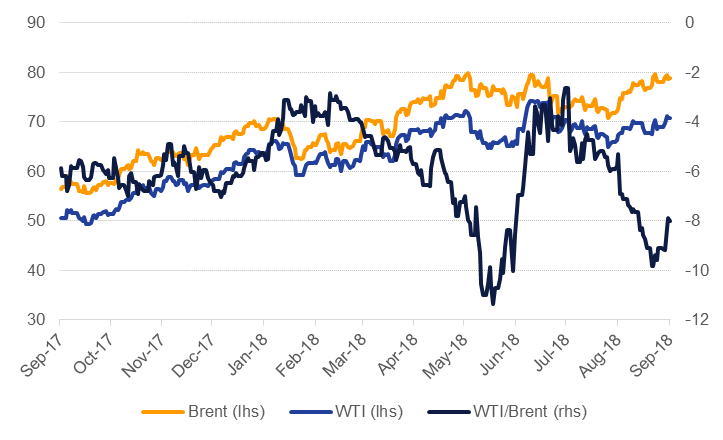

Oil benchmarks gained their second week in a row with both Brent and WTI managing to break above recent hurdles of USD 80/b and USD 70/b respectively. Brent futures gained 0.9% last week to close at USD 78.80/b while WTI closed the week at USD 70.78/b, up nearly 2.6%. Brent futures have pushed above USD 80/b four times this year but have yet to close above that level. Despite the moves up to USD 80/b volatility in Brent markets has actually been decreasing in recent weeks as tightening international market fundamentals relentlessly pull the market upward.

OPEC meets with its partners in Algiers today to assess the current condition of oil markets and potentially approve another increase in production to compensate for the expected loss of Iranian output. We expect that those OPEC countries with available spare capacity, led by Saudi Arabia, will increase output but not completely offset the drop in Iranian barrels. Were they do so the oil market would be even more uncomfortably tight than we forecast for 2019 as spare capacity is eroded. OPEC’s decision will be closely watched though as US president Donald Trump again took to Twitter to lambast the producers’ bloc into raising production. The pending market tightness is at least partly the responsibility of the White House’s current Iran sanctions policy and the threat of heightened geopolitical risk over the next several months looks to remain high, keeping a bid under Brent prices.

Forward curves tightened further last week with the backwardation in both Brent and WTI curves strengthening. At the front end of the curve the spread in 1-2month Brent futures hit USD 0.56/b at the end of last week while in WTI it was a little more than USD 0.4/b. The threat of the WTI curve flipping back into contango appears to have receded for now as the US benchmark is pulled up along with the move in Brent, likely helped along by news that price reporting agencies are considering whether to include US cargoes in their Brent assessment and thereby raising demand for US crudes.

Drilling activity held ground last week with just one rig out of service. However, investors still remain highly split on the outlooks for Brent and WTI. The exodus out of WTI long positions continues with net length falling by nearly 16k contracts while in Brent more than 27.8k net long positions were added. Options markets are also showing a weaker bias to puts with the 25 delta risk reversal on 1 month Brent basically hovering near neutral while the put premium is narrowing in longer dated options.

US crude stocks declined their fifth week in a row last week but the overall picture of US petroleum inventories still appears amply supplied. Total products inventories were more than 6.4% higher than their five-year average last week, the widest level in the last year. Refinery demand is showing some signs of slipping from recent highs which could bode for an uptick in crude stocks which have erased nearly all their massive build in 2015-17.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research