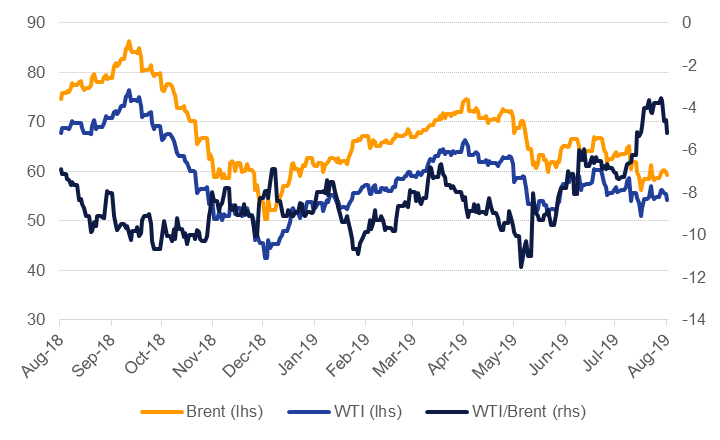

The latest escalation of the US-China trade war helped to sink oil markets at the end of the week with both Brent and WTI futures declining on Friday. Over the course of the week WTI fell almost 1.3% while Brent managed a gain of almost 1.2%. Considering the scale of negative economic news coming out at the end of the week, the performance of crude futures was relatively healthy. However, as markets are likely of adopt an increasingly risk-off tone as the fallout of the US-China trade war becomes clear, we would expect to see the trajectory for crude set more and more by non-oil specific headlines in the coming weeks.

China will now levy a tariff of 5% on imports of US crude from September 1st, the first time it has directly targeted crude oil, although LNG imports from the US were already facing tariffs. A 5% tariff on WTI bound from Houston represents nearly USD 3/b, cutting into margins for Chinese refiners already negatively affected by lower values for fuel oil. China had seen a rapid pace of growth in imports of US crude, taking an average of almost 400k b/d in the first half of 2018 compared with 222k b/d on average in 2017. But China has used oil flows as a trade negotiating tool—imports almost fell to 0 in the second half of 2018. Chinese refineries may seek to displace US barrels and push US crude to alternative destinations or force prices lower to compensate for the higher rates.

Forward curves showed a mixed performance last week with longer dated Brent spreads widening their backwardation while WTI weakened as news that China will impose tariffs on US crude raised the prospect of inventory builds or price discounting. Spreads at the front of the curve strengthened in both Brent and WTI. Dubai spreads strengthened, closing at USD 1.93/b in 1-3 month spreads despite few new headlines from the Middle East. The UK has announced it will send an additional warship to the Gulf region to ensure security of UK-flagged vessels passing through the Strait of Hormuz.

Inventories globally are displaying a seasonal decline, most notably in the US where crude stocks remain below their five-year average. Total inventories in the US, however, remain high thanks to relatively stable levels of gasoline and distillates.

Investor positioning toward crude remains ambiguous as the outlook for commodities generally is subject to the US-China trade relationship. Net length in Brent futures and options fell by more than 6.5k contracts as investors cut long positions while in WTI net length rose thanks to a sizeable drop in short positions. However, we expect there is likely to be an adjustment in positioning following the latest trade war developments with more longs taken out of the market.

Source: Emirates NBD Research

Source: Emirates NBD Research