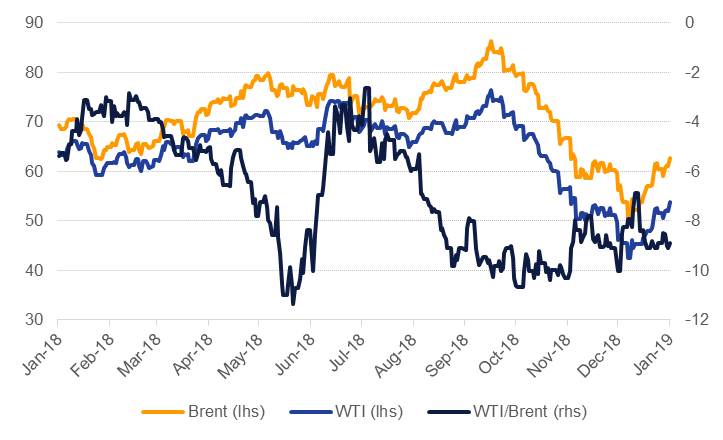

Oil markets continued their strong start to the year last week, up 4.3% in WTI at USD 53.80/b and 3.7% in Brent at USD 62.70/b. Front month Brent futures are now up more than 16% since the end of last year while WTI has gained 18%. Last week’s gains were the third consecutive increase but were at the slowest pace so far this year. Positive market sentiment on the outlook for trade talks between the US and China helped cheer markets generally last week: both copper and the S&P 500 also ended the week in positive territory.

The IEA has released its first market report for the year and kept its forecast for oil demand growth level at 1.4m b/d, an acceleration on the 1.3m b/d estimated for 2018. The agency expects that China and India will account for almost two-thirds of all growth this year, raising market scrutiny on the dynamics of both economies that will allow for a faster pace of growth in oil demand. We are still skeptical that 2019 will be a faster year of growth than 2018 given non-trade related risks (eg volatile FX, debt levels, withdrawal of monetary stimulus) to the performance of most economies, not least of which are China and India. Trade talks between China and the US are yet to be resolved and there is no guarantee that they will end positively, keeping a prominent downside risk entrenched in oil markets for the year.

OPEC was also busy publishing last week. The producers’ bloc released official targets in relation to the production cuts it announced in December and confirmed the widely reported figure of a 3% cut in volumes from an October 2018 baseline level. The UAE is set to cut output by just under 100k b/d and Saudi Arabia by 322k b/d. The list should help support sentiment that OPEC is committed to these cuts as the lack of clarity around them when announced raised doubt over how enthusiastically they would be implemented. The official targets also allows the market to assess compliance and identify potential ‘free-riders’ if some countries underperform. We noted in our revised 2019 oil market outlook that OPEC diplomacy could be fractious this year and caution that the targets could provide a tool for the more compliant members to castigate others, leading to tougher meetings this year.

Brent forward prices have started to poke their head above the parapet of backwardation. The 1-2 month spread ended the week at USD 0.11/b in backwardation while the June/Dec 19 spread ended the week backwardated by USD 0.41/b, its widest level since mid-November. WTI has yet to respond to the same upward pull in time spreads as the US market still looks heavily supplied. Crude stocks in the US have converged on their five-year average but there have been heavy builds in products in the first few weeks of the year, taking total crude and product inventories well above their five-year average level (gasoline stocks in particular look substantially elevated). In response to OPEC members cutting output, the Dubai curve is beginning to tighten; the 1-3 month spread closed at USD 0.42/b in backwardation at the end of last week.

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.