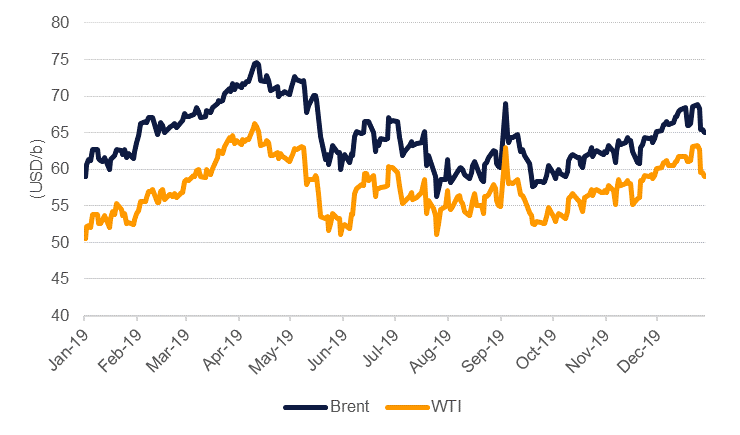

The geopolitical spark that helped pushed Brent oil futures above USD 70/b last week snuffed itself out quickly as it became apparent that an escalation of tension in the Middle East had no impact on oil market fundamentals or flows of physical crude from the region. Brent futures fell more than 5% last week to settle below USD 65/b while WTI dropped nearly 6.4% and closed at USD 59.04/b. The decline last week was the first weekly decline in the past six weeks and only the second weekly drop in the last 10.

Market views from senior policymakers all tried to look through the recent escalation in tension to the underlying market fundamentals. Fatih Birol, head of the IEA said he didn’t expect prices to “jump” thanks to the current heavy supply picture while commentary from OPEC’s secretary general and the UAE’s energy minister indicated they expected to see a relatively soft first half for 2020.

As benchmark futures declined, so did market structures. The backwardation at the front of the Brent and WTI curves weakened substantially. In WTI, the front of the curve is barely holding in backwardation (just USD 0.05/b on the 1-2 month spread) while in Brent the spread closed the week at USD 0.73/b. Longer-dated spreads also shrank with Dec spreads for 20/21 in both Brent and WTI moving below USD 3/b after having started the week wider than USD 4/b.

Geopolitical tension between the US and Iran is likely to remain a theme for markets over the next few weeks and likely catalyzed investors expanding their net long positions in Brent and WTI futures and options. Net length in Brent expanded by 15k contracts last week while WTI speculative positions rose by 4.7k contracts. But with fundamentals unable to support prices moving higher, and speculative position appearing stretched, futures may be in line for a downward correction as investors take profit. In Brent, net length is at 13% of total open interest while in WTI net speculative positions account for more than 10% of total open interest.

Source: Bloomberg,Emirates NBD Research.

Source: Bloomberg,Emirates NBD Research.