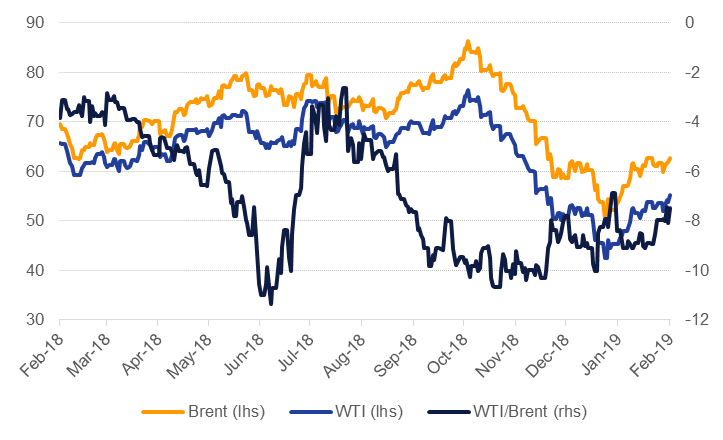

Crude futures recorded a strong start to the year, up more than 18% in January for WTI and more than 15% in Brent futures. The gains were the strongest month on month increase since April 2016. OPEC’s production cuts, a risk-on tone to markets, no derailment of US-China trade talks and the imposition of US sanctions on PDVSA all contributed to a bullish month for oil. Prices gained in the final week of January, more than reversing the prior week’s decline: WTI closed at USD 55.26/b and Brent at USD 62.75/b.

Forward curves strengthened even as there was some distortion at the front end related to the expiry of the Brent March contract. Brent Dec spreads closed at USD 0.87/b in 19/20 and more than USD 1.30/b in 20/21, their strongest levels since mid-November 2016. In WTI, the front end of the curve remains in contango but Dec spreads gained: 19/20 ended the week in a backwardation of USD 0.48/b compared with a Monday close of a contango of USD 0.12/b. Dubai spreads (1-3 month) have added nearly USD 1/b since the start of the year and ended last week in a backwardation of USD 0.66/b. With the heavy, sour market tightening in response to OPEC cuts and sanctions imposed on PDVSA the Brent/Dubai EFS is weakening consistently. Brent/Dubai EFS closed the week at USD 0.6/b, roughly half its level at the start of the year.

Inventories-globally-were roughly flat in the latest reported data. Total crude and product stocks in the US slipped by barely 0.4% while in Singapore stocks were relatively unchanged and gains in gasoil, jet and gasoline in north-west Europe were offset by large draws in fuel oil. As we outlined in our last assessment of oil inventories flat levels aren’t themselves enough to support a bullish case for crude prices and we would be looking for consistent draws—similar to Q2-Q3 2018—to allow January’s move in crude prices to be replicated.

The US drilling rig slipped last week by 15 rigs but did little to move the needle on overall levels. Prices for WTI at Midland have now converged roughly on par with WTI Cushing as the market prices in a slower pace of expansion by Permian producers and more access to export terminals via new pipelines opening later this year. Mars, a benchmark for heavier sour crude in the Gulf of Mexico, rose to more than USD 7/b above WTI in late January as the market assessed the impact of sanctions on PDVSA but ended last week below USD 5/b as maintenance season in the region beckons.

Conditions for Asia refineries remain lackluster. Benchmark Singapore gasoline cracks on Brent remain negative and fell to as low as USD -2.85/b mid last week. Our representative 321 margin for Singapore margins last week fell to just USD 0.51/b for dated Brent and USD 0.33/b for Dubai.

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.

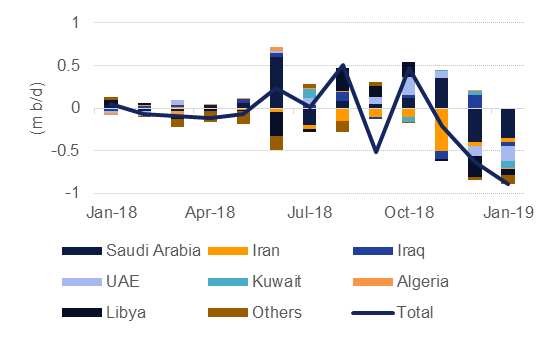

The first surveys of OPEC’s production levels for January are hitting the markets and are coming in roughly as expected. Total production fell by nearly 900k b/d month on month in January, following on from an already sharp decline of 630k b/d recorded in January (Reuters estimates). Total production has fallen three months running and fell to slightly below 31m b/d in January (excluding Qatar).

Production cuts were consistent across all members as markets will fix their scrutiny on how compliant OPEC countries have been in meeting the terms of their December production cut decision. Saudi Arabia contributed the largest share of the monthly cuts—350k b/d—while output in the UAE fell by 170k b/d, Kuwait 90k b/d and Iraq was down 50k b/d. Output in both Iran and Venezuela, where the oil industries are under US sanctions, fell by 50k b/d a piece.

Source: EIKON, Emirates NBD Research. Note: m/m change.

Source: EIKON, Emirates NBD Research. Note: m/m change.

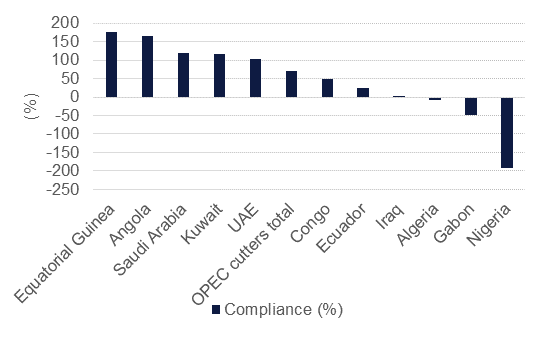

While countries across OPEC did cut production month on month, their adherence to production targets remains varied. Among the large producers Saudi Arabia’s production cut hit 118% of its targeted level while the UAE came in at nearly 100%. Iraq underperformed, achieving just 2% of its targeted cut of 141k b/d from its October reference level. Collective compliance hit 70%, implying those members committed to the cuts will need to deepen their cuts more to achieve the cuts of 812k b/d pledged by OPEC members.

Russia’s oil production has also decline m/m in January as the country is party to the production cut agreement. However, its level of compliance has fallen far short of most large OPEC producers, achieving -19% adherence to its target of 11.19m b/d. The official targets for OPEC+ producers could end up being a double edged sword in terms of achieving consensus on production levels going forward. On one hand they can give a strong signal to markets over the level of commitment by major producers to addressing over-supply in the market. But on the other hand, they may sow division within OPEC as those countries doing the heavy lifting (ie, Saudi Arabia) take free riders to task or pay little attention to their views on markets.

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.

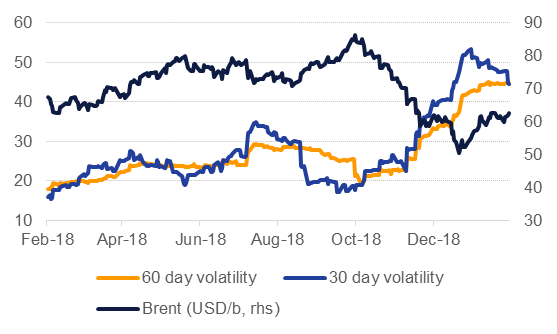

Maintaining constructive relations between producers within OPEC+ will be necessary to ensure unity in the face of external pressure on production levels, particularly from US president Donald Trump. If prices repeat another month like January’s strong performance we would expect Trump to begin another Twitter barrage at OPEC, shaking confidence in the sustainability of any rallies.

Our expectation is for OPEC MENA producers to be roughly as compliant as they were in 2017-18 with their production cut targets, meaning over-compliance by Saudi Arabia and the UAE and under-delivery by Iraq and Algeria. By the second half of the year we forecast that production will be increasing from most producers as they seek to occupy market-share ceded by declining production in Venezuela and Iran. However, this trend of increasing/decreasing production will lock producers into a pro-cyclical pattern of chasing moves in oil prices in the name of keeping markets balanced. OPEC actions, given how heavy handed they are in shifting markets, may end up exacerbating rather than tempering volatility in oil prices.

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.