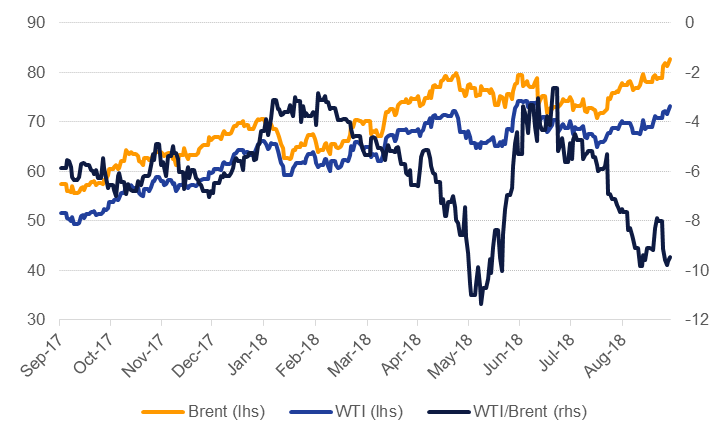

Oil markets extended their gains last week to close at their highest level since 2014. Brent futures pushed well above USD 80/b and ended the week up nearly 5% at USD 82.72/b. WTI closed the week at USD 73.25/b, up 3.5%. Average prices for the quarter ended higher and both were up more than 44% y/y in Q3. Markets have generally pushed higher on expectation of tighter supply in the coming months thanks to US sanctions coming into effect on Iran and we wouldn’t rule out a sentiment-driven surge higher. But we would need to see a more clearly negative supply risk for any further spike supported by fundamentals.

US president Donald Trump again appealed directly to OPEC to encourage the producers’ bloc to raise output in order to dampen down prices. He has also reportedly called King Salman of Saudi Arabia directly to discuss oil markets. However, after characterizing OPEC as “ripping the world off” last week at the UN General Assembly, producers will be reticent to quickly fall in line with the US president’s demands. We still anticipate a modest increase in production from several producers within OPEC but they will be extremely wary of flooding the market with crude after several painful years of bringing the market back into balance.

Forward curves continued to tighten last week with December spreads in both Brent and WTI seeing a larger backwardation. Market reports indicate that Chinese refiners are moving away from taking Iranian barrels, a flow over which there had been considerable market uncertainty. If Chinese refiners do comply with US sanctions more fully than expected than the market balance is likely to tighten even more aggressively and push time spreads, particularly in Brent, even higher.

US drilling activity fell by three rigs last week, the second consecutive drop in a row. For September only one rig was added and holding the total rig count effectively flat for the last five months. Investors also increased their long positions in Brent, the fifth consecutive weekly increase in net length, the longest stretch of builds since July-August 2017. The Brent long/short ratio is hitting near extreme levels again, up to nearly 20:1 last week while speculative net length is holding more than 16% of total Brent open interest. Net length in WTI expanded last week but only thanks to a short positions being closed.

Total US crude and petroleum inventories ticked up again last week, remaining above their five-year average even as crude stocks have hovering back near 2015 levels. A major drop in refinery utilization last week was likely down to turnarounds as refineries as they switch to winter grade gasoline. Inventories at Singapore bounced up from recent lows thanks to a tick up in fuel oil and distillate stocks. Nevertheless, the picture appears reasonably tight, helping cracks against Brent in distillates and fuel oil stabilize or improve slightly last week.

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.