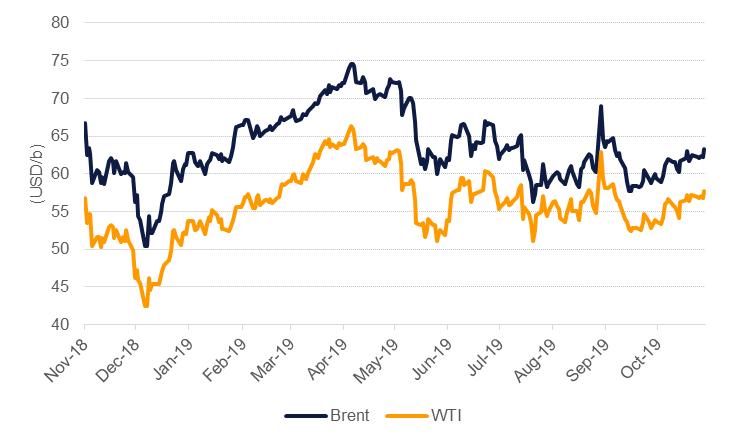

Oil markets ended the week on a positive footing as markets responded to news that trade discussions between China and the US were reaching their “final stage” even as Wilbur Ross, the US Commerce Secretary noted that there would be no deal until there was a “deal on everything.” The outcome of trade talks between both countries will push and prod oil prices over the next few weeks and we would caution that markets have previously priced in an imminent deal only for policymakers to subvert it with new, stringent requests. Brent futures settled at USD 63.30/b, up 1.3%, while WTI closed the week at USD 57.72/b, a gain of 0.8%.

The IEA kept its oil demand growth forecast for 2020 intact at 1.2m b/d, an acceleration from 1m b/d this year, as it expects higher refinery runs thanks to IMO 2020 regulations coming into effect. The IEA did note risks related to the trade dispute between China and the US but in a positive message to consumers suggested that the oil market will remain well supplied in 2020 thanks to large output growth from the US, Brazil, Norway and Guyana. At 2.3m b/d of non-OPEC supply growth the IEA is strongly bullish on the outlook for growth, more so even than some executives in the shale patch in the US. The higher non-OPEC forecast will mean that the call on the producers’ bloc falls to just 28.9m b/d for 2020, around 1m b/d below OPEC’s October production.

OPEC’s own projections earlier in the week were hardly more comforting for the producers’ bloc. It expects non-OPEC supply to expand by 2.2m b/d in 2020 from 1.8m b/d in 2019, again thanks to higher volumes from the US and Norway. OPEC’s secretary general, Mohammad Barkindo, did try and talk up the group’s prospects by suggesting non-OPEC supply could substantially underperform growth expectations.

Time spreads showed a generally tightening trend last week with Brent and WTI December spreads gaining. Movement at the front end of the curve was relatively more muted with Brent’s backwardation in 1-2 month spreads holding at around USD 0.9/b and WTI at a small contango of close to USD 0.1/b. Dubai time spreads narrowed with the 1-3 month spread closing in a backwardation of below USD 2/b last week, compared with slightly above that level a week earlier.

Investor long positions in both Brent and WTI expanded last week with Brent net length rising by 28.4k contracts and WTI net length up by more than 37.6k. Investors remain far more bullish on Brent than WTI with net length as a share of open interest almost twice as high for the international grade.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research