE (123%), Kuwait (128%) and Angola (187%). However, Iraq remains an underperformer, achieving just 52% of its production cut target while compliance among other producers was less significant. OPEC came under pressure in the middle of the week when US president Donald Trump again targeted the producers’ bloc via tweet, calling on them to ‘relax’ and help to dampen oil prices. However, messaging from senior OPEC leaders, notably Khalid al Falih, Saudi Arabia’s energy minister, looks as though OPEC will keep cuts in place in the second half of the year as well. OPEC will message that it intends to keep cuts in place but as prices grind higher on a tightening market we expect to see output gradually increase by the end of 2019.

Time spreads were weaker over the course of last week. WTI spreads at the front of the curve remained in a contango anchored around USD 0.4/b, roughly where they have been for the last few weeks while the contango in Brent at the front of the curve strengthened. Longer-dated spreads (Dec 19/20) did gain for both WTI and Brent but closed the week below recent highs.

Investors continued to push into long positions in Brent, adding nearly 16k net long contracts. Net length in Brent futures has gained eight weeks running and has pushed the long/short ratio to over 6, its highest level since October 2018 back when prices were threatening USD 80/b and above. Brent futures have risen more than 20% ytd but the gains have generally occurred on a few days and the market has spent most of the year holding onto USD 60/b in January and USD 64/b in February. With economic data consistently underperforming and OPEC production limitations already baked into the price, we find it difficult to pinpoint the next variable that will allow for another USD 4-5/b boost to Brent futures.

Despite signs of economic slack, refined fuel prices outperformed crude. RBOB futures added more than 7% while diesel on both sides of the Atlantic fell 1.5% for ULSD and 1.2% for ICE LSGO. The relative outperformance helped refining margins snap back from recent lows. Even in Singapore, where product inventories continue to push higher, margins improved across the barrel, with fuel oil back into premium over crude. An uptick in buying activity in Singapore FO appears to be behind the gains as inventory levels in major trading ports all at glutted levels: Fujairah FO stocks rose 19% w/w at the end of February.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research